Last week the European Central Bank (ECB) started buying corporate bonds. Over the course of the last four year the ECB has committed to “do whatever it takes” to save an ill-conceived monetary union and a dysfunctional Euro. Among its programs were the purchase of member-state government bonds (baptized as assets) and a policy of negative interest rates. Now, the new scheme is aiming to boost EU corporate bond prices, reduce the yields on EU corporate bonds, and artificially sustain an unnatural situation where growth and productivity remain wanted.

We are of the opinion that such a policy introduces further market distortions and misallocates capital. This new scheme may be able to further boost the prices of EU bonds and probably also EU equities, as EU-based companies will follow the American example of repurchasing their stocks. In addition, the spreads between government and corporate bonds should narrow. Furthermore, we are of the opinion that capital released will also find its way across the Atlantic, boosting US equities and bonds

Therefore, the overall ECB scheme is another form of the well known but misconceived effort to boost financial asset prices and create a placebo effect in anticipation of a deus ex machina

who is expected to take care of the problems with a magic wand.

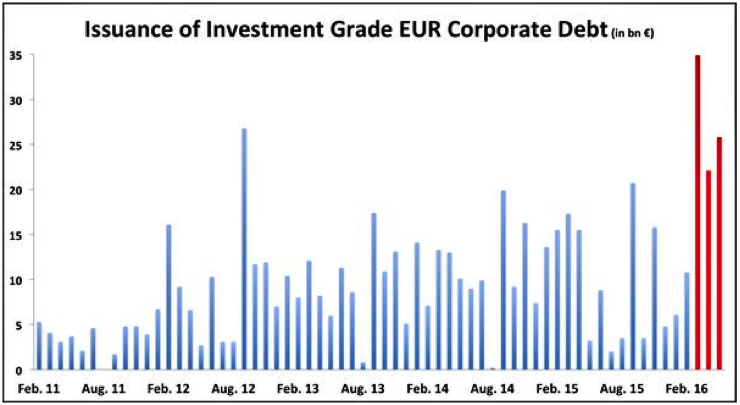

In anticipation of the new ECB scheme, EU-based corporate bond issuance exceeded all records of the last five years, as shown below.

As a result of the ECB’s anticipated action, EU corporate bond yields have declined significantly over the last few months and almost 15% of them pay negative interest rates as shown below!

As a result of the ECB’s anticipated action, EU corporate bond yields have declined significantly over the last few months and almost 15% of them pay negative interest rates as shown below!

It is unheard of for corporate bonds – which carry default risk among other risks– to have negative yields. Of course, this would have never happened if it were not for the ECB and its convoluted schemes of negative rates.

It is unheard of for corporate bonds – which carry default risk among other risks– to have negative yields. Of course, this would have never happened if it were not for the ECB and its convoluted schemes of negative rates.

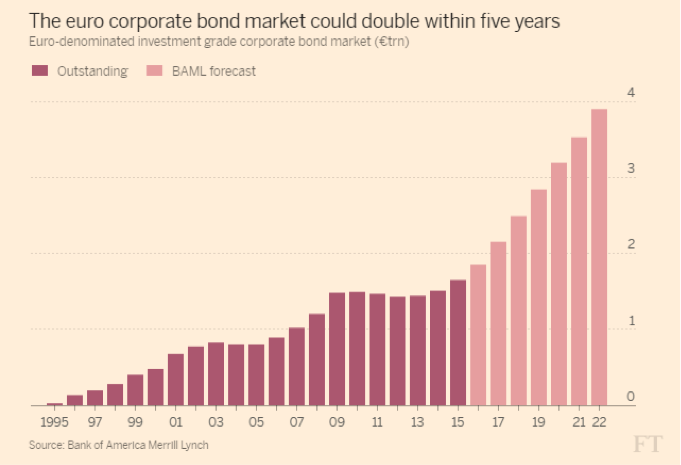

As corporate yields decline and the spreads between corporate and sovereign decline too, the appetite for higher risk may also lead to narrower spreads between investment-grade and junk bond yields with the result being a higher appetite for risk and a push to deploy capital. As the latter occurs the anticipation will be that the debt market will experience a rejuvenation via higher bond issuance, as shown below.

As corporate yields decline and the spreads between corporate and sovereign decline too, the appetite for higher risk may also lead to narrower spreads between investment-grade and junk bond yields with the result being a higher appetite for risk and a push to deploy capital. As the latter occurs the anticipation will be that the debt market will experience a rejuvenation via higher bond issuance, as shown below.

We consider the corporate bond purchases by the ECB a natural outcome of their commitment to sustain a monetary union through artificial means that has nothing to do with productivity. Their over-commitment to purchase sovereign bonds may be running into a wall if the targeted volume of sovereign bonds does not exist; thus the need to start buying corporate paper. Moreover, what may seem as uncoordinated action among central banks (Japanese, ECB, Fed, Swiss, Nordic, etc.) may end up being a coordinated symphony of debt that also reflects the character of fiscal policies.

We consider the corporate bond purchases by the ECB a natural outcome of their commitment to sustain a monetary union through artificial means that has nothing to do with productivity. Their over-commitment to purchase sovereign bonds may be running into a wall if the targeted volume of sovereign bonds does not exist; thus the need to start buying corporate paper. Moreover, what may seem as uncoordinated action among central banks (Japanese, ECB, Fed, Swiss, Nordic, etc.) may end up being a coordinated symphony of debt that also reflects the character of fiscal policies.

The bewilderment related to the current state of economic and financial affairs may temporarily be addressed by a political change that gives fiscal policy (tax and spending) a primary role. Under such a regime, where the primacy of fiscal policy is restored with the explicit help of an accommodating central bank, equity and debt markets may enjoy another run. Let’s not forget that under fiscal pressures the Habsburgs of Spain promoted gold and silver explorations in the New World. Let’s not also forget that under fiscal pressures William III’s government established the central bank in England. Furthermore, we also need to recall that John Law’s scheme of paper money was an attempt to convert French government debt into equity. Certainly, it would be a mistake to neglect that under fiscal pressures following revolutions both the Americans and the French issued paper money in unprecedented amounts.

The same story continued in the 20th century where chaos was followed by order, only for the cycle to be repeated every few decades. Historically speaking we could say that following the failed attempts to sustain an unsustainable debt situation the anchor of stability was implemented. Let’s hope that this time it would not be different.

Negative Rates and their Effects on the Equities and Bond Markets: Bifurcation Meets Bewilderment in Historical Perspective

Author : John E. Charalambakis

Date : June 14, 2016

Last week the European Central Bank (ECB) started buying corporate bonds. Over the course of the last four year the ECB has committed to “do whatever it takes” to save an ill-conceived monetary union and a dysfunctional Euro. Among its programs were the purchase of member-state government bonds (baptized as assets) and a policy of negative interest rates. Now, the new scheme is aiming to boost EU corporate bond prices, reduce the yields on EU corporate bonds, and artificially sustain an unnatural situation where growth and productivity remain wanted.

We are of the opinion that such a policy introduces further market distortions and misallocates capital. This new scheme may be able to further boost the prices of EU bonds and probably also EU equities, as EU-based companies will follow the American example of repurchasing their stocks. In addition, the spreads between government and corporate bonds should narrow. Furthermore, we are of the opinion that capital released will also find its way across the Atlantic, boosting US equities and bonds

Therefore, the overall ECB scheme is another form of the well known but misconceived effort to boost financial asset prices and create a placebo effect in anticipation of a deus ex machina

who is expected to take care of the problems with a magic wand.

In anticipation of the new ECB scheme, EU-based corporate bond issuance exceeded all records of the last five years, as shown below.

The bewilderment related to the current state of economic and financial affairs may temporarily be addressed by a political change that gives fiscal policy (tax and spending) a primary role. Under such a regime, where the primacy of fiscal policy is restored with the explicit help of an accommodating central bank, equity and debt markets may enjoy another run. Let’s not forget that under fiscal pressures the Habsburgs of Spain promoted gold and silver explorations in the New World. Let’s not also forget that under fiscal pressures William III’s government established the central bank in England. Furthermore, we also need to recall that John Law’s scheme of paper money was an attempt to convert French government debt into equity. Certainly, it would be a mistake to neglect that under fiscal pressures following revolutions both the Americans and the French issued paper money in unprecedented amounts.

The same story continued in the 20th century where chaos was followed by order, only for the cycle to be repeated every few decades. Historically speaking we could say that following the failed attempts to sustain an unsustainable debt situation the anchor of stability was implemented. Let’s hope that this time it would not be different.