Over the course of the last few days, some important pieces were published on the valuation of equities and bonds. At the same time we observed independent referendums taking place in Spain and in Kurdistan. The latter could possibly be signs of a devolutionary movement where states split, new city-states emerge, international maps are redrawn, and geopolitical tensions rise. These observations point to a flux state of affairs that could possibly generate market turmoil. Let’s review some facts:

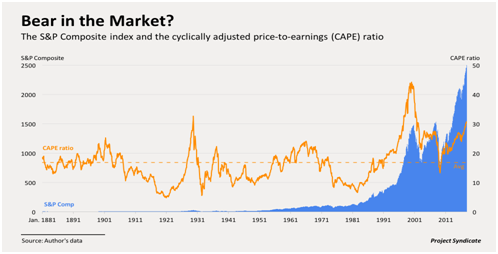

As Robert Shiller pointed out in his recent piece (https://www.project-syndicate.org/commentary/us-stock-volatility-bear-market-by-robert-j–shiller-2017-09), the US equities market is characterized by high valuation that resembles the attributes of equities before a bear market shows its teeth. Specifically, before the bear market occurred in thirteen occasions since 1871, earnings were growing and volatility was low. The graph below shows that the main measure of valuation known as CAPE (Cyclically Adjusted Price Earnings ratio) stands at the record level of almost 30 versus the historical average of 17. Moreover, the two times that the CAPE stood above 30, trouble followed.

In another piece Carmen and Vincent Reinhart (https://www.project-syndicate.org/commentary/north-korea-fear-drives-low-interest-rates-by-carmen-reinhart-and-vincent-reinhart-2017-09) remind us that the “rare and disaster risk” is among us which in turn heats up competition for safe havens and could possibly explain the low levels of interest rates.

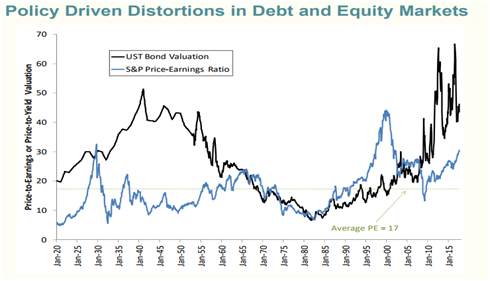

To that we should probably add two things: First, the Bloomberg piece that bond market sales may intensify after bond traders placed big short in Treasuries given Fed’s intentions to shrink its balance sheet and keep raising rates. Second, the important piece by Larry Goodman, President of the Center of Financial Stability, shows that not only stocks but most importantly bonds are overvalued (see graph below and http://www.centerforfinancialstability.org/speeches/ShanghaiDRF_090517.pdf).

At a time when faith in the stabilizing influence and leadership of the U.S. is fading while US-related geopolitical tremors are brewing (N. Korea, abandonment of the Iranian deal, etc.), the world is experiencing rising uncertainty over secession in Spain/Catalonia, Iraq/Kurdistan, while other crises are still going on. Who can exclude the possibility that devolutionary forces are at work — which will lead to further secession movements (e.g. N. Italy) and eventually to the devolution of the international system — when we take into account some incomprehensible policies that undermine stability?

Remembering Tom Petty, who left this world last Tuesday, let his lyrics be our concluding remarks:

Well I know what’s right

I got just one life

In a world that keeps on pushin’ me around

But I’ll stand my ground

Market Valuations and Devolution: Mythos, Madness, or an Allegory?

Author : John E. Charalambakis

Date : October 5, 2017

Over the course of the last few days, some important pieces were published on the valuation of equities and bonds. At the same time we observed independent referendums taking place in Spain and in Kurdistan. The latter could possibly be signs of a devolutionary movement where states split, new city-states emerge, international maps are redrawn, and geopolitical tensions rise. These observations point to a flux state of affairs that could possibly generate market turmoil. Let’s review some facts:

As Robert Shiller pointed out in his recent piece (https://www.project-syndicate.org/commentary/us-stock-volatility-bear-market-by-robert-j–shiller-2017-09), the US equities market is characterized by high valuation that resembles the attributes of equities before a bear market shows its teeth. Specifically, before the bear market occurred in thirteen occasions since 1871, earnings were growing and volatility was low. The graph below shows that the main measure of valuation known as CAPE (Cyclically Adjusted Price Earnings ratio) stands at the record level of almost 30 versus the historical average of 17. Moreover, the two times that the CAPE stood above 30, trouble followed.

In another piece Carmen and Vincent Reinhart (https://www.project-syndicate.org/commentary/north-korea-fear-drives-low-interest-rates-by-carmen-reinhart-and-vincent-reinhart-2017-09) remind us that the “rare and disaster risk” is among us which in turn heats up competition for safe havens and could possibly explain the low levels of interest rates.

To that we should probably add two things: First, the Bloomberg piece that bond market sales may intensify after bond traders placed big short in Treasuries given Fed’s intentions to shrink its balance sheet and keep raising rates. Second, the important piece by Larry Goodman, President of the Center of Financial Stability, shows that not only stocks but most importantly bonds are overvalued (see graph below and http://www.centerforfinancialstability.org/speeches/ShanghaiDRF_090517.pdf).

At a time when faith in the stabilizing influence and leadership of the U.S. is fading while US-related geopolitical tremors are brewing (N. Korea, abandonment of the Iranian deal, etc.), the world is experiencing rising uncertainty over secession in Spain/Catalonia, Iraq/Kurdistan, while other crises are still going on. Who can exclude the possibility that devolutionary forces are at work — which will lead to further secession movements (e.g. N. Italy) and eventually to the devolution of the international system — when we take into account some incomprehensible policies that undermine stability?

Remembering Tom Petty, who left this world last Tuesday, let his lyrics be our concluding remarks:

Well I know what’s right

I got just one life

In a world that keeps on pushin’ me around

But I’ll stand my ground