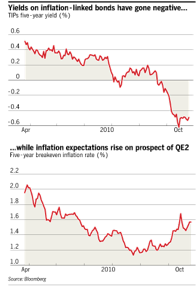

Just a few days ago the auction for TIPS (Treasury Inflation Protection Securities) produced for the first time ever negative yields. When we take into account that TIPS’ correlation with the conventional inflation measure (CPI) barely exceeds twenty percent, then we can understand that TIPS is not the optimal place to park cash and be protected from potential inflationary pressures. The graph below shows both the negative yield and the inflationary expectations.

We are of the opinion that there are better places where cash can be parked and enjoy better yields and prospects. Last November in our newsletter, we took the position that in times like these, dividend plays offer promising returns. Moreover, and as our clients have seen, carefully selected MLPs (Master-Limited-Partnerships), especially in the energy sector, offer good yields (some of them over 6%) and growth prospects. In addition, the energy sector in general is a good buffer for inflation, as history has shown.

We are of the opinion that there are better places where cash can be parked and enjoy better yields and prospects. Last November in our newsletter, we took the position that in times like these, dividend plays offer promising returns. Moreover, and as our clients have seen, carefully selected MLPs (Master-Limited-Partnerships), especially in the energy sector, offer good yields (some of them over 6%) and growth prospects. In addition, the energy sector in general is a good buffer for inflation, as history has shown.

In addition, global dividend plays offer additional exchange rate protection-prospect. In an environment where the dollar is losing ground, a global dividend play advances returns due to strengthened foreign currencies. The latter is another option – better in our opinion- than TIPS.

We would be happy to discuss individualized options for your portfolio, if you called our office.

The expected move by the Fed – known as QE2 – is advancing inflationary expectations and puzzles investors worldwide. Precious metals in general have the best prospects against inflation. However, while gold has gained significantly this year, in the last couple of weeks has been going sideways. Same thing is happening to silver, which has gained significantly since we took a position in it in late June. How could we explain this late sideways movement?

Just a couple of days ago, Bart Chilton who serves on the Commodities Futures Trading Commission (CFTC), complained that some major precious metals traders manipulate the markets which are tainted by violations of federal commodities law. If those alleged shenanigans are taking place, then we expect precious metals, and especially silver to gain significantly by year’s end and possibly even more in 2011.

If traders are shorting metals (in the COMEX market one third of the short positions is held by four traders, according to CFTC data), then a reversal of fortunes could allow precious metals to gain a significant percentage within a few months time. In addition, if currency instability evolves (see our November 2010 newsletter which is dedicated to that theme), then precious metals and hard assets in general would be the ultimate refuge in a system that discredits paper assets.

The Fed may not have a “magic wand” for the economy, but it could certainly start pushing the rock in the right direction.

Negative Yields, Inflationary Expectations, and Portfolio Allocation: In what Directions is Sisyphus Pushing the Rock?

Author : John E. Charalambakis

Date : November 2, 2010

Just a few days ago the auction for TIPS (Treasury Inflation Protection Securities) produced for the first time ever negative yields. When we take into account that TIPS’ correlation with the conventional inflation measure (CPI) barely exceeds twenty percent, then we can understand that TIPS is not the optimal place to park cash and be protected from potential inflationary pressures. The graph below shows both the negative yield and the inflationary expectations.

In addition, global dividend plays offer additional exchange rate protection-prospect. In an environment where the dollar is losing ground, a global dividend play advances returns due to strengthened foreign currencies. The latter is another option – better in our opinion- than TIPS.

We would be happy to discuss individualized options for your portfolio, if you called our office.

The expected move by the Fed – known as QE2 – is advancing inflationary expectations and puzzles investors worldwide. Precious metals in general have the best prospects against inflation. However, while gold has gained significantly this year, in the last couple of weeks has been going sideways. Same thing is happening to silver, which has gained significantly since we took a position in it in late June. How could we explain this late sideways movement?

Just a couple of days ago, Bart Chilton who serves on the Commodities Futures Trading Commission (CFTC), complained that some major precious metals traders manipulate the markets which are tainted by violations of federal commodities law. If those alleged shenanigans are taking place, then we expect precious metals, and especially silver to gain significantly by year’s end and possibly even more in 2011.

If traders are shorting metals (in the COMEX market one third of the short positions is held by four traders, according to CFTC data), then a reversal of fortunes could allow precious metals to gain a significant percentage within a few months time. In addition, if currency instability evolves (see our November 2010 newsletter which is dedicated to that theme), then precious metals and hard assets in general would be the ultimate refuge in a system that discredits paper assets.

The Fed may not have a “magic wand” for the economy, but it could certainly start pushing the rock in the right direction.