The markets nowadays are in purgatory. What is the task of professional market watchers and fund managers? In a nutshell we would say it is to unmask portfolio holding’s self- alienation in their secular form, once they have been unmasked in their sacred form.

Unfortunately, sometimes professionals treat particular holdings like sacred items that cannot be touched. We are of the opinion that even gold that we have advocated for over ten years cannot be treated like a sacred cow, and when warranted, profits should be taken. Such a tactical move however – given the temporary political and financial maneuvering in order to kick the can down the road – does not negate our long-term position that in the midst of the forming chaos the precious metals will start their upward trend again (implying a secular bull market in precious metals that may still have a few years to go).

In Hegelian philosophy we have a triad known as being-nothing-becoming. Without necessarily espousing it, we are afraid that the market schizophrenia observed in the last several weeks portrays the essence of that philosophy which eventually may lead to a contraction unseen and unfelt for several decades now.

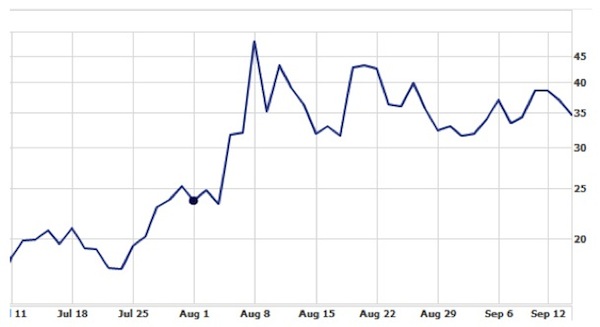

Here is a sample of that schizophrenia as it is reflected in the volatility index (VIX).

As the figure above shows, from July 25 to August 8, the price of VIX increased by more than 140%, reflecting the nothingness a.k.a. desperation of the markets. Then on August 9, the price dropped by more than 20%, reflecting the optimism (the being) that the markets are alive. That show repeated itself twice that week.

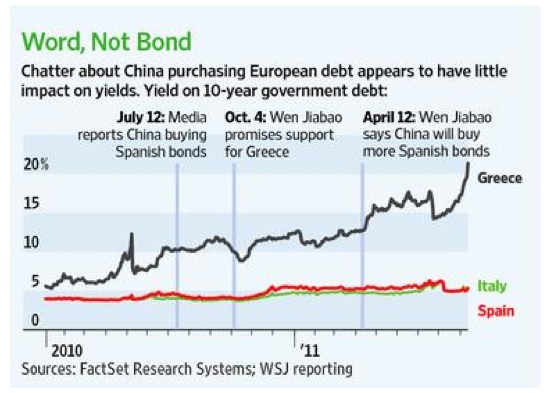

We could say the same thing regarding the market direction just last week. Italian yields were rising, EU markets were shaky, when suddenly a rumor circulated that the Chinese will buy Italian paper. The markets turned around within an hour on just a rumor. Now, regarding the rumor –since we have seen this story before – we offer our readers the graph below which clearly shows that China has not increased its EU bond purchases and while such rumors temporarily may suspend the upward trend of yields, reality keeps coming back, as we expect it to do again in the near future once the political and financial manipulations run out of steam.

The unity of the being and nothing in the markets produces the becoming of a gamma ray burst (GRB) phenomenon of financial black holes – see previous posts on this subject – that has the potential of devastating the markets, producing catastrophic chaos in the process.

We are entering into a period that for a few weeks may produce optimistic signals, but which is underwritten by toxic assets and unsustainable debt that may not be feasible to be refinanced. Defaults (not only sovereign) will squeeze illiquid assets and will depress incomes and returns. During these defaults and the ensuing fallout we may see additional jobs being destroyed. The amount of money needed to rescue the EU sovereigns could exceed $2.2 trillion and we question the EU appetite for such an amount. Moreover, the undercapitalization of the EU banks and their need to refinance hundreds of billions of dollars in paper they have issued (see September newsletter) will strain liquidity, and that squeeze alone may weakne even healthy balance sheets of nations, banks, and corporations.

Ode to anchors made up of steel and not paper!

On Being and Nothing: Are the Markets Reflecting the Becoming of Nothingness?

Author : John E. Charalambakis

Date : September 19, 2011

The markets nowadays are in purgatory. What is the task of professional market watchers and fund managers? In a nutshell we would say it is to unmask portfolio holding’s self- alienation in their secular form, once they have been unmasked in their sacred form.

Unfortunately, sometimes professionals treat particular holdings like sacred items that cannot be touched. We are of the opinion that even gold that we have advocated for over ten years cannot be treated like a sacred cow, and when warranted, profits should be taken. Such a tactical move however – given the temporary political and financial maneuvering in order to kick the can down the road – does not negate our long-term position that in the midst of the forming chaos the precious metals will start their upward trend again (implying a secular bull market in precious metals that may still have a few years to go).

In Hegelian philosophy we have a triad known as being-nothing-becoming. Without necessarily espousing it, we are afraid that the market schizophrenia observed in the last several weeks portrays the essence of that philosophy which eventually may lead to a contraction unseen and unfelt for several decades now.

Here is a sample of that schizophrenia as it is reflected in the volatility index (VIX).

As the figure above shows, from July 25 to August 8, the price of VIX increased by more than 140%, reflecting the nothingness a.k.a. desperation of the markets. Then on August 9, the price dropped by more than 20%, reflecting the optimism (the being) that the markets are alive. That show repeated itself twice that week.

We could say the same thing regarding the market direction just last week. Italian yields were rising, EU markets were shaky, when suddenly a rumor circulated that the Chinese will buy Italian paper. The markets turned around within an hour on just a rumor. Now, regarding the rumor –since we have seen this story before – we offer our readers the graph below which clearly shows that China has not increased its EU bond purchases and while such rumors temporarily may suspend the upward trend of yields, reality keeps coming back, as we expect it to do again in the near future once the political and financial manipulations run out of steam.

The unity of the being and nothing in the markets produces the becoming of a gamma ray burst (GRB) phenomenon of financial black holes – see previous posts on this subject – that has the potential of devastating the markets, producing catastrophic chaos in the process.

We are entering into a period that for a few weeks may produce optimistic signals, but which is underwritten by toxic assets and unsustainable debt that may not be feasible to be refinanced. Defaults (not only sovereign) will squeeze illiquid assets and will depress incomes and returns. During these defaults and the ensuing fallout we may see additional jobs being destroyed. The amount of money needed to rescue the EU sovereigns could exceed $2.2 trillion and we question the EU appetite for such an amount. Moreover, the undercapitalization of the EU banks and their need to refinance hundreds of billions of dollars in paper they have issued (see September newsletter) will strain liquidity, and that squeeze alone may weakne even healthy balance sheets of nations, banks, and corporations.

Ode to anchors made up of steel and not paper!