As a starting point allow me please to summarize what we communicated to our clients during the recent market turmoil. First, let’s review what we perceive are the main causes of the turmoil which may continue in the near future:

- The bond market is experiencing losses and yields are rising mainly because of anticipated interest rates hikes by the Fed and some anticipated price (inflationary) pressures.

- The bond market weakness and the anticipated rate hikes are also hurting equities.

- Traders who have gone long on equities and also have shorted volatility got wrong both sides of the trade and hence algorithmic trading exacerbated the nervousness in the markets.

- The market run-up, especially since mid-December, created room for a mini-correction.

- Margin calls also contribute to the decline.

- Political risk is rising in Washington D.C.

- The market may be testing/greeting the new Fed Chair.

- Normally, in similar situations we would have expected that safe havens such as precious metals, bonds, and the dollar would have strengthened. However, this has not happened during the current selloff.

Here is our reaction to the market developments:

- The market fundamentals have not changed. Earnings and profits’ growth remain healthy; corporate sales growth is on an upswing trajectory; corporate balance sheets are in a better shape than they were in the last few years; economic growth looks promising both in the US and abroad; incomes are rising; corporate and consumer confidence look strong; employment levels are very good; and interest rates are still very low. Therefore, given the healthy fundamentals, we are of the opinion that discipline and calmness should prevail. After all, we do not jump out of a train when it goes through a tunnel.

- The market needs a breather from time-to-time. When that happens – and assuming that the fundamentals remain healthy – some market opportunities may appear.

- As we have been commenting in our weekly updates, the market may be a bit overvalued, however market aberrations where the market can sustain a valuation above historical averages (e.g. P/E average or 200-day moving average) are not so abnormal, especially when we are going through a period of economic and technological changes whose outcome will be affecting the current generation.

- Greater market volatility is expected in the foreseeable future. To that we should add greater political volatility.

- The market rewards a long-term perspective and that’s the perspective we are taking.

There were concerns that we may have a repetition of the 2008 crisis where liquidity dries up in the market and a systemic event undermines confidence. However, if that were to be the case, then the following three things should have happened almost immediately:

- First, we would have seen the yields on junk bonds go through the roof.

- Second, the spreads would have risen significantly.

- Third, the Libor would have jumped.

As we know, none of those things happened; therefore, while volatility rose the underlying market dynamics remain healthy.

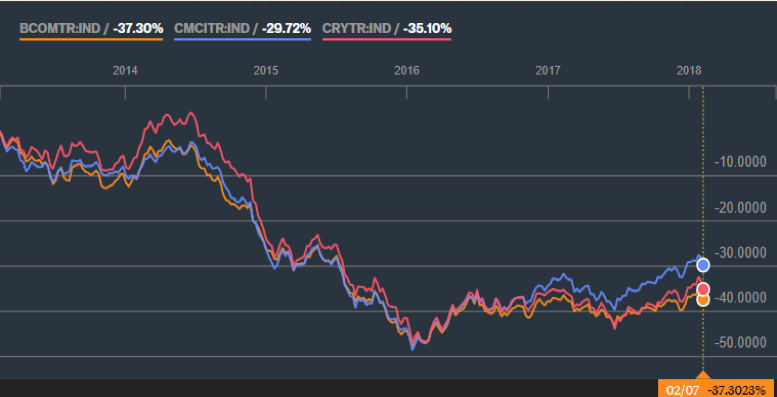

That brings me to today’s point. Given the market volatility, portfolios need diversification in such a way that asset classes added would not be highly correlated with equities and bonds. Moreover, given the inflationary concerns, adding an asset class that normally protects against inflation seems to be a no-brainer. Furthermore, if that asset class has been experiencing low valuations, it might be a good time to add it to the portfolio. Welcome to commodities (hard such as precious metals and oil, as well as soft such as grains). The graph below represents the Bloomberg Commodities Index over the course of the last five years.

In our humble opinion, it cries out: Buy me on the upswing that is being formed.

Commodities have been in an incredible downtrend for years now. However, their cycles last more than just a few months and after all they represent real intrinsic values (not just paper values). Given the global growth trends, constrained supplies, record readings for manufacturing, boosted outputs around the world, rising PMIs, and given their low valuations as well as their low correlation with other asset classes, we believe that they are worth looking into as a possible addition to portfolios.

Market Turmoil, Portfolios and Commodities: Time to Diversify, Part I

Author : John E. Charalambakis

Date : February 8, 2018

As a starting point allow me please to summarize what we communicated to our clients during the recent market turmoil. First, let’s review what we perceive are the main causes of the turmoil which may continue in the near future:

Here is our reaction to the market developments:

There were concerns that we may have a repetition of the 2008 crisis where liquidity dries up in the market and a systemic event undermines confidence. However, if that were to be the case, then the following three things should have happened almost immediately:

As we know, none of those things happened; therefore, while volatility rose the underlying market dynamics remain healthy.

That brings me to today’s point. Given the market volatility, portfolios need diversification in such a way that asset classes added would not be highly correlated with equities and bonds. Moreover, given the inflationary concerns, adding an asset class that normally protects against inflation seems to be a no-brainer. Furthermore, if that asset class has been experiencing low valuations, it might be a good time to add it to the portfolio. Welcome to commodities (hard such as precious metals and oil, as well as soft such as grains). The graph below represents the Bloomberg Commodities Index over the course of the last five years.

In our humble opinion, it cries out: Buy me on the upswing that is being formed.

Commodities have been in an incredible downtrend for years now. However, their cycles last more than just a few months and after all they represent real intrinsic values (not just paper values). Given the global growth trends, constrained supplies, record readings for manufacturing, boosted outputs around the world, rising PMIs, and given their low valuations as well as their low correlation with other asset classes, we believe that they are worth looking into as a possible addition to portfolios.