In a interview on CNBC Mario Draghi (the head of the European Central Bank, ECB) told us yesterday that he is concerned about capital insufficiencies, balance sheet holes, and backstops related to the EU banks. He added that there is a need to “dispel the fog” regarding eurozone banks’ balance sheets, while he added that somehow the “doom-loop” between banks and their sovereigns (where eventually the banks finance their sovereigns’ deficits) need to break. For a moment I thought I was hearing someone who was advocating the breakup of those banks as well as of the eurozone given that in his opinion the advertised recovery is “weak, uneven, and fragile”. My fear is that the Camel approach (see explanation below) taken by the ECB and the EU in general reflects a hedonistic uninformed utilitarianism (see closing paragraph as to the why) that cannot advance the common good because its a-priori assumptions are misguided to the point of being delusional.

The credibility of the ECB and possibly of the Euro itself as an international reserve currency hangs in the stress tests planned for next year. If the overall assessments which will be made in three phases next year, reveal gaping holes in the banks’ balance sheets, then the anemic recovery not only will it be reversed but it may evolve into a deep recession at a time when the great wall of steroids a.k.a. China starts its tremors (I emphasize that they will be just the beginning) and the Japanese economy awakens to the horrific reality that cannot afford the medicine (both fiscal and monetary) prescribed.

Speaking of the EU fragile recovery and the upcoming Chinese tremors, let’s review the following graphs:

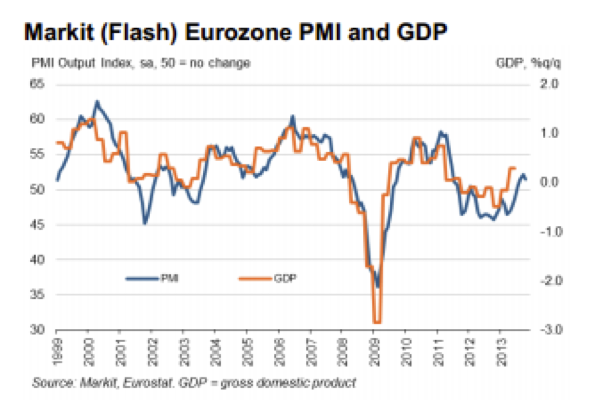

As it is shown above the eurozone’s Markit Purchasing Managers’ Index (PMI, which combines both manufacturing and service) fell in October from its two-year high – while estimates were calling for a figure even higher than in September – confirming Draghi’s fears about a fragile recovery. However, the terrifying picture in the second graph above portrays a zone where the youth face at least one lost decade where their skills will be undervalued. When we combine that with the graying of the EU and the unfunded fiscal liabilities, then we can only become weary about the medium term picture for the EU.

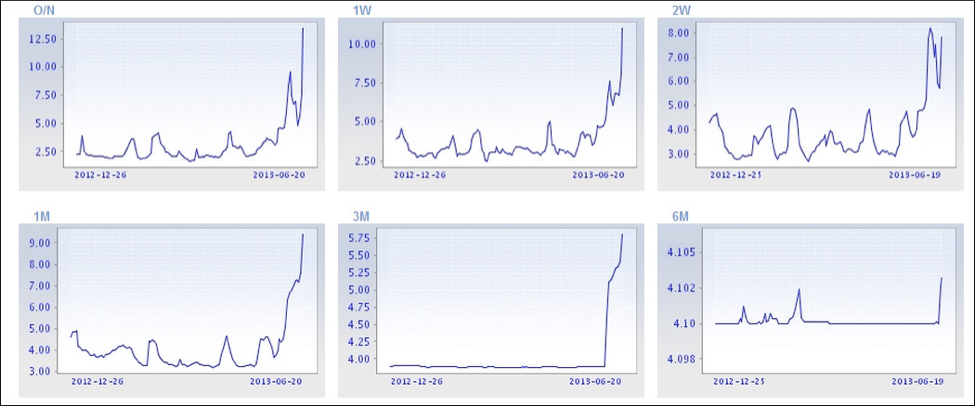

As for China the volatility of the interbank rate (as shown below in intervals ranging from one week to six months) is just one of the warning signs of an impending financial shock that will burst some of its bubbles. It is interesting to note that last night the rate jumped by 150 basis points.

Very briefly I should note here that this volatility in the Chinese interbank rate signifies a liquidity squeeze and an effort by the central bank to restrain credit in an attempt for a smooth landing (which history tells us never happen).

Returning now to our theme, we should note that earlier this month Vitor Constancio (ECB’s VP) declared that EU banks are in a much better shape than what the markets perceptions are. Let’s hope that he is right and that this is not just a public relations effort of moral suasion to lure the public into the banks’ efforts to recapitalize themselves. My fear is that the attempted drive to have the banks hold as core equity capital only 8% of their risk-weighted-assets, will prove to be insufficient given the unrealized losses that the banks have in shipping, real estate, and toxic “assets” in the form of structured finance products, to name just three areas of significant concern.

The reliance of the ECB on national central banks creates moral hazard issues which will undermine the Camel tests (Camel is an acronym of the tests performed on capital adequacy, assets, management capability, earnings, and finally on liquidity and sensitivity to market risks). The endemic links between national banks and internal pressures as well as the need to sustain a stable disequilibrium, may not allow the real picture to be revealed (like in Greece and Cyprus when in previous stress tests bankrupt banks were declared “healthy”) regarding their operations, how they are being funded, their true losses, the quality of their assets, and their counter-party liabilities. The IMF has issued warnings about the urgent need to find capital and fill the gaping holes, but so far band-aids have been applied.

If the assessments reveal big gaps, the sovereigns do not have the ability to create backstops and fund those banks, unless EU rules are broken and new ones are set into place. At that point, we should not be surprised if an EU-wide bail-in approach is taken, and thus depositors’ funds are used to recapitalize the banks (something that as we wrote before has been agreed upon among sovereigns and banking authorities).

Needless to say that the involvement of the EU banks in non-transparent derivatives trading could reveal additional huge collateral holes which conservatively could exceed €2-3 trillion, a number that cannot be covered by any means except massive quantitative measures that will undermine financial stability. However, the ECB’s tests may not dare to touch that sacred collateral space.

Where does this leave investors regarding holdings in financial stocks? I believe that for the foreseeable future (6-10 months) financial stocks should perform well reflecting the moral suasion efforts by the ECB to save the day. However, my concern is that ECB’s approach is a form of outcome utilitarianism where the goodness of its actions is not judged based on an objective measure of truth due to their inherent character, but rather on a subjective fiat measure that attempts to advance the satisfaction and utility of those who perpetrated the crisis in the first place.

On “Doom-Loops”, Insufficient Capital, Camels, and Utilitarianism: Market Suasion or Delusion?

Author : John E. Charalambakis

Date : October 24, 2013

In a interview on CNBC Mario Draghi (the head of the European Central Bank, ECB) told us yesterday that he is concerned about capital insufficiencies, balance sheet holes, and backstops related to the EU banks. He added that there is a need to “dispel the fog” regarding eurozone banks’ balance sheets, while he added that somehow the “doom-loop” between banks and their sovereigns (where eventually the banks finance their sovereigns’ deficits) need to break. For a moment I thought I was hearing someone who was advocating the breakup of those banks as well as of the eurozone given that in his opinion the advertised recovery is “weak, uneven, and fragile”. My fear is that the Camel approach (see explanation below) taken by the ECB and the EU in general reflects a hedonistic uninformed utilitarianism (see closing paragraph as to the why) that cannot advance the common good because its a-priori assumptions are misguided to the point of being delusional.

The credibility of the ECB and possibly of the Euro itself as an international reserve currency hangs in the stress tests planned for next year. If the overall assessments which will be made in three phases next year, reveal gaping holes in the banks’ balance sheets, then the anemic recovery not only will it be reversed but it may evolve into a deep recession at a time when the great wall of steroids a.k.a. China starts its tremors (I emphasize that they will be just the beginning) and the Japanese economy awakens to the horrific reality that cannot afford the medicine (both fiscal and monetary) prescribed.

Speaking of the EU fragile recovery and the upcoming Chinese tremors, let’s review the following graphs:

As it is shown above the eurozone’s Markit Purchasing Managers’ Index (PMI, which combines both manufacturing and service) fell in October from its two-year high – while estimates were calling for a figure even higher than in September – confirming Draghi’s fears about a fragile recovery. However, the terrifying picture in the second graph above portrays a zone where the youth face at least one lost decade where their skills will be undervalued. When we combine that with the graying of the EU and the unfunded fiscal liabilities, then we can only become weary about the medium term picture for the EU.

As for China the volatility of the interbank rate (as shown below in intervals ranging from one week to six months) is just one of the warning signs of an impending financial shock that will burst some of its bubbles. It is interesting to note that last night the rate jumped by 150 basis points.

Very briefly I should note here that this volatility in the Chinese interbank rate signifies a liquidity squeeze and an effort by the central bank to restrain credit in an attempt for a smooth landing (which history tells us never happen).

Returning now to our theme, we should note that earlier this month Vitor Constancio (ECB’s VP) declared that EU banks are in a much better shape than what the markets perceptions are. Let’s hope that he is right and that this is not just a public relations effort of moral suasion to lure the public into the banks’ efforts to recapitalize themselves. My fear is that the attempted drive to have the banks hold as core equity capital only 8% of their risk-weighted-assets, will prove to be insufficient given the unrealized losses that the banks have in shipping, real estate, and toxic “assets” in the form of structured finance products, to name just three areas of significant concern.

The reliance of the ECB on national central banks creates moral hazard issues which will undermine the Camel tests (Camel is an acronym of the tests performed on capital adequacy, assets, management capability, earnings, and finally on liquidity and sensitivity to market risks). The endemic links between national banks and internal pressures as well as the need to sustain a stable disequilibrium, may not allow the real picture to be revealed (like in Greece and Cyprus when in previous stress tests bankrupt banks were declared “healthy”) regarding their operations, how they are being funded, their true losses, the quality of their assets, and their counter-party liabilities. The IMF has issued warnings about the urgent need to find capital and fill the gaping holes, but so far band-aids have been applied.

If the assessments reveal big gaps, the sovereigns do not have the ability to create backstops and fund those banks, unless EU rules are broken and new ones are set into place. At that point, we should not be surprised if an EU-wide bail-in approach is taken, and thus depositors’ funds are used to recapitalize the banks (something that as we wrote before has been agreed upon among sovereigns and banking authorities).

Needless to say that the involvement of the EU banks in non-transparent derivatives trading could reveal additional huge collateral holes which conservatively could exceed €2-3 trillion, a number that cannot be covered by any means except massive quantitative measures that will undermine financial stability. However, the ECB’s tests may not dare to touch that sacred collateral space.

Where does this leave investors regarding holdings in financial stocks? I believe that for the foreseeable future (6-10 months) financial stocks should perform well reflecting the moral suasion efforts by the ECB to save the day. However, my concern is that ECB’s approach is a form of outcome utilitarianism where the goodness of its actions is not judged based on an objective measure of truth due to their inherent character, but rather on a subjective fiat measure that attempts to advance the satisfaction and utility of those who perpetrated the crisis in the first place.