The tale of the last two-three weeks seems to have given room to a market upswing that is softening due to some rising concerns. Chinese government’s stock market intervention subsided –for now – the local market turmoil but has opened another wound whose story is still to be drafted. The Greek government, with its absurd moves, has created a disastrous situation (it’s quite an achievement for a government to destroy the foundations of an economy in such a short period of time) and has planted the seeds for another round of depression. In both cases, investors seem to think that the visible hand of central powers (Chinese and the EU) is better than the invisible hand of free markets which sometimes requires catharsis.

We are in a business cycle that is characterized by fragile liquidity. There are cyclical changes at work in terms of changing risk appetite, which when combined with structural changes (where broker dealers of bonds are holding less inventory), create market winds that affect demand and supply conditions in the bond market. As those conditions change, bond market liquidity – understood as the ability to sell a debt instrument at a price not much different than the price of the last transaction – is affected, and thus both equity and debt markets experience volatility.

Creating bond market liquidity is a form of scientific art, where market makers (bond dealers) need to respond to shifting tides regarding risk appetite for non-sovereign issues. A dualistic liquidity framework may be developing where liquidity may be found for sovereign debt, but not easily for corporate bonds (especially the higher yielding ones). Market makers are not in the business of storing securities; they are in the business of trading those securities and making money on the spreads. If buyers refrain from buying, then the market-making activity will be suspended, non-sovereign bond prices will decline, yields will rise and uncertainty takes hold of the market. If bond dealers’ appetite to provide immediacy in the market declines (by stepping in and buying the sell orders for their own balance sheet), then price discovery becomes shaky and thus the market experiences fragility.

There is then a feedback loop mechanism where a market upswing feeds the dealers’ appetite for market making which in turn sustains the market’s upswing. On the other hand, if market conditions deteriorate (e.g. due to earnings disappointments, Chinese tremors, geopolitical tensions, unexpected interest rate increases, etc.) market makers’ appetite for risky assets declines, and given the huge inflow in bond funds over the course of the last few years, the concern is if the sellers will be able to exit when the postman rings the bell. If sale orders cannot be fulfilled at expected price ranges, then liquidity concerns have the potential of creating significant shocks in both equity and bond markets. This is shaping to be the tale of head and tailwinds that may be forming the next crisis.

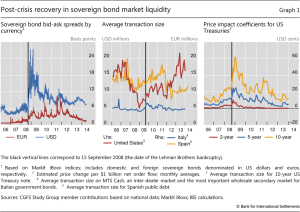

The figure below, tells us three things: First, the spreads for sovereign bonds (denominated in dollars and Euros) have returned to their pre-crisis levels. Hence, liquidity has been mostly recovered for sovereigns. Second, trading volume has also recovered for these sovereigns, which re-affirms that liquidity has recovered. Third, the price impact coefficient tells us that to execute a transaction in these kind of securities is not as costly as during the crisis, further supporting the claim that liquidity has been restored.

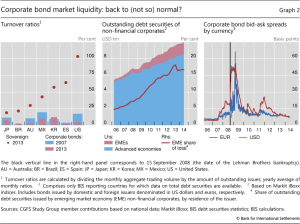

When we turn now to corporate issues, we observe a different picture. First, we see that turnover ratios (defined as trading volume divided by outstanding amounts) indicate declining liquidity (see left panel in the graph below). Second, trading volumes have not kept pace with the surge in debt issuance (see center panel below) which also signifies lower liquidity. Finally (right panel) the bid-ask spreads remain higher than the pre-crisis level, and when we take into account the hunger for yield and the hundreds of billions that have been poured into bond funds, we become concerned.

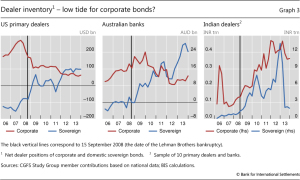

The dualistic bond market can also be seen in the following graph, where the inventory of corporate bonds for US and Australian banks is falling (Australia was chosen in order to show that even a country that was not affected that much by the financial crisis still follows the bond market segmentation trajectory) while the inventory for sovereigns is rising (Indian dealers inventory for sovereign declined when thr Fed’s tapering was announced).

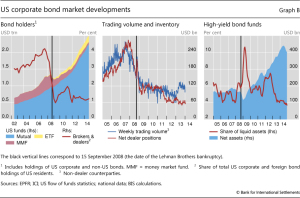

Where then do all these observations lead us? I would say that the declining inventory that dealers hold is indicative of their unwillingness to catch the knife when rates start rising and mutual funds start liquidating. More than one trillion dollars has been poured into higher yielding funds while dealers keep holding less and less inventory (left and center panels below). As bid-ask spreads narrow, the risk that dealers will reduce their positions – when market valuations change – is rising, which in turn implies that as the share of liquid assets held is declining (right panel below), medium-size financial shocks may produce disproportional market/price dislocations.

It will be interesting to examine and measure someday the mispricing of assets, the misallocation of capital, and the cannibalization of all the markets, courtesy of the central powers who think that they can do better than the markets.

Market Fragility and the Business Cycle: The Tales of Blowing Winds

Author : John E. Charalambakis

Date : July 22, 2015

The tale of the last two-three weeks seems to have given room to a market upswing that is softening due to some rising concerns. Chinese government’s stock market intervention subsided –for now – the local market turmoil but has opened another wound whose story is still to be drafted. The Greek government, with its absurd moves, has created a disastrous situation (it’s quite an achievement for a government to destroy the foundations of an economy in such a short period of time) and has planted the seeds for another round of depression. In both cases, investors seem to think that the visible hand of central powers (Chinese and the EU) is better than the invisible hand of free markets which sometimes requires catharsis.

We are in a business cycle that is characterized by fragile liquidity. There are cyclical changes at work in terms of changing risk appetite, which when combined with structural changes (where broker dealers of bonds are holding less inventory), create market winds that affect demand and supply conditions in the bond market. As those conditions change, bond market liquidity – understood as the ability to sell a debt instrument at a price not much different than the price of the last transaction – is affected, and thus both equity and debt markets experience volatility.

Creating bond market liquidity is a form of scientific art, where market makers (bond dealers) need to respond to shifting tides regarding risk appetite for non-sovereign issues. A dualistic liquidity framework may be developing where liquidity may be found for sovereign debt, but not easily for corporate bonds (especially the higher yielding ones). Market makers are not in the business of storing securities; they are in the business of trading those securities and making money on the spreads. If buyers refrain from buying, then the market-making activity will be suspended, non-sovereign bond prices will decline, yields will rise and uncertainty takes hold of the market. If bond dealers’ appetite to provide immediacy in the market declines (by stepping in and buying the sell orders for their own balance sheet), then price discovery becomes shaky and thus the market experiences fragility.

There is then a feedback loop mechanism where a market upswing feeds the dealers’ appetite for market making which in turn sustains the market’s upswing. On the other hand, if market conditions deteriorate (e.g. due to earnings disappointments, Chinese tremors, geopolitical tensions, unexpected interest rate increases, etc.) market makers’ appetite for risky assets declines, and given the huge inflow in bond funds over the course of the last few years, the concern is if the sellers will be able to exit when the postman rings the bell. If sale orders cannot be fulfilled at expected price ranges, then liquidity concerns have the potential of creating significant shocks in both equity and bond markets. This is shaping to be the tale of head and tailwinds that may be forming the next crisis.

The figure below, tells us three things: First, the spreads for sovereign bonds (denominated in dollars and Euros) have returned to their pre-crisis levels. Hence, liquidity has been mostly recovered for sovereigns. Second, trading volume has also recovered for these sovereigns, which re-affirms that liquidity has recovered. Third, the price impact coefficient tells us that to execute a transaction in these kind of securities is not as costly as during the crisis, further supporting the claim that liquidity has been restored.

When we turn now to corporate issues, we observe a different picture. First, we see that turnover ratios (defined as trading volume divided by outstanding amounts) indicate declining liquidity (see left panel in the graph below). Second, trading volumes have not kept pace with the surge in debt issuance (see center panel below) which also signifies lower liquidity. Finally (right panel) the bid-ask spreads remain higher than the pre-crisis level, and when we take into account the hunger for yield and the hundreds of billions that have been poured into bond funds, we become concerned.

The dualistic bond market can also be seen in the following graph, where the inventory of corporate bonds for US and Australian banks is falling (Australia was chosen in order to show that even a country that was not affected that much by the financial crisis still follows the bond market segmentation trajectory) while the inventory for sovereigns is rising (Indian dealers inventory for sovereign declined when thr Fed’s tapering was announced).

Where then do all these observations lead us? I would say that the declining inventory that dealers hold is indicative of their unwillingness to catch the knife when rates start rising and mutual funds start liquidating. More than one trillion dollars has been poured into higher yielding funds while dealers keep holding less and less inventory (left and center panels below). As bid-ask spreads narrow, the risk that dealers will reduce their positions – when market valuations change – is rising, which in turn implies that as the share of liquid assets held is declining (right panel below), medium-size financial shocks may produce disproportional market/price dislocations.

It will be interesting to examine and measure someday the mispricing of assets, the misallocation of capital, and the cannibalization of all the markets, courtesy of the central powers who think that they can do better than the markets.