The market celebrated a Dow Jones Industrial Average that reached 20,000 yesterday. Is this too much of good news? Is it sustainable and could it be that investors are carried away? Could a correction erase the good performance since November given the high market multiples, the protectionist turn in US trade policy, the Brexit tremors, and the uncertainty over the future of the EU? Let’s review some fundamentals that have uplifted the market since November:

-Anticipated US policy (taxes, fiscal stimulus, deregulation)

-Higher US growth rate

-Higher corporate earnings

-Higher consumer and investor sentiment

-Projections’ reversal for financial and energy companies

-Higher risk appetite and lower risk premium in an environment where risks to the economy no longer point down

-Higher PMIs in the EU

Is it possible that the above trends be reversed? Of course, it is possible. Maybe the US Congress and political gridlock will not allow all anticipated policies to materialize. It’s even possible that investors will pause at the market’s high multiples. Trade conflicts – let alone a trade war – could have serious negative effects. Higher rates could lower earnings and spending, or even the simple fact that we are on the seventh consecutive year of expansion may give investors a pause, especially when we take into account that asset prices have been inflated because of unorthodox monetary policy while corporate cash flow barely covers capital investments and dividends.

Given the above real concerns, our position is that overall the market is tilted for an upswing at least in the near term. Specifically, here are our views for the major markets around the globe:

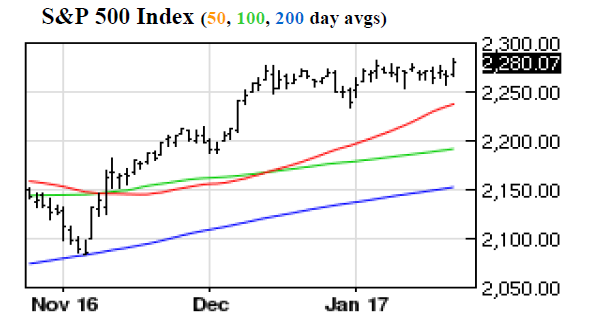

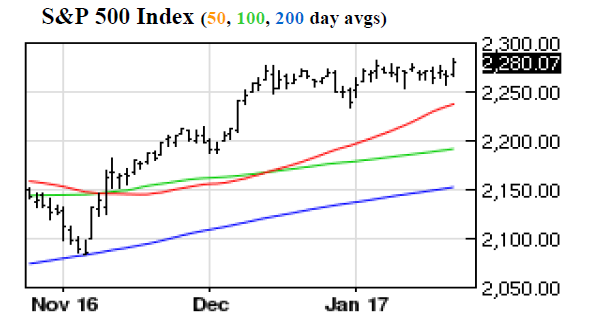

US: For reasons presented above (see bullet points) and mainly due to anticipated policies and the earnings recovery, an upward momentum for the equities seems to be sustainable. The financial stress index is below its threshold level and the overall market has a positive trend relative to 50, 100, and 200 days moving averages, signifying that positive momentum, as the following graph shows.

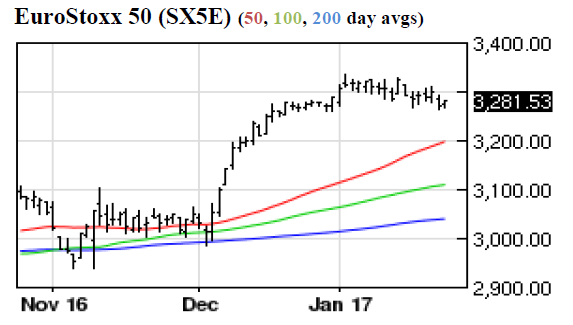

EU: The positive figures (production, spending, growth, earnings, etc.) although not very significant are in the right direction. A turmoil related to Brexit could derail upswing trend, however at least for the next 6 months things seem to be under control. The downward trajectory of the Euro helps too. The Eurostoxx 50 is above the 50, 100, 200 days moving averages signifying a positive momentum too, as shown below.

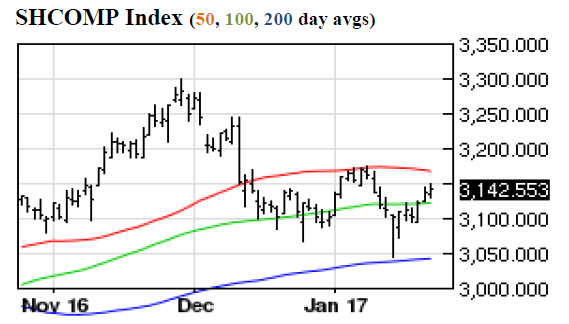

China: The Chinese market faces some headwinds (debt, liquidity, trade relations with the US, capital flight, bubbles) however we believe that they will be able to contain an implosion of their problems/bubbles (given that this is a very political year for them), hence overall Chinese markets could go sideways or enjoy some limited gains. The Shanghai Index is below its 50-day moving average but above its 100 and 200 days moving averages.

Japan: As for Japan, we believe that the weaker Yen and the Japanese extra measures in fighting Japanification will help the market to obtain some upside for the next 6 months. The Nikkei Index remains above its 50, 100, and 200 days moving averages providing support and a limited momentum, as shown below.

On balance and in conclusion and provided that we do share the concerns discussed above, we are of the opinion that value-oriented equities are safer investments and possibly even more promising than the high-flying stocks. There are three reasons for such a position: First, they have multiples that are below the market being laggards and dogs in the market rally of the last few years; Second, their fundamentals position them to grow faster in a cyclical upswing; Thirdly, from a historical standpoint laggards outperform the market when the latter is given an additional boost beyond its normal cycle.

New Market Highs and Underperformers: Fundamentals Meet Technical Charts

Author : John E. Charalambakis

Date : January 25, 2017

The market celebrated a Dow Jones Industrial Average that reached 20,000 yesterday. Is this too much of good news? Is it sustainable and could it be that investors are carried away? Could a correction erase the good performance since November given the high market multiples, the protectionist turn in US trade policy, the Brexit tremors, and the uncertainty over the future of the EU? Let’s review some fundamentals that have uplifted the market since November:

-Anticipated US policy (taxes, fiscal stimulus, deregulation)

-Higher US growth rate

-Higher corporate earnings

-Higher consumer and investor sentiment

-Projections’ reversal for financial and energy companies

-Higher risk appetite and lower risk premium in an environment where risks to the economy no longer point down

-Higher PMIs in the EU

Is it possible that the above trends be reversed? Of course, it is possible. Maybe the US Congress and political gridlock will not allow all anticipated policies to materialize. It’s even possible that investors will pause at the market’s high multiples. Trade conflicts – let alone a trade war – could have serious negative effects. Higher rates could lower earnings and spending, or even the simple fact that we are on the seventh consecutive year of expansion may give investors a pause, especially when we take into account that asset prices have been inflated because of unorthodox monetary policy while corporate cash flow barely covers capital investments and dividends.

Given the above real concerns, our position is that overall the market is tilted for an upswing at least in the near term. Specifically, here are our views for the major markets around the globe:

US: For reasons presented above (see bullet points) and mainly due to anticipated policies and the earnings recovery, an upward momentum for the equities seems to be sustainable. The financial stress index is below its threshold level and the overall market has a positive trend relative to 50, 100, and 200 days moving averages, signifying that positive momentum, as the following graph shows.

EU: The positive figures (production, spending, growth, earnings, etc.) although not very significant are in the right direction. A turmoil related to Brexit could derail upswing trend, however at least for the next 6 months things seem to be under control. The downward trajectory of the Euro helps too. The Eurostoxx 50 is above the 50, 100, 200 days moving averages signifying a positive momentum too, as shown below.

China: The Chinese market faces some headwinds (debt, liquidity, trade relations with the US, capital flight, bubbles) however we believe that they will be able to contain an implosion of their problems/bubbles (given that this is a very political year for them), hence overall Chinese markets could go sideways or enjoy some limited gains. The Shanghai Index is below its 50-day moving average but above its 100 and 200 days moving averages.

Japan: As for Japan, we believe that the weaker Yen and the Japanese extra measures in fighting Japanification will help the market to obtain some upside for the next 6 months. The Nikkei Index remains above its 50, 100, and 200 days moving averages providing support and a limited momentum, as shown below.

On balance and in conclusion and provided that we do share the concerns discussed above, we are of the opinion that value-oriented equities are safer investments and possibly even more promising than the high-flying stocks. There are three reasons for such a position: First, they have multiples that are below the market being laggards and dogs in the market rally of the last few years; Second, their fundamentals position them to grow faster in a cyclical upswing; Thirdly, from a historical standpoint laggards outperform the market when the latter is given an additional boost beyond its normal cycle.