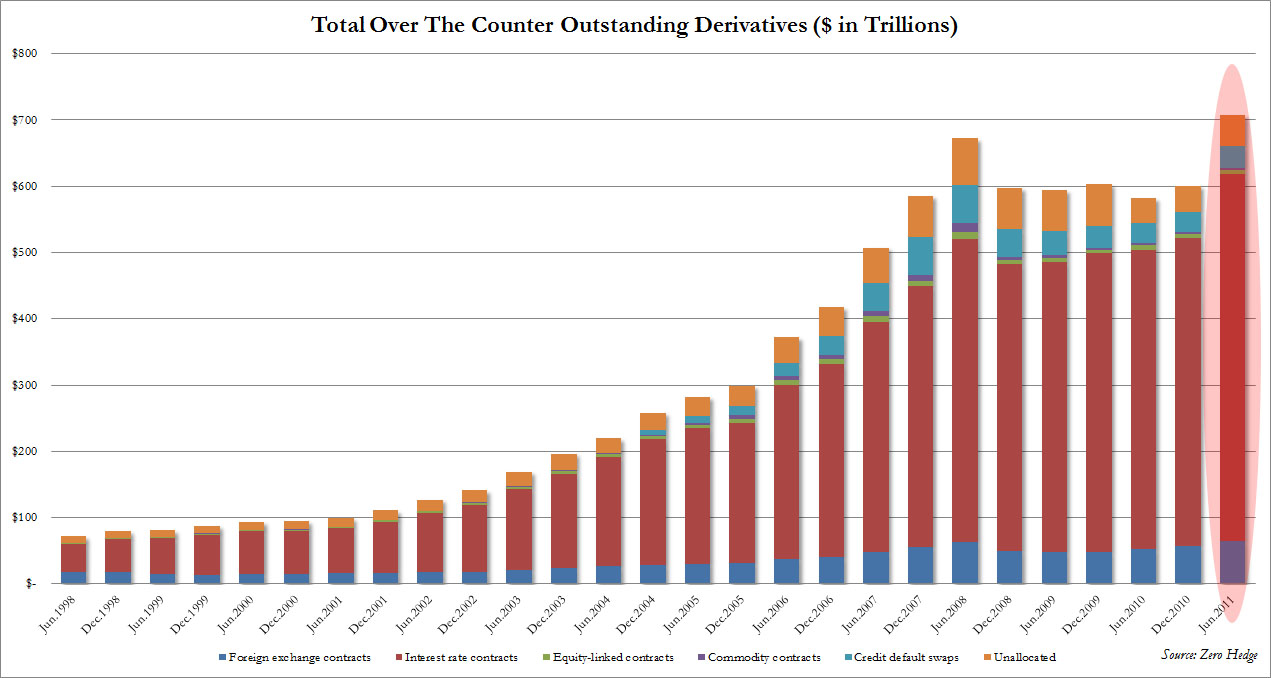

Last Thursday evening, JP Morgan Chase admitted to losses of at least $2 billion on a $100 billion derivatives bet, baptized as hedging. As time goes by, the actual losses may increase. For review purposes, it is helpful to revisit the worldwide $700 trillion monster called derivatives.

While the global economy grew by less than one trillion (a mere 1.4%) in 2011, the derivatives grew by $107 trillion (or 17.80%)! A margin call on some of them could devastate balance sheets. Some banks might be too big to manage.

The collateralization and securitization of those toxic paper “assets”/bets advanced credit creation, converted the money supply process into an endogenous process controlled by the biggest banks – with the Fed a soldier ready to obey the collateralization calls, rather than the general/watch hawk in the money creation process – while cheapened standards, destroyed wealth and competitive advantages, misallocated assets, fattened tail risks, and created malignant economic and financial situations.

The outcome of this malignant situation was the financial crisis that started in the summer 2007 and is continuing with the EU-wide crisis. Over the weekend we were told that the Spanish government decided to require its banks to budget for greater loss provisions. Such additional provisions amount to about $38 billion, and if we count the previous provisions of about $65 billion, then well over $100 loss provisions for just Spanish banks are thought to do the trick. With all due respect, this reminds us of the previous firewalls announced in the EU through the EFSF soon to be replaced by the ESM, which amounted to almost nothing.

Also during the weekend we heard news related to the slowdown in China, which resulted in a new cut of the bank reserve ratio. We anticipate greater monetary stimuli in China, and we also believe that the ground is being prepared for the ECB to open the spigot and start buying EU bonds, while also financing EU-wide banks. The new measures of quantitative easing (QE) in China and the EU may be followed by a new round of QE (however it is baptized) in the US.

We are of the opinion that as QE measures are being prepared worldwide, a new round of gains for hard assets and particularly for precious metals may start. We have been on the record for a few months now that precious metals were destined to take a pause, as they did. Our expectation was that such a pause would have lasted a few more months; however, it seems that we may find soon that this would not be the case.

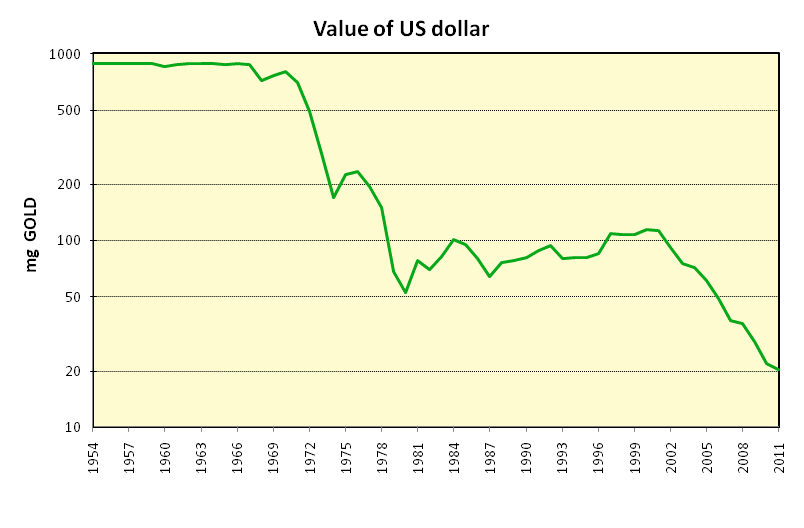

This leads us to the need to renew the call for a global monetary anchor that would stabilize the monetary system. The truth is that fiat currencies have no future (see graph below) unless are tied to an anchor.

The graph above, signifies the lost purchasing power of the dollar in relation to gold since 1913. Monetary expansion without wealth and value creation creates financial crises that destroy nations and people.

We believe that the next 12-24 months are very critical and could signify the beginning of four major global turns:

First, the start of the breakup of the big banks that caused the financial crisis.

Second, a change in US energy policy, where natural gas will start replacing oil as the primary energy source.

Third, the establishment of an independent Palestinian state and the change in the geopolitics in the Middle East.

Fourth, the beginning of designing a new global monetary anchor where precious metal will be playing a vital role.

On Bank Losses, Hedging, Fiat Currencies, and Risks: The Role of Anchors

Author : John E. Charalambakis

Date : May 14, 2012

Last Thursday evening, JP Morgan Chase admitted to losses of at least $2 billion on a $100 billion derivatives bet, baptized as hedging. As time goes by, the actual losses may increase. For review purposes, it is helpful to revisit the worldwide $700 trillion monster called derivatives.

While the global economy grew by less than one trillion (a mere 1.4%) in 2011, the derivatives grew by $107 trillion (or 17.80%)! A margin call on some of them could devastate balance sheets. Some banks might be too big to manage.

The collateralization and securitization of those toxic paper “assets”/bets advanced credit creation, converted the money supply process into an endogenous process controlled by the biggest banks – with the Fed a soldier ready to obey the collateralization calls, rather than the general/watch hawk in the money creation process – while cheapened standards, destroyed wealth and competitive advantages, misallocated assets, fattened tail risks, and created malignant economic and financial situations.

The outcome of this malignant situation was the financial crisis that started in the summer 2007 and is continuing with the EU-wide crisis. Over the weekend we were told that the Spanish government decided to require its banks to budget for greater loss provisions. Such additional provisions amount to about $38 billion, and if we count the previous provisions of about $65 billion, then well over $100 loss provisions for just Spanish banks are thought to do the trick. With all due respect, this reminds us of the previous firewalls announced in the EU through the EFSF soon to be replaced by the ESM, which amounted to almost nothing.

Also during the weekend we heard news related to the slowdown in China, which resulted in a new cut of the bank reserve ratio. We anticipate greater monetary stimuli in China, and we also believe that the ground is being prepared for the ECB to open the spigot and start buying EU bonds, while also financing EU-wide banks. The new measures of quantitative easing (QE) in China and the EU may be followed by a new round of QE (however it is baptized) in the US.

We are of the opinion that as QE measures are being prepared worldwide, a new round of gains for hard assets and particularly for precious metals may start. We have been on the record for a few months now that precious metals were destined to take a pause, as they did. Our expectation was that such a pause would have lasted a few more months; however, it seems that we may find soon that this would not be the case.

This leads us to the need to renew the call for a global monetary anchor that would stabilize the monetary system. The truth is that fiat currencies have no future (see graph below) unless are tied to an anchor.

The graph above, signifies the lost purchasing power of the dollar in relation to gold since 1913. Monetary expansion without wealth and value creation creates financial crises that destroy nations and people.

We believe that the next 12-24 months are very critical and could signify the beginning of four major global turns:

First, the start of the breakup of the big banks that caused the financial crisis.

Second, a change in US energy policy, where natural gas will start replacing oil as the primary energy source.

Third, the establishment of an independent Palestinian state and the change in the geopolitics in the Middle East.

Fourth, the beginning of designing a new global monetary anchor where precious metal will be playing a vital role.