Goethe’s insights into the seriousness of the problem of historical epistemology reminds us that in human history some have chosen to reject the notion of historical truth by diverting their poetic enthusiasm to heroic events that like in a legend have transformed the world. For them this time is truly different. Nowadays, a number of market participants question the sustainability of the US equities market. One of the main arguments has been the price/earnings ratio (P/E) which has been rising over the course of the last three-four years. We all have been hearing about a bubble being formed in the markets. The objective of this commentary is to examine the possibility that the upswing may continue temporarily due to a “permanent” stimulus (primarily monetary) built into the expectations of market participants, which in turn creates a market euphoria in the presence of collateral holes and opaque financial instruments both of which threaten a market collapse.

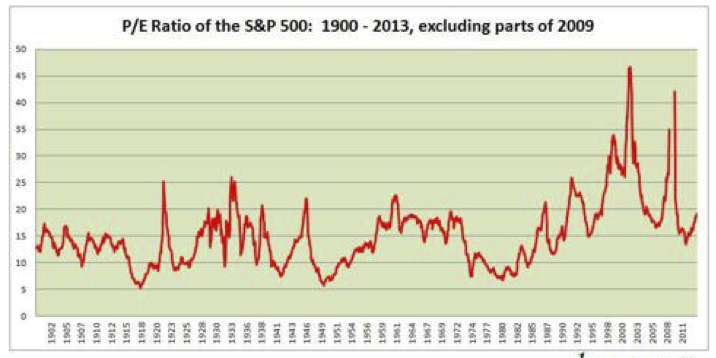

But first, let’s take a look at the historical P/E ratio since 1900.

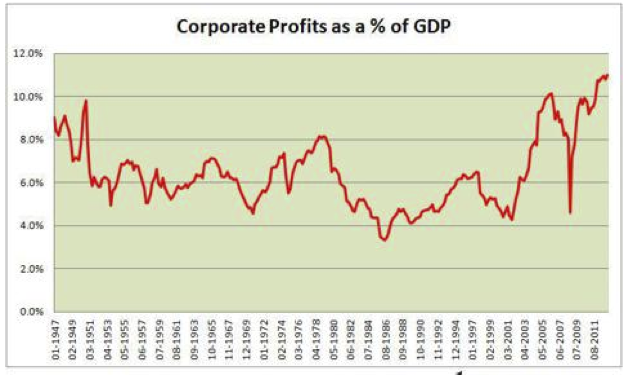

As Jay Huneycutt recently commented in a Seeking Alpha article, the P/E ratio reached bubble territory in the early 1920s, in 1933, in late 1990s, and in 2008 primarily due to an earnings collapse. Currently the P/E ratio stands a bit higher than 19 when the median has been about 14.8. However, while the P/E ratio has been rising so do corporate profits, while someone may also point out that we are far from the bubble territory that starts around a P/E of 25. The graph below portrays S&P 500 corporate earnings as a fraction of the GDP.

From an earnings standpoint then we could say that there is room for the equities market to grow stronger, especially when we take into account the unprecedented monetary measures, including the latest swaps of paper (which in turn will be used for credit creation) between the Fed, its primary dealers, and hedge funds, among others.

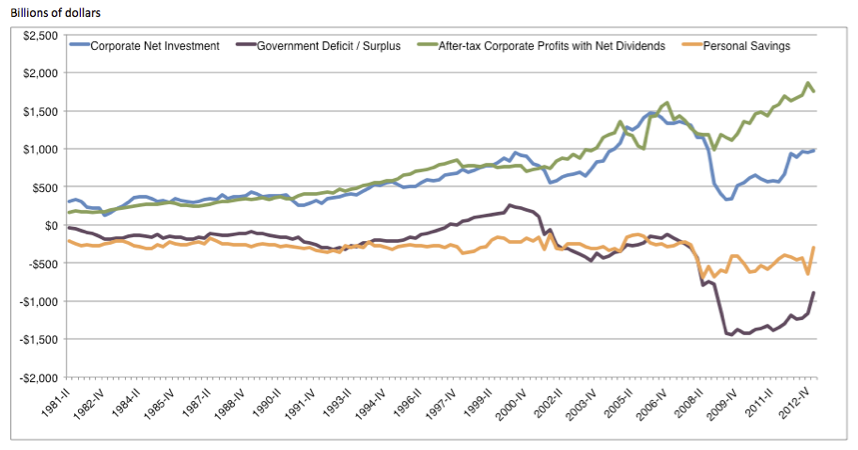

On top of the monetary stimulus we should also take into account the stimulus provided by fiscal deficits. As the combined effect of the stimuli enters the economy, it creates an earnings magnification effect which in turn supports capital investments. The outcome of this process is a stronger equities market that creates a sense that the economy has turned the corner, and therefore safe havens may no longer be as necessary as we thought just three-four years ago (hence a partial explanation of the weak prices in precious metals). The figure below shows the co-movement of the variables mentioned above.

What then could we say as we are approaching the end of 2013 and the beginning of a new year? I believe that from a preliminary overview, the markets are positioning for decent returns in 2014, inflated by the outcomes of that “permanent” stimulus. However, while this party may last another year or two, the clouds will be gathering from Tokyo to Beijing and from Berlin, London, and Paris to Buenos Aires and New York. Who could then exclude the possibility of a perfect market storm?

As those clouds will be gathering, we may need to go back and re-read Goethe’s views on efforts to rewrite history, as they include hints on investment practices. Even more, we better listen to the echoes of his words in Dichtung und Wahrheit:

“For virtue lies within past history

Enshrined in deeds beyond compare.

And thus what lives in perpetuity

Gains power from what comes after it;

Reflection source of continuity,

Alone brings man eternal benefit.

This is the question’s sole solution

Which seeks our other fatherland;

What’s constant in our earthly constitution

Fulfills eternity’s demand.”

Liquidity, Goethe, and the Magnification Effect: Growing Stronger on a Weaker Ground

Author : John E. Charalambakis

Date : November 10, 2013

Goethe’s insights into the seriousness of the problem of historical epistemology reminds us that in human history some have chosen to reject the notion of historical truth by diverting their poetic enthusiasm to heroic events that like in a legend have transformed the world. For them this time is truly different. Nowadays, a number of market participants question the sustainability of the US equities market. One of the main arguments has been the price/earnings ratio (P/E) which has been rising over the course of the last three-four years. We all have been hearing about a bubble being formed in the markets. The objective of this commentary is to examine the possibility that the upswing may continue temporarily due to a “permanent” stimulus (primarily monetary) built into the expectations of market participants, which in turn creates a market euphoria in the presence of collateral holes and opaque financial instruments both of which threaten a market collapse.

But first, let’s take a look at the historical P/E ratio since 1900.

As Jay Huneycutt recently commented in a Seeking Alpha article, the P/E ratio reached bubble territory in the early 1920s, in 1933, in late 1990s, and in 2008 primarily due to an earnings collapse. Currently the P/E ratio stands a bit higher than 19 when the median has been about 14.8. However, while the P/E ratio has been rising so do corporate profits, while someone may also point out that we are far from the bubble territory that starts around a P/E of 25. The graph below portrays S&P 500 corporate earnings as a fraction of the GDP.

From an earnings standpoint then we could say that there is room for the equities market to grow stronger, especially when we take into account the unprecedented monetary measures, including the latest swaps of paper (which in turn will be used for credit creation) between the Fed, its primary dealers, and hedge funds, among others.

On top of the monetary stimulus we should also take into account the stimulus provided by fiscal deficits. As the combined effect of the stimuli enters the economy, it creates an earnings magnification effect which in turn supports capital investments. The outcome of this process is a stronger equities market that creates a sense that the economy has turned the corner, and therefore safe havens may no longer be as necessary as we thought just three-four years ago (hence a partial explanation of the weak prices in precious metals). The figure below shows the co-movement of the variables mentioned above.

What then could we say as we are approaching the end of 2013 and the beginning of a new year? I believe that from a preliminary overview, the markets are positioning for decent returns in 2014, inflated by the outcomes of that “permanent” stimulus. However, while this party may last another year or two, the clouds will be gathering from Tokyo to Beijing and from Berlin, London, and Paris to Buenos Aires and New York. Who could then exclude the possibility of a perfect market storm?

As those clouds will be gathering, we may need to go back and re-read Goethe’s views on efforts to rewrite history, as they include hints on investment practices. Even more, we better listen to the echoes of his words in Dichtung und Wahrheit: