The official start of the fall season is upon us. Music is still played over loud speakers and the politicians plan for their rallies and agendas. Over the wires, we read about Chairman Bernanke’s hypothetical plans to start buying equities for the Fed’s portfolio. We certainly hope not!

The global economy in general and the American economy in particular have more than a few mountains to climb. It’s the mountain of worthless paper “assets”; it’s the mountain of debt; it’s the mountain of unfunded liabilities; it’s the mountain of trade deficits; it’s the mountain of credit over-extension; it’s the mountain of lost jobs; it’s the mountain of bubbles lying around; it’s the mountain of fiat money; it’s the mountain of insecurity and instability; to name just a few of them.

Climbing the mountains sometimes creates the false hope that the summit is close, only to be disappointed by the view from the distance in the midst of a valley. While climbing, weather conditions may change. Snowstorms may be dangerous. Snowballs with the potential of becoming avalanches are lethal. In the latter a refuge is needed, and good signals are valuable. In the midst of the storm a race to the bottom of the mountain can inflict panic. In the immediate past few writings (September newsletter and also some commentaries) we warned of potential avalanches. At the same time we were happy to see our recommendation on silver (see July-August newsletter) to be enjoying a 12% return, while our favorite (gold) is gaining ground.

Economies have just started paying off debt. The restructuring and deleveraging process will take years. Assuming that the architects will take off a few floors from the global credit/financial architecture and the collapse is avoided, we believe that we may be in for a long recession and/or a subnormal growth (a true great recession) that may last a few years. As we analyzed in our April issue, most economies have a true debt/GDP measure that exceeds 400% (we include both public and private obligations). In addition to that, the off-balance-sheet liabilities make the situation even worse. Extending credit for more unproductive borrowing is schizophrenic. At the same time, deflationary forces reduce corporate profits, and thus the combined long-term expectations decline too.

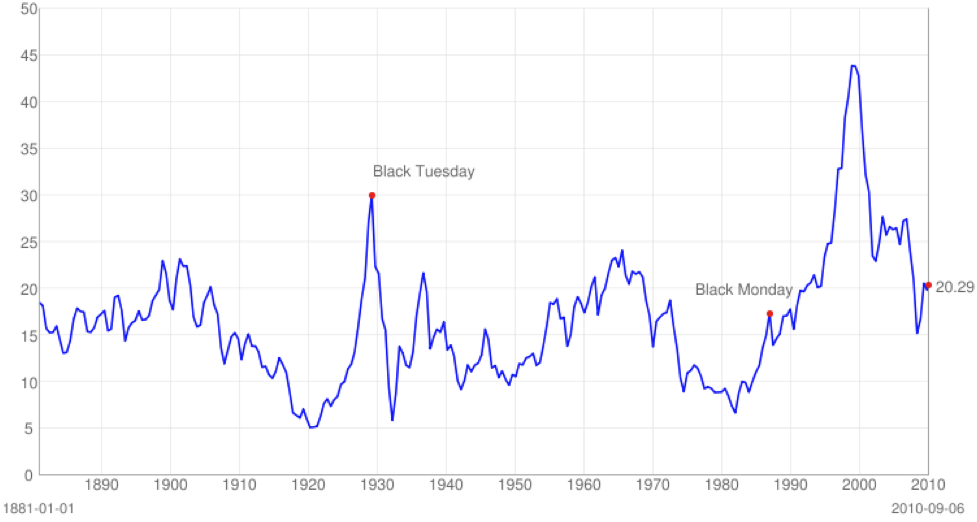

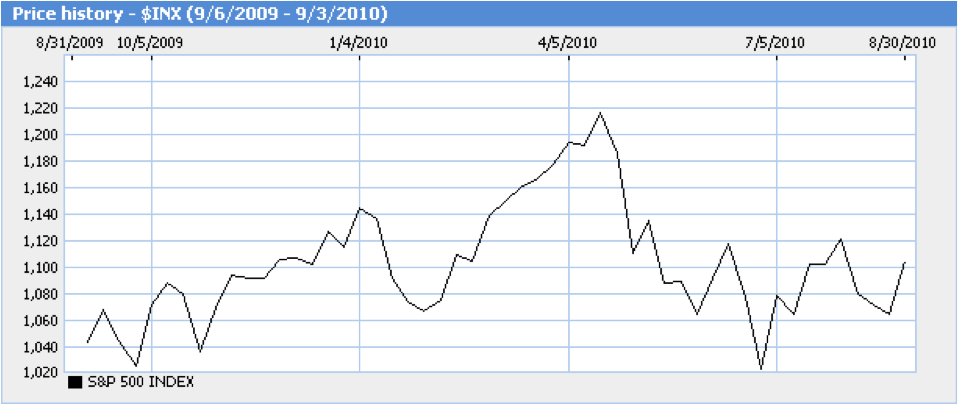

The S&P 500 stands at about 20 times average 10-year trailing earnings. We consider that level very expensive (bonds are very expensive too, as we recently wrote). In previous similar cases (e.g. 1949 and 1981-’82) multiples fell to between five and nine times. If the situation were to repeat itself today, a 12 times multiple, could see the S&P falling to about 670 from about 1100 these days (that’s an almost 40% drop). The following two figures show us the P/E ratio for the S&P 500, as well as the S&P index. Thus, a strategy might involve a shortening of the S&P index, while at the same time someone could hedge that step by following a hybrid structure by investing in some sound floating-rate funds. The latter will gain in value if the economy unexpectedly gains strength and/or if interest rates start rising. These funds adjust to fluctuating market conditions given the fact that they do not have fixed interest payouts. Of course, an investor should take into account the credit quality of the funds. At the same time the particular investor could supplement that hedge by investing in some preferred stocks (or even better in an index fund of preferred stocks) and in a Utilities Index that also pays good dividends.

We would be happy to discuss the above with you. As always, please enjoy the ride.

Mountains to Climb

Author : John E. Charalambakis

Date : September 9, 2010

The official start of the fall season is upon us. Music is still played over loud speakers and the politicians plan for their rallies and agendas. Over the wires, we read about Chairman Bernanke’s hypothetical plans to start buying equities for the Fed’s portfolio. We certainly hope not!

The global economy in general and the American economy in particular have more than a few mountains to climb. It’s the mountain of worthless paper “assets”; it’s the mountain of debt; it’s the mountain of unfunded liabilities; it’s the mountain of trade deficits; it’s the mountain of credit over-extension; it’s the mountain of lost jobs; it’s the mountain of bubbles lying around; it’s the mountain of fiat money; it’s the mountain of insecurity and instability; to name just a few of them.

Climbing the mountains sometimes creates the false hope that the summit is close, only to be disappointed by the view from the distance in the midst of a valley. While climbing, weather conditions may change. Snowstorms may be dangerous. Snowballs with the potential of becoming avalanches are lethal. In the latter a refuge is needed, and good signals are valuable. In the midst of the storm a race to the bottom of the mountain can inflict panic. In the immediate past few writings (September newsletter and also some commentaries) we warned of potential avalanches. At the same time we were happy to see our recommendation on silver (see July-August newsletter) to be enjoying a 12% return, while our favorite (gold) is gaining ground.

Economies have just started paying off debt. The restructuring and deleveraging process will take years. Assuming that the architects will take off a few floors from the global credit/financial architecture and the collapse is avoided, we believe that we may be in for a long recession and/or a subnormal growth (a true great recession) that may last a few years. As we analyzed in our April issue, most economies have a true debt/GDP measure that exceeds 400% (we include both public and private obligations). In addition to that, the off-balance-sheet liabilities make the situation even worse. Extending credit for more unproductive borrowing is schizophrenic. At the same time, deflationary forces reduce corporate profits, and thus the combined long-term expectations decline too.

The S&P 500 stands at about 20 times average 10-year trailing earnings. We consider that level very expensive (bonds are very expensive too, as we recently wrote). In previous similar cases (e.g. 1949 and 1981-’82) multiples fell to between five and nine times. If the situation were to repeat itself today, a 12 times multiple, could see the S&P falling to about 670 from about 1100 these days (that’s an almost 40% drop). The following two figures show us the P/E ratio for the S&P 500, as well as the S&P index. Thus, a strategy might involve a shortening of the S&P index, while at the same time someone could hedge that step by following a hybrid structure by investing in some sound floating-rate funds. The latter will gain in value if the economy unexpectedly gains strength and/or if interest rates start rising. These funds adjust to fluctuating market conditions given the fact that they do not have fixed interest payouts. Of course, an investor should take into account the credit quality of the funds. At the same time the particular investor could supplement that hedge by investing in some preferred stocks (or even better in an index fund of preferred stocks) and in a Utilities Index that also pays good dividends.

We would be happy to discuss the above with you. As always, please enjoy the ride.