In this commentary, we will discuss examples of how misguided policies and debates focus the public’s attention to minor issues, with the result being that the causes are not addressed, and hence the economic pain to be excruciating as years goes by. We will start with Japan then move to the US, and will close with the EU. As a concluding note, we will offer a few thoughts on the occasion of the festive days.

The new Japanese government seems to be determined to relax its fiscal discipline as well as push for expansionary monetary measures that will stimulate exports via Yen depreciation. Indeed, over the last few days both the dollar and the euro have gained significant ground against the yen, as the following graphs show.

Dollar vs. Yen

Euro vs. Yen

It is obvious that the Japanese are reverting back into the old prescription of export-oriented growth. The problem however is that their savings have been declining, their debt-to-GDP ratio is the worst in the developed world, their demographic trends have already start backfiring, and the dynamic/innovative/highly productive economy is in a stage of permanent decline. Therefore, it is our belief that the newly elected Japanese government has selected a phantom strategy that tries to divert attention from the real problems. The problem is that by trying to major in the minors they may force the country to miss the boat, in terms of what really brings growth and creates prosperity for the people.

Another phantom diversion has to do with the infamous “fiscal cliff” in the US. The latter implies that government spending has to be reduced every year – and for the next ten years – by a mere 0.82% of GDP. Again, political manipulations push us to think about the ephemeral and the temporary i.e. to major in the minors, rather than focus on the real problems of raising productivity, human capital, wealth creation, capital preservation, debt reduction, and the threats from the derivatives bomb.

When a single bank’s derivatives bets exceed the global GDP, we live in dangerous land that requires majoring in the majors and not to be concerned about the minors. All in all, 95% of the US derivatives’ exposure is held by five banks. It is obvious that such exposure far exceeds their capital and their collective ability to face another crisis. Is it time to stop the leveraging process and start defusing the derivatives bomb? Conducting monetary policy for the sake of saving big banks and their toxic assets is the epitome of a vessel that not only has lost its anchor and compass, but also its ability to think in terms of direction and what really matters.

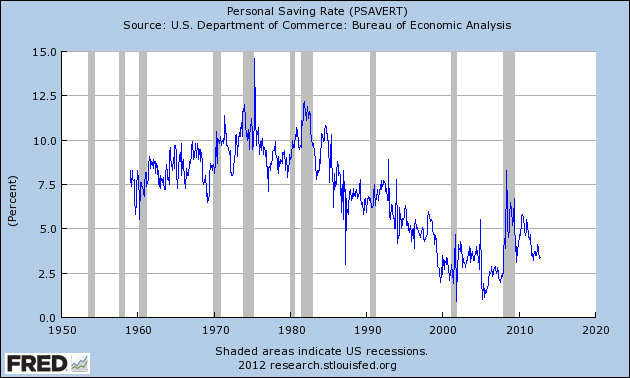

Such monetary policy keeps the price of debt high, reduces savings (see graph below), cheapens the currency, and in the medium term will result in currency warfare, while eventually will reduce the price of financial instruments, i.e. will backfire since the latter will force interest rates much higher.

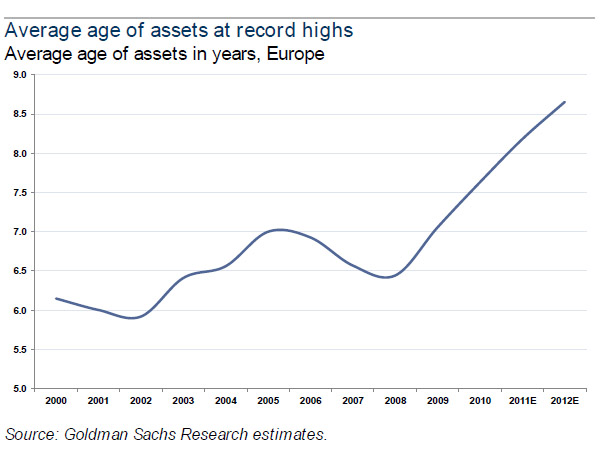

The EU case of majoring in the minors has to do with the envisioned banking union. Thus, instead of focusing their attention to the much needed political integration – if the EU project is to survive in the long term – they postpone any discussion on such topics, and rather focused on the supervisor of a banking union. On the surface, it seems that they are trying to address a systemic issue. The problem however is that once again they focused on the symptoms rather than the causes. Legal experts at Bundesbank declared that the project has “no lasting, sustainable foundation”. It seems that they seek a mutualization of liabilities with a decreasing and aging asset base (see graph below). Such efforts during recessionary times and with the unfunded liabilities rising can only be described as nano-diversion of majoring in the minors.

We conclude this weeks’ commentary with some brief thoughts about a “minor” manger that split history into BC and AD. More than two millennia later we still feel the reverberations from that manger. It seems that it wants to remind us that at the center of history there is a divine purpose whose story cuts against the grain of every heroic explanation. The manger’s story goes against the conventional wisdom of celebrating heroes, horses rather than donkeys, lies over truth, money over integrity, and appearances/perceptions over substance. The manger’s story is about turning our attention to things of true value where the minor players become the major shakers of history.

Merry Christmas!

Majoring in the Minors: Economic Realities and Phantom Diversions

Author : John E. Charalambakis

Date : December 21, 2012

In this commentary, we will discuss examples of how misguided policies and debates focus the public’s attention to minor issues, with the result being that the causes are not addressed, and hence the economic pain to be excruciating as years goes by. We will start with Japan then move to the US, and will close with the EU. As a concluding note, we will offer a few thoughts on the occasion of the festive days.

The new Japanese government seems to be determined to relax its fiscal discipline as well as push for expansionary monetary measures that will stimulate exports via Yen depreciation. Indeed, over the last few days both the dollar and the euro have gained significant ground against the yen, as the following graphs show.

Dollar vs. Yen

Euro vs. Yen

It is obvious that the Japanese are reverting back into the old prescription of export-oriented growth. The problem however is that their savings have been declining, their debt-to-GDP ratio is the worst in the developed world, their demographic trends have already start backfiring, and the dynamic/innovative/highly productive economy is in a stage of permanent decline. Therefore, it is our belief that the newly elected Japanese government has selected a phantom strategy that tries to divert attention from the real problems. The problem is that by trying to major in the minors they may force the country to miss the boat, in terms of what really brings growth and creates prosperity for the people.

Another phantom diversion has to do with the infamous “fiscal cliff” in the US. The latter implies that government spending has to be reduced every year – and for the next ten years – by a mere 0.82% of GDP. Again, political manipulations push us to think about the ephemeral and the temporary i.e. to major in the minors, rather than focus on the real problems of raising productivity, human capital, wealth creation, capital preservation, debt reduction, and the threats from the derivatives bomb.

When a single bank’s derivatives bets exceed the global GDP, we live in dangerous land that requires majoring in the majors and not to be concerned about the minors. All in all, 95% of the US derivatives’ exposure is held by five banks. It is obvious that such exposure far exceeds their capital and their collective ability to face another crisis. Is it time to stop the leveraging process and start defusing the derivatives bomb? Conducting monetary policy for the sake of saving big banks and their toxic assets is the epitome of a vessel that not only has lost its anchor and compass, but also its ability to think in terms of direction and what really matters.

Such monetary policy keeps the price of debt high, reduces savings (see graph below), cheapens the currency, and in the medium term will result in currency warfare, while eventually will reduce the price of financial instruments, i.e. will backfire since the latter will force interest rates much higher.

The EU case of majoring in the minors has to do with the envisioned banking union. Thus, instead of focusing their attention to the much needed political integration – if the EU project is to survive in the long term – they postpone any discussion on such topics, and rather focused on the supervisor of a banking union. On the surface, it seems that they are trying to address a systemic issue. The problem however is that once again they focused on the symptoms rather than the causes. Legal experts at Bundesbank declared that the project has “no lasting, sustainable foundation”. It seems that they seek a mutualization of liabilities with a decreasing and aging asset base (see graph below). Such efforts during recessionary times and with the unfunded liabilities rising can only be described as nano-diversion of majoring in the minors.

We conclude this weeks’ commentary with some brief thoughts about a “minor” manger that split history into BC and AD. More than two millennia later we still feel the reverberations from that manger. It seems that it wants to remind us that at the center of history there is a divine purpose whose story cuts against the grain of every heroic explanation. The manger’s story goes against the conventional wisdom of celebrating heroes, horses rather than donkeys, lies over truth, money over integrity, and appearances/perceptions over substance. The manger’s story is about turning our attention to things of true value where the minor players become the major shakers of history.

Merry Christmas!