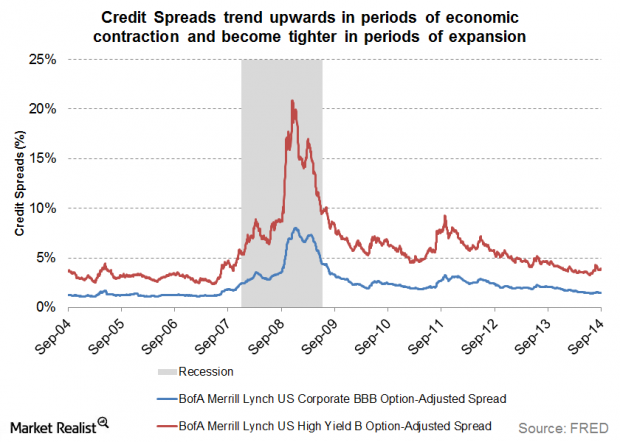

Historically speaking credit markets serve as a reliable signal regarding global economic conditions. Tight spreads between corporate and government bonds have been indicating improving economic conditions, faster growth, higher incomes and profits and rising business confidence. On the contrary widening spreads are indicative of trouble coming into the markets and the economy. As the graph below shows, spreads (for both investment-grade as well as for junk bonds) started rising in late summer 2007 and reached their highs in September 2008 during the peak of the financial crisis.

We also saw (as demonstrated below) that spreads started rising in the middle of 2015 and reaching a high (for the last three years) in early 2016 as concerns about China, growth, and corporate profits became part of investors’ menu.

As of the end of last week, credit spreads have tightened, indicating improving economic conditions and expectations. Last week we pointed out some of the main factors that have created this optimism. We choose in this commentary to point out that in this exuberant spirit we cannot neglect the risks and uncertainties that surround financial markets and the global economy. Such negligence implies that we are mispricing those risks, and is equivalent of a person who cancels his life insurance because the doctor told him that the chemotherapy seems to be working.

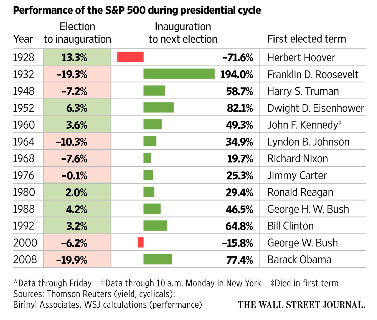

Even if the markets’ scent is growth and finally the economy may break out of its slow growth mode in 2017 (unlikely for the EU and emerging markets), we cannot allow mispricing of risk to take hold in portfolios. Economic and financial reality in the post-crisis era requires vigilance because the markets are not the best predictors at judging presidents, as the table below shows.

It seems we live in a post-truth reality where we believe that all we do is a risk-free exercise of arbitrage. The great dangers that surround such misconception are two: First, we underestimate the global financial risks that are underlying in the global economy; and second the tightening of the credit spreads is mainly due to rising Treasury yields rather than due to lower interest rates for corporate debt. On the contrary the percentage of sales paid as interest on corporate debt is rising and will continue rising. Therefore, a reversal in the spreads’ trajectory should be priced into the investors’ forward P/E ratio and valuations.

From a historical perspective tightening credit spreads usually affect positively the market and mostly industrial, consumer discretionary, and information technology firms.

As the lines above were drafted the city of Aleppo fell indicating the failure of the West to have a coherent rules-based strategy that can sustain and advance the world order. Another refugee crisis will be unfolding and in the spirit of the days I recall a small child who found refuge by the banks of the Nile, escaping the rage of a deadly king and ending up changing history.

Mispricing Risk and Market Conditions at the Dawn of the New Year: Rules, Aleppo and the Banks of the Nile

Author : John E. Charalambakis

Date : December 19, 2016

Historically speaking credit markets serve as a reliable signal regarding global economic conditions. Tight spreads between corporate and government bonds have been indicating improving economic conditions, faster growth, higher incomes and profits and rising business confidence. On the contrary widening spreads are indicative of trouble coming into the markets and the economy. As the graph below shows, spreads (for both investment-grade as well as for junk bonds) started rising in late summer 2007 and reached their highs in September 2008 during the peak of the financial crisis.

We also saw (as demonstrated below) that spreads started rising in the middle of 2015 and reaching a high (for the last three years) in early 2016 as concerns about China, growth, and corporate profits became part of investors’ menu.

As of the end of last week, credit spreads have tightened, indicating improving economic conditions and expectations. Last week we pointed out some of the main factors that have created this optimism. We choose in this commentary to point out that in this exuberant spirit we cannot neglect the risks and uncertainties that surround financial markets and the global economy. Such negligence implies that we are mispricing those risks, and is equivalent of a person who cancels his life insurance because the doctor told him that the chemotherapy seems to be working.

Even if the markets’ scent is growth and finally the economy may break out of its slow growth mode in 2017 (unlikely for the EU and emerging markets), we cannot allow mispricing of risk to take hold in portfolios. Economic and financial reality in the post-crisis era requires vigilance because the markets are not the best predictors at judging presidents, as the table below shows.

It seems we live in a post-truth reality where we believe that all we do is a risk-free exercise of arbitrage. The great dangers that surround such misconception are two: First, we underestimate the global financial risks that are underlying in the global economy; and second the tightening of the credit spreads is mainly due to rising Treasury yields rather than due to lower interest rates for corporate debt. On the contrary the percentage of sales paid as interest on corporate debt is rising and will continue rising. Therefore, a reversal in the spreads’ trajectory should be priced into the investors’ forward P/E ratio and valuations.

From a historical perspective tightening credit spreads usually affect positively the market and mostly industrial, consumer discretionary, and information technology firms.

As the lines above were drafted the city of Aleppo fell indicating the failure of the West to have a coherent rules-based strategy that can sustain and advance the world order. Another refugee crisis will be unfolding and in the spirit of the days I recall a small child who found refuge by the banks of the Nile, escaping the rage of a deadly king and ending up changing history.