The global equities market and its bullishness has experienced a shock. By some historical standards such as the P/E ratio and the forward-looking earnings multiple, the markets (at least some sectors) are overvalued, and thus the Japanese catastrophe becomes an invitation for some corrective action.

Of course, issues such as “what will happen with precious metals?”, “will the US dollar become the ultimate safe haven?”, “will we experience a global recession due to the events in Japan?” are vital and at the core of the most recent developments.

Let’s start with immediate effects. It is anticipated that Japanese production will decline (information says that almost 20% of the global supply of semiconductors and chips are produced in the Japanese region that is at the heart of the catastrophe), and hence demand for materials and energy (among others) will fall temporarily. In addition, some shortages may be observed which have price implications. However, we consider these effects to be short-lived. Moreover, the counter-balancing effects due to reconstruction efforts and projects will more than compensate for these temporary shortcomings and negative market effects. From that perspective, our conclusion is that the Japanese events (save for a major nuclear catastrophe which is unlikely) cannot become the seeds for a global recession (the cause for such a scenario may be found elsewhere, as shown below).

On the contrary, we expect that demand for energy to increase and that will boost conventional energy prices higher, which if combined with the New Silk Road would become a cornerstone for investments in the energy sector. In addition, and given the global debate that is emerging regarding the safety of nuclear power, we believe that the recent events will boost investments in alternative sources for energy and hence for someone with at least a six-year horizon, the time might be on hand for an allocation in that sector. (Our April newsletter will be dedicated to the energy sector).

Speaking of sector allocations, we could state at this stage and again taking into account the Japanese reconstruction efforts – but most importantly the New Silk Road – that global infrastructure should experience significant revival in the next few years, and thus allocations in that sector too should make sense (something we will be addressing in our May newsletter).

At this stage, allow us to clarify that while the earthquake and tsunami are truly black swan phenomena (meaning that they are unpredictable and thus unavoidable), the nuclear catastrophe is not (similar to the fact that the financial crisis was not a black swan phenomenon), since and according to the London Daily Telegraph and the New York Times, Japan had been warned years ago that their nuclear factories could not withstand a major earthquake, while reports show that it chose cheaper reactors rather than the safer but more expensive ones…

Japan seems to be a classic asymmetric case. Specifically, its debt level is the highest in the world. At the same time its savings might be high but the recent events are pushing the yen higher which makes its exports less attractive. Its demographic trends are troubling and the graying of its population put significant pressures on public finances, especially when we take into account the hundreds of billions of dollars that need to be spent for reconstruction purposes. The sclerotic nature of its politics along with the need for cash after the disaster complements a time financial bomb that may not evolve in a linear fashion.

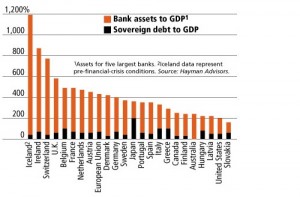

The strengthening of the Yen –due to higher demand and the conversion of US dollar assets into Yen – might be offset by massive quantitative easing efforts by the Bank of Japan (BoJ). Those efforts may finally break the deflationary pressures in Japan, however our concern focuses on the graph below.

The graph above shows that Japan has the worst debt to GDP ratio among developed countries. The accumulation of bank assets relative to GDP is also unhealthy, and the mixture of all of the above increases financial instability.

The combination of unhealthy bank assets relative to GDP worldwide (see figure above), the existence of toxic assets, the collateralization and securitization of paper assets, the sovereign debt crisis in the EU, the Middle East turmoil, the Chinese bubbles, and the surface of the Japanese problems, contribute to higher levels of financial disorder a.k.a. as entropy, which in turn raises the uncertainty levels.

Hence, while the Silk Road and the reconstruction efforts point to higher demand for base metals and energy prices, the world will be testing the strength of paper currencies, and in the midst of all this higher entropy situation, markets will start looking again for stable anchors that have been tested throughout history.

Let’s close by examining an overall portfolio structure. Two things need to be said: First, someone needs to examine the holdings in relationship to strategic long-term positions; and second, the holdings in relationship to potential outcomes and possible developments due to unforeseen circumstances (i.e. due to truly black swan phenomena).

Taking into account the first factor, investments in energy, food, and precious metals are strategic positions which should be viewed with a long-term time horizon. Developments such as the one in Japan (again unforeseen), force investors to over-react which resembles a person who desires to jump from a fast-moving train. We recommend trusting the engineer to move the train through the dark tunnel.

Over-reaction can cause panic and changes in holdings and asset allocation that in the long-run will hurt the portfolio. Hence, while temporarily some positions may exhibit volatility, we believe it reflects a temporary bad chapter in a good book. The sectors mentioned before (energy, food, and precious metals) should be vital in a portfolio and thus as an asset allocation should be retained.

In addition to their strategic nature, we think that under the particular circumstances those sectors in the intermediate term may benefit too. The rationale is as follows: 30% of Japan’s energy depends on nuclear power. A portion of this will be replaced by more traditional sources (oil, gas, coal). Hence, more traditional sources for energy such as oil and natural gas will be sought after (of course we understand that temporarily production will decline pushing oil prices down, however, reconstruction will move them back into higher levels soon thereafter). Also damaged food supplies will be supplemented by imported grains. The latter as a long-term investment depends on the rising incomes of emerging economies, and their middle classes that demand better nutrition.

Now gold is the ultimate safe haven, especially in an era where fiat currencies (i.e. currencies back up by nothing) start coming under question. If the worst happens –God forbid – then, I would not be surprised if fund managers turn a fraction of their holdings to precious metals. Given the supply constraints, gold could experience a significant gain.

Finally, when we take into account the second factor (holdings in relation to potential scenarios), we need to be thinking of the unthinkable, i.e. a major catastrophic nuclear meltdown, which will affect food chains, production, and several other countries including – but not limited to – China, and S. Korea. Under this scenario, all asset classes may suffer. Japanese, Chinese, Koreans, etc. will be forced to sell holdings (including US bonds) which could foster a bond market meltdown and skyrocketing interest rates.

Has anyone said ode to hard assets?

Market Developments in the Wake of the Japanese Catastrophe: Are we Facing a Rising Global Financial Entropy ?

Author : John E. Charalambakis

Date : March 17, 2011

The global equities market and its bullishness has experienced a shock. By some historical standards such as the P/E ratio and the forward-looking earnings multiple, the markets (at least some sectors) are overvalued, and thus the Japanese catastrophe becomes an invitation for some corrective action.

Of course, issues such as “what will happen with precious metals?”, “will the US dollar become the ultimate safe haven?”, “will we experience a global recession due to the events in Japan?” are vital and at the core of the most recent developments.

Let’s start with immediate effects. It is anticipated that Japanese production will decline (information says that almost 20% of the global supply of semiconductors and chips are produced in the Japanese region that is at the heart of the catastrophe), and hence demand for materials and energy (among others) will fall temporarily. In addition, some shortages may be observed which have price implications. However, we consider these effects to be short-lived. Moreover, the counter-balancing effects due to reconstruction efforts and projects will more than compensate for these temporary shortcomings and negative market effects. From that perspective, our conclusion is that the Japanese events (save for a major nuclear catastrophe which is unlikely) cannot become the seeds for a global recession (the cause for such a scenario may be found elsewhere, as shown below).

On the contrary, we expect that demand for energy to increase and that will boost conventional energy prices higher, which if combined with the New Silk Road would become a cornerstone for investments in the energy sector. In addition, and given the global debate that is emerging regarding the safety of nuclear power, we believe that the recent events will boost investments in alternative sources for energy and hence for someone with at least a six-year horizon, the time might be on hand for an allocation in that sector. (Our April newsletter will be dedicated to the energy sector).

Speaking of sector allocations, we could state at this stage and again taking into account the Japanese reconstruction efforts – but most importantly the New Silk Road – that global infrastructure should experience significant revival in the next few years, and thus allocations in that sector too should make sense (something we will be addressing in our May newsletter).

At this stage, allow us to clarify that while the earthquake and tsunami are truly black swan phenomena (meaning that they are unpredictable and thus unavoidable), the nuclear catastrophe is not (similar to the fact that the financial crisis was not a black swan phenomenon), since and according to the London Daily Telegraph and the New York Times, Japan had been warned years ago that their nuclear factories could not withstand a major earthquake, while reports show that it chose cheaper reactors rather than the safer but more expensive ones…

Japan seems to be a classic asymmetric case. Specifically, its debt level is the highest in the world. At the same time its savings might be high but the recent events are pushing the yen higher which makes its exports less attractive. Its demographic trends are troubling and the graying of its population put significant pressures on public finances, especially when we take into account the hundreds of billions of dollars that need to be spent for reconstruction purposes. The sclerotic nature of its politics along with the need for cash after the disaster complements a time financial bomb that may not evolve in a linear fashion.

The strengthening of the Yen –due to higher demand and the conversion of US dollar assets into Yen – might be offset by massive quantitative easing efforts by the Bank of Japan (BoJ). Those efforts may finally break the deflationary pressures in Japan, however our concern focuses on the graph below.

The graph above shows that Japan has the worst debt to GDP ratio among developed countries. The accumulation of bank assets relative to GDP is also unhealthy, and the mixture of all of the above increases financial instability.

The combination of unhealthy bank assets relative to GDP worldwide (see figure above), the existence of toxic assets, the collateralization and securitization of paper assets, the sovereign debt crisis in the EU, the Middle East turmoil, the Chinese bubbles, and the surface of the Japanese problems, contribute to higher levels of financial disorder a.k.a. as entropy, which in turn raises the uncertainty levels.

Hence, while the Silk Road and the reconstruction efforts point to higher demand for base metals and energy prices, the world will be testing the strength of paper currencies, and in the midst of all this higher entropy situation, markets will start looking again for stable anchors that have been tested throughout history.

Let’s close by examining an overall portfolio structure. Two things need to be said: First, someone needs to examine the holdings in relationship to strategic long-term positions; and second, the holdings in relationship to potential outcomes and possible developments due to unforeseen circumstances (i.e. due to truly black swan phenomena).

Taking into account the first factor, investments in energy, food, and precious metals are strategic positions which should be viewed with a long-term time horizon. Developments such as the one in Japan (again unforeseen), force investors to over-react which resembles a person who desires to jump from a fast-moving train. We recommend trusting the engineer to move the train through the dark tunnel.

Over-reaction can cause panic and changes in holdings and asset allocation that in the long-run will hurt the portfolio. Hence, while temporarily some positions may exhibit volatility, we believe it reflects a temporary bad chapter in a good book. The sectors mentioned before (energy, food, and precious metals) should be vital in a portfolio and thus as an asset allocation should be retained.

In addition to their strategic nature, we think that under the particular circumstances those sectors in the intermediate term may benefit too. The rationale is as follows: 30% of Japan’s energy depends on nuclear power. A portion of this will be replaced by more traditional sources (oil, gas, coal). Hence, more traditional sources for energy such as oil and natural gas will be sought after (of course we understand that temporarily production will decline pushing oil prices down, however, reconstruction will move them back into higher levels soon thereafter). Also damaged food supplies will be supplemented by imported grains. The latter as a long-term investment depends on the rising incomes of emerging economies, and their middle classes that demand better nutrition.

Now gold is the ultimate safe haven, especially in an era where fiat currencies (i.e. currencies back up by nothing) start coming under question. If the worst happens –God forbid – then, I would not be surprised if fund managers turn a fraction of their holdings to precious metals. Given the supply constraints, gold could experience a significant gain.

Finally, when we take into account the second factor (holdings in relation to potential scenarios), we need to be thinking of the unthinkable, i.e. a major catastrophic nuclear meltdown, which will affect food chains, production, and several other countries including – but not limited to – China, and S. Korea. Under this scenario, all asset classes may suffer. Japanese, Chinese, Koreans, etc. will be forced to sell holdings (including US bonds) which could foster a bond market meltdown and skyrocketing interest rates.

Has anyone said ode to hard assets?