At the time of this drafting the news centers on different fronts: Prime Minister Socrates in Portugal announced his resignation over a lost confidence vote in the parliament that was about the fourth austerity package of measures within a year! Portugal soon may be rushing to the rescue of the European Financial Stability Fund and to the IMF. However, such rescue will be challenged in the political vacuum that is being created.

At the same time, the allies’ offensive on the Gaddafi’s forces continues while also trying to find an identity. Yemen’ s president announced his resignation after he lost control and the confidence of his military, following the massacre of civilians by his presidential guards. Bahrain continues burning, while flares are rising up in Syria and Algeria. Israel is facing challenges from Palestinians, while Japanese nuclear crisis is still alive.

On the home front, voices arose questioning a forming bubble in the markets. “Extraordinary speculative activity” in the words of a Fed official, while oil continues its rally and precious metals position themselves for another rally (see proxies for both below).

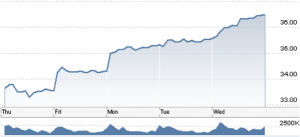

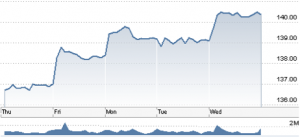

Silver Prices March 17-23, 2011

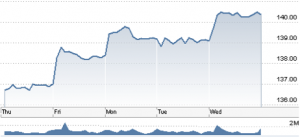

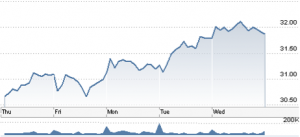

Gold prices March 17-23, 2011

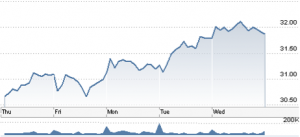

Oil prices March 17-23, 2001

We have started taking positions on natural gas which we believe will benefit from recent turmoil (see following graph). It could turn out to be as good as the silver turnout we positioned our portfolios for last June.

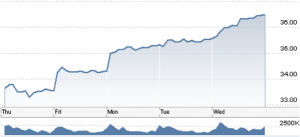

Natural Gas Prices, March 17-23, 2011

We believe that there are minimum strategic positions in precious metals, energy, and agricultural commodities that every portfolio should include. In those positions we could also include some minimum holdings in international real estate, primarily for income/dividend purposes as the latter these days deliver returns of over 8% annually (see graph below).

International Real Estate Holdings Prices

Thus, while Portugal’s yields hit record highs and Irish bond yields exceed 10%, investors strive to seek returns in an environment of elevated risk. The EU Brussels meeting on Friday will be challenged by those events which may start the decline of the Euro (even if we believe the latter will face its challenge after the swaps end in late June). The Middle East stalemate will elevate fears and possibly jeopardize smooth democratic transitions (recent events in Egypt are not that encouraging).

While those centrifugal forces are developing, industrial base metals (nickel, copper, etc.) seem to be dislocated from the broader market tone and are gaining ground, which might point to a re-affirmed divergence between developed markets’ risks and developing markets’ prospects.

We are facing an inflection point in the curve of globalization, which means that if a shock is experienced within the next 24 months, an economic vacuum may appear due to toxic assets, low money multiplier, fiscal deficits, global trade imbalances, currency tensions, and political instability. Such a shock may not be similar to any other the global economy has ever experienced, given the absence of an anchor.

To the above we could only add SIC TRANSIT GLORIA MUNDI.

On Burning Developments and Economic Prospects: Centrifugal Forces and Countercyclical Strategies

Author : John E. Charalambakis

Date : March 25, 2011

At the time of this drafting the news centers on different fronts: Prime Minister Socrates in Portugal announced his resignation over a lost confidence vote in the parliament that was about the fourth austerity package of measures within a year! Portugal soon may be rushing to the rescue of the European Financial Stability Fund and to the IMF. However, such rescue will be challenged in the political vacuum that is being created.

At the same time, the allies’ offensive on the Gaddafi’s forces continues while also trying to find an identity. Yemen’ s president announced his resignation after he lost control and the confidence of his military, following the massacre of civilians by his presidential guards. Bahrain continues burning, while flares are rising up in Syria and Algeria. Israel is facing challenges from Palestinians, while Japanese nuclear crisis is still alive.

On the home front, voices arose questioning a forming bubble in the markets. “Extraordinary speculative activity” in the words of a Fed official, while oil continues its rally and precious metals position themselves for another rally (see proxies for both below).

Silver Prices March 17-23, 2011

Gold prices March 17-23, 2011

Oil prices March 17-23, 2001

We have started taking positions on natural gas which we believe will benefit from recent turmoil (see following graph). It could turn out to be as good as the silver turnout we positioned our portfolios for last June.

Natural Gas Prices, March 17-23, 2011

We believe that there are minimum strategic positions in precious metals, energy, and agricultural commodities that every portfolio should include. In those positions we could also include some minimum holdings in international real estate, primarily for income/dividend purposes as the latter these days deliver returns of over 8% annually (see graph below).

International Real Estate Holdings Prices

Thus, while Portugal’s yields hit record highs and Irish bond yields exceed 10%, investors strive to seek returns in an environment of elevated risk. The EU Brussels meeting on Friday will be challenged by those events which may start the decline of the Euro (even if we believe the latter will face its challenge after the swaps end in late June). The Middle East stalemate will elevate fears and possibly jeopardize smooth democratic transitions (recent events in Egypt are not that encouraging).

While those centrifugal forces are developing, industrial base metals (nickel, copper, etc.) seem to be dislocated from the broader market tone and are gaining ground, which might point to a re-affirmed divergence between developed markets’ risks and developing markets’ prospects.

We are facing an inflection point in the curve of globalization, which means that if a shock is experienced within the next 24 months, an economic vacuum may appear due to toxic assets, low money multiplier, fiscal deficits, global trade imbalances, currency tensions, and political instability. Such a shock may not be similar to any other the global economy has ever experienced, given the absence of an anchor.

To the above we could only add SIC TRANSIT GLORIA MUNDI.