A recent investors’ survey done by Bank of America Merrill Lynch found that more and more investors believe that stocks are overvalued. Expectations about earnings, taxes, spending, and regulatory regime, have uplifted equities worldwide, but recently a sense of anxiety that started with lower oil prices and transmitted in the arena of whether or not the Trump trade has legs to grow, has been settling into the markets. The data show that on a forward price-to-earnings (P/E) measure, the S&P 500 is at its highest level over the course of the last twelve years. The graph below reflects the anxiety that we may be facing a pause in the current stock market rally.

In addition, the Price-to-Sales ratio (PSR) is at almost record level and US equities account for close to 40% of global equity value while they make up only 25% of global GDP. Hence, our previous commentary that a partial and gradual allocation outside the US (especially in the EU), may be justified at this stage.

Having said that, allow me also to state that we do not see any immediate bear market or significant correction in the horizon. The forces that uplifted the sentiment are alive and well, and the Fed’s actions in raising short term interest rates do not seem to detract from that sentiment. Furthermore, we do not see any immediate threat from the higher yields (at least not until the ten-year Treasury reaches 3.30-3.5%). On the contrary, the rising yields portray a healthy picture that allows the economy to be unchained from the Fed’s steroids.

Of course, that doesn’t mean that we do not have our concerns that range from political instability to geopolitics and the fact that China’s riskiest corporate borrowers are raising huge amount of money through junk bonds, despite the fact that defaults quadrupled last year. Our main concern concentrates on the forces of global devolution coupled with collateral holes, unfunded liabilities, and of course derivative products. The combination of those forces could possibly lead us down the road to a major market meltdown, which takes me to the second part of this week’s commentary.

Last week I had the opportunity to view the exhibition titled “America After the Fall: Paintings in the 1930s”, at the Royal Academy of Arts in London. In one of the most desperate economic and political times in the US, the nation was struggling to find its new identity. The exhibition demonstrates that struggle as artists sought to portray the people’s search for a new soul through artistic expressions of abstraction, regionalism, and surrealism. It was a time of upheaval in economic, social, political, business, and geopolitical fronts that define the new character of America. The exuberance of the 1920s and the rural frugality, was giving way to the realism of industrialization, populism, urban life, depression, and finally war. Modernity was getting ready for post-modernity where truth is manufactured rather than discovered. During the turbulent years of the 1930s, America felt expelled from the Garden of Eden. Disillusion replaced the notions of hope and opportunity. During the chaotic years of economic depression fascism and communism took hold of politics and life was never the same again.

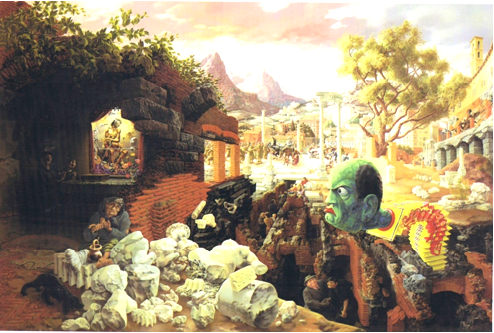

What better then than to present an illuminating figure from that exhibition by the title “The Eternal City”, by Peter Blume. The setting reflects the Roman Forum, the Coliseum, and the Catacombs.

Mussolini’s head as it is springing from the rubbles represents the nightmare that is about to unfold across the globe. The catastrophe of the 1930s was followed by the destruction of the 1940s, both of which followed a period of unprecedented prosperity bought on credit and the utopian deal in Versailles.

My humble hope is that this time is different…

Market Valuations and Reflationary Expectations: What Can we Learn from a London Art Exhibition?

Author : John E. Charalambakis

Date : March 23, 2017

A recent investors’ survey done by Bank of America Merrill Lynch found that more and more investors believe that stocks are overvalued. Expectations about earnings, taxes, spending, and regulatory regime, have uplifted equities worldwide, but recently a sense of anxiety that started with lower oil prices and transmitted in the arena of whether or not the Trump trade has legs to grow, has been settling into the markets. The data show that on a forward price-to-earnings (P/E) measure, the S&P 500 is at its highest level over the course of the last twelve years. The graph below reflects the anxiety that we may be facing a pause in the current stock market rally.

In addition, the Price-to-Sales ratio (PSR) is at almost record level and US equities account for close to 40% of global equity value while they make up only 25% of global GDP. Hence, our previous commentary that a partial and gradual allocation outside the US (especially in the EU), may be justified at this stage.

Having said that, allow me also to state that we do not see any immediate bear market or significant correction in the horizon. The forces that uplifted the sentiment are alive and well, and the Fed’s actions in raising short term interest rates do not seem to detract from that sentiment. Furthermore, we do not see any immediate threat from the higher yields (at least not until the ten-year Treasury reaches 3.30-3.5%). On the contrary, the rising yields portray a healthy picture that allows the economy to be unchained from the Fed’s steroids.

Of course, that doesn’t mean that we do not have our concerns that range from political instability to geopolitics and the fact that China’s riskiest corporate borrowers are raising huge amount of money through junk bonds, despite the fact that defaults quadrupled last year. Our main concern concentrates on the forces of global devolution coupled with collateral holes, unfunded liabilities, and of course derivative products. The combination of those forces could possibly lead us down the road to a major market meltdown, which takes me to the second part of this week’s commentary.

Last week I had the opportunity to view the exhibition titled “America After the Fall: Paintings in the 1930s”, at the Royal Academy of Arts in London. In one of the most desperate economic and political times in the US, the nation was struggling to find its new identity. The exhibition demonstrates that struggle as artists sought to portray the people’s search for a new soul through artistic expressions of abstraction, regionalism, and surrealism. It was a time of upheaval in economic, social, political, business, and geopolitical fronts that define the new character of America. The exuberance of the 1920s and the rural frugality, was giving way to the realism of industrialization, populism, urban life, depression, and finally war. Modernity was getting ready for post-modernity where truth is manufactured rather than discovered. During the turbulent years of the 1930s, America felt expelled from the Garden of Eden. Disillusion replaced the notions of hope and opportunity. During the chaotic years of economic depression fascism and communism took hold of politics and life was never the same again.

What better then than to present an illuminating figure from that exhibition by the title “The Eternal City”, by Peter Blume. The setting reflects the Roman Forum, the Coliseum, and the Catacombs.

Mussolini’s head as it is springing from the rubbles represents the nightmare that is about to unfold across the globe. The catastrophe of the 1930s was followed by the destruction of the 1940s, both of which followed a period of unprecedented prosperity bought on credit and the utopian deal in Versailles.

My humble hope is that this time is different…