It seems that the bond and equities markets are telling us two different stories. The former with the declining – and in some major cases negative – yields is like foretelling a story of slow growth, rising risks, and absence of a capital spending drive. The latter (especially the US equity markets) keep hitting new highs, implying an optimism of higher growth, rising earnings, and rosy spending. The obvious disconnect between the two is troubling especially when we take into account that these kind of market developments opt for gravity defiance when they seek to overturn historical facts of 50+ years.

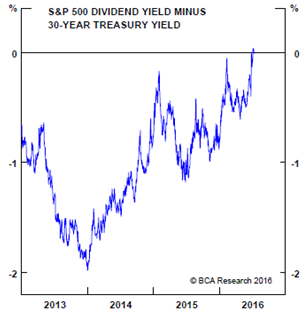

The historical fact I am referring to looks at the difference between the dividend yield of the S&P 500 and the yield on the ten-year Treasury. That difference historically speaking is negative as shown below.

However, the negative difference has recently been overturned which points out to possible valuation issues. Specifically, the reversal of the historical and natural order of yields defies market gravity for both the bond and equity markets. It possibly points out to overvalued bond and equity markets when political pandering surfaces and the political pendulum swings unpredictably to sides that they themselves defy political gravity. The result might be a disequilibrium that will throw off valuations, expectations, and business confidence.

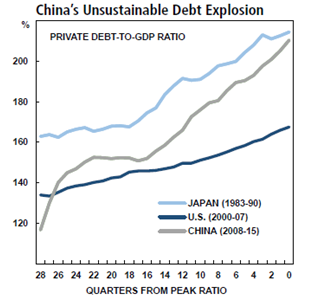

The driving of the masses/herds into riskier assets when the fundamentals do not justify such a drive endangers the geoeconomic climate at a time when the second largest economy of the world faces its own existential test. Such a test centers on the fact that the credit growth in China (as shown below) has been defying debt gravity and such defiance – even in opaque government accounting – has limits.

At a time when several Chinese firms are unable to make good on their bond interest payments and hundreds of billions of dollars of Chinese debt require refinancing in the next five months, investors cannot be caught asleep at the wheel. The markets’ disconnect represent a warning that absurdity has its limits simply because it is not natural.

Markets’ Disconnect, Political Pandering, and Business Climate: Valuations at the Dawn of Major Chinese Refinancing Needs

Author : John E. Charalambakis

Date : July 14, 2016

It seems that the bond and equities markets are telling us two different stories. The former with the declining – and in some major cases negative – yields is like foretelling a story of slow growth, rising risks, and absence of a capital spending drive. The latter (especially the US equity markets) keep hitting new highs, implying an optimism of higher growth, rising earnings, and rosy spending. The obvious disconnect between the two is troubling especially when we take into account that these kind of market developments opt for gravity defiance when they seek to overturn historical facts of 50+ years.

The historical fact I am referring to looks at the difference between the dividend yield of the S&P 500 and the yield on the ten-year Treasury. That difference historically speaking is negative as shown below.

However, the negative difference has recently been overturned which points out to possible valuation issues. Specifically, the reversal of the historical and natural order of yields defies market gravity for both the bond and equity markets. It possibly points out to overvalued bond and equity markets when political pandering surfaces and the political pendulum swings unpredictably to sides that they themselves defy political gravity. The result might be a disequilibrium that will throw off valuations, expectations, and business confidence.

The driving of the masses/herds into riskier assets when the fundamentals do not justify such a drive endangers the geoeconomic climate at a time when the second largest economy of the world faces its own existential test. Such a test centers on the fact that the credit growth in China (as shown below) has been defying debt gravity and such defiance – even in opaque government accounting – has limits.

At a time when several Chinese firms are unable to make good on their bond interest payments and hundreds of billions of dollars of Chinese debt require refinancing in the next five months, investors cannot be caught asleep at the wheel. The markets’ disconnect represent a warning that absurdity has its limits simply because it is not natural.