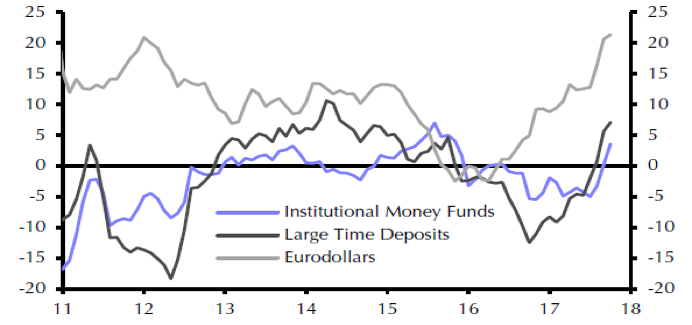

The recent data on M3 (a broader definition of money supply that includes money market funds and large time deposits) show that its growth has been 6.5% (year-on-year) and actually stands at a three-year high (see graph below). How could that be explained and how could it be related to the markets’ outlook for next year?

One reason for this is the Eurodollar market (dollars deposited in accounts outside the US) and oil prices. As oil prices have been rising and seem to be stabilizing around $55/barrel (we could even see them in the low $60s), more dollars are circulated and deposited to bank accounts. In addition, as short-term rates rise (and they are expected to keep rising) large time deposits increase and thus more money becomes available. Historically speaking when short-term rates rise, savings deposits decline while demand for money market funds increases. Also historically speaking, as M3 growth accelerates, the growth rate in business loans also picks up and economic activity is boosted. Therefore, from those perspectives sales, profits, and expectations are expected to remain elevated and support the markets.

Source: Capital Economics

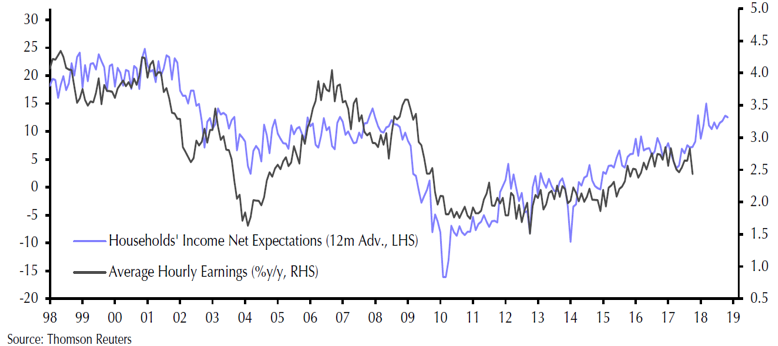

We could say that the sector that could benefit from the above is the financial sector. Moreover, as economic activity increases, we also believe that industrials stocks should do well. Now, when we take into consideration consumer confidence and the latest data on it (see graph below), then we would not be surprised if consumer discretionary stocks also do well in the next few months.

The Conference Board Consumer Confidence Index stands at its 17-year high, indicating that consumer spending may accelerate. It is interesting to note – as the figure above shows – that consumers are very upbeat about their income expectations which usually lead them to spend more money and thus boost sales and profits.

Finally, it should be noted that based on current projections wage growth could rise as much as 3% in 2018, which will further boost spending and potentially create higher than normal inflationary pressures by the end of 2018.

Monetary Trends and 2018 Outlook: Searching for Value

Author : John E. Charalambakis

Date : November 30, 2017

The recent data on M3 (a broader definition of money supply that includes money market funds and large time deposits) show that its growth has been 6.5% (year-on-year) and actually stands at a three-year high (see graph below). How could that be explained and how could it be related to the markets’ outlook for next year?

One reason for this is the Eurodollar market (dollars deposited in accounts outside the US) and oil prices. As oil prices have been rising and seem to be stabilizing around $55/barrel (we could even see them in the low $60s), more dollars are circulated and deposited to bank accounts. In addition, as short-term rates rise (and they are expected to keep rising) large time deposits increase and thus more money becomes available. Historically speaking when short-term rates rise, savings deposits decline while demand for money market funds increases. Also historically speaking, as M3 growth accelerates, the growth rate in business loans also picks up and economic activity is boosted. Therefore, from those perspectives sales, profits, and expectations are expected to remain elevated and support the markets.

Source: Capital Economics

We could say that the sector that could benefit from the above is the financial sector. Moreover, as economic activity increases, we also believe that industrials stocks should do well. Now, when we take into consideration consumer confidence and the latest data on it (see graph below), then we would not be surprised if consumer discretionary stocks also do well in the next few months.

The Conference Board Consumer Confidence Index stands at its 17-year high, indicating that consumer spending may accelerate. It is interesting to note – as the figure above shows – that consumers are very upbeat about their income expectations which usually lead them to spend more money and thus boost sales and profits.

Finally, it should be noted that based on current projections wage growth could rise as much as 3% in 2018, which will further boost spending and potentially create higher than normal inflationary pressures by the end of 2018.