For some odd reason there exists a split among even the most well-known economists regarding what the current Greek debt crisis means in the grand scheme of things, both for the country itself as well as the Eurozone as a whole.

On one side are those who tout the small stature of the Greek economy and thus brush it off as an insignificant factor and player in the dynamics of European economic stability; they liken Greek troubles to a rotting limb whose amputation stops the spread of infection. What economists who place themselves into this camp fail to realize is that in the age of globalization and interconnectivity, who you are connected to can be just as important as who you are, which leads us to the second viewpoint.

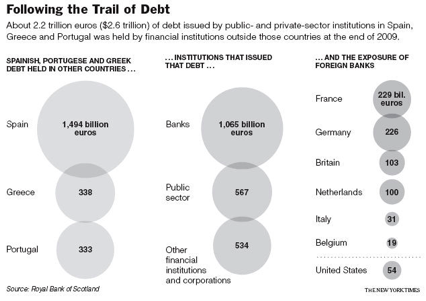

With Greek bond yields rising to over 10% recently, it is clear fear cannot yet be tamed from the Greek situation. Greece is in the midst of an insolvency crisis (their bonds are officially junk status) as Nouriel Roubini stated in the Financial Times and as we have noted for months. As the diagram below from the New York Times demonstrates, over $2 trillion of debt from Greece, Spain and Portugal is held by financial institutions outside the issuing countries with France and Germany, the Eurozone’s two most important economies, as the largest holders. Most analyses of debt crises in these European economies revolve around government bonds, but that leaves too much debt unaccounted for, as the diagram shows.

The pain from Greek worries will return within the next 12 months and a restructuring of the debt is exceedingly likely. Such an act will have even more severe ramifications for the Eurozone as a whole as well as some of its individual economies, but indicators have already started to demonstrate that Euro fears extend beyond the PIGS and into the continent’s most critical economies.

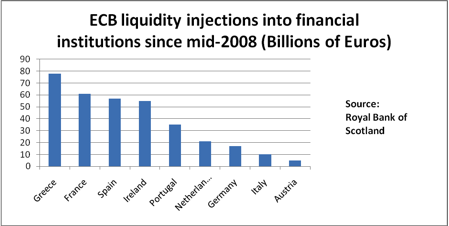

The Royal Bank of Scotland has issued a report detailing liquidity injections from the ECB into European economies (data reproduced above). Greece ranks highest with nearly 80 billion Euros but second is the rarely mentioned French economy at nearly 70 billion Euros. While as a share of GDP Greece’s number is far more disconcerting, France’s extensive exposure to troubled debt could spell drastic consequences in the future.

Hypo Real Estate, a financial services institution in Germany, has exposure of over 80 billion Euros in only public debt from Greece, Spain, and Portugal, amounting to over 22% of their total assets; that’s a lot of eggs in one basket. ECB economists themselves have noted that accessing these emergency provisions is a prime indicator of health for respective banking sectors. If that’s the case, then we contend that not enough attention has been directed at the most critical banking sectors of France and Germany and their respective wounds (as examining only public sector holdings is far too narrow a lens). If tremors arise from within these two respective economies, recovery for the European Union becomes much more complicated and daunting.

Given the above values we need to remind you that Argentina’s debt crisis was only $100 billion and they had the ability to devalue their currency. This time is different. A sovereign crisis of this proportion in what is regarded in an advanced economy is not a cyclical phenomenon and represents just how high the game of easy money and cheap credit was played during the last decade.

On Debt Contagion and Banks’ Balance Sheets

Author : John E. Charalambakis

Date : July 8, 2010

For some odd reason there exists a split among even the most well-known economists regarding what the current Greek debt crisis means in the grand scheme of things, both for the country itself as well as the Eurozone as a whole.

On one side are those who tout the small stature of the Greek economy and thus brush it off as an insignificant factor and player in the dynamics of European economic stability; they liken Greek troubles to a rotting limb whose amputation stops the spread of infection. What economists who place themselves into this camp fail to realize is that in the age of globalization and interconnectivity, who you are connected to can be just as important as who you are, which leads us to the second viewpoint.

With Greek bond yields rising to over 10% recently, it is clear fear cannot yet be tamed from the Greek situation. Greece is in the midst of an insolvency crisis (their bonds are officially junk status) as Nouriel Roubini stated in the Financial Times and as we have noted for months. As the diagram below from the New York Times demonstrates, over $2 trillion of debt from Greece, Spain and Portugal is held by financial institutions outside the issuing countries with France and Germany, the Eurozone’s two most important economies, as the largest holders. Most analyses of debt crises in these European economies revolve around government bonds, but that leaves too much debt unaccounted for, as the diagram shows.

The pain from Greek worries will return within the next 12 months and a restructuring of the debt is exceedingly likely. Such an act will have even more severe ramifications for the Eurozone as a whole as well as some of its individual economies, but indicators have already started to demonstrate that Euro fears extend beyond the PIGS and into the continent’s most critical economies.

The Royal Bank of Scotland has issued a report detailing liquidity injections from the ECB into European economies (data reproduced above). Greece ranks highest with nearly 80 billion Euros but second is the rarely mentioned French economy at nearly 70 billion Euros. While as a share of GDP Greece’s number is far more disconcerting, France’s extensive exposure to troubled debt could spell drastic consequences in the future.

Hypo Real Estate, a financial services institution in Germany, has exposure of over 80 billion Euros in only public debt from Greece, Spain, and Portugal, amounting to over 22% of their total assets; that’s a lot of eggs in one basket. ECB economists themselves have noted that accessing these emergency provisions is a prime indicator of health for respective banking sectors. If that’s the case, then we contend that not enough attention has been directed at the most critical banking sectors of France and Germany and their respective wounds (as examining only public sector holdings is far too narrow a lens). If tremors arise from within these two respective economies, recovery for the European Union becomes much more complicated and daunting.

Given the above values we need to remind you that Argentina’s debt crisis was only $100 billion and they had the ability to devalue their currency. This time is different. A sovereign crisis of this proportion in what is regarded in an advanced economy is not a cyclical phenomenon and represents just how high the game of easy money and cheap credit was played during the last decade.