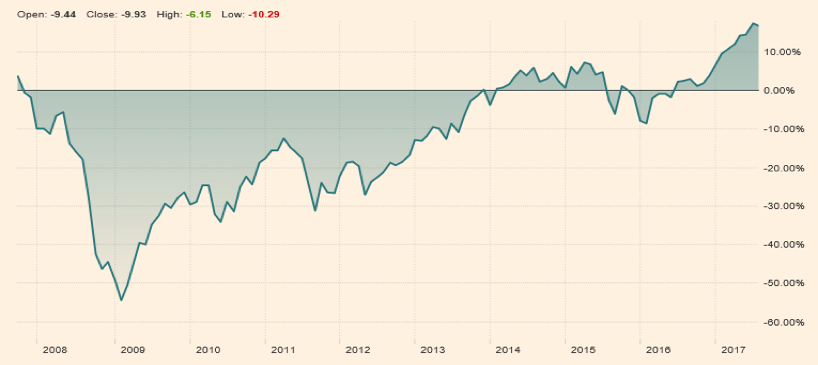

The central bankers’ conference in Jackson Hole, Wyoming ended last week, and with it several questions arose as we reached the 10th anniversary of the financial crisis started showing its ugly face. During that period a number of assets classes have more than recovered their losses and enjoyed significant gains (S&P 500, gold, junk bonds, etc.), while others (EU equities, Euro, commodities) are still below crisis-era levels. The graph below demonstrates the All-World FTSE index in the last ten years.

As we reflect on the crisis, we cannot forget that the abnormal policies that were followed (both monetary and fiscal) saved the day, but they have also loaded the global economy with trillions of dollars of additional debt while suppressing interest rates, misallocating capital, and creating distortions in asset classes. Speaking of those policies we cannot neglect the fact that the global debt as a fraction of global GDP is about 330%, which by any standard is unsustainable, especially when we take into account two fundamental things: First, that normalization of interest rates could be an illusion; and second, the hundreds of billions of dollars of unfunded liabilities (mainly pensions and health care obligations) around the world.

Therefore, as central banks start debating the trimming of their balance sheets (QExit) and the normalization of monetary policies, we should be asking if we can afford normal/natural rates of interest, and if such QExit measures could trigger new imbalances in what we record as “assets” i.e. bonds which are nothing but third party liabilities. Any tremors in that asset class have the potential to derail the global economy.

A good-case scenario we could envision is the continuation of a market upswing based on four fundamental presuppositions, namely:

- Strong earnings sustained by healthy spending

- Mergers and Acquisitions (M&A), taking advantage of low rates

- Increased international trade and commodities upswing that will also uplift the fortunes of emerging economies, and

- A European recovery based on a structural shift in the EU that will segment the union and create a core and a periphery, each of which will be moving at different speeds while creating new norms

The growth rate of the GDP in both developed and emerging economies has room to improve (especially in the EU and Japan) which suggests that greater currency-hedged exposure in those markets may be warranted. However, the abnormality of policies over the last decade may have distorted the predictive power of the yield curve, which means that the latter may have lost its power to foretell of an impending recession.

We are of the opinion that the distortions introduced by the responses to the 2007 crisis may be justifying Aldus Huxley and his fear that the masses will be controlled by infusing lethargic pleasure rather than pain (George Orwell’s fear), creating a passive culture/society unable to think and unable to assess the dangers that such pathetic behavior encompasses.

Jackson Hole and the 10th Anniversary from the Financial Crisis: QExit and Prospects

Author : John E. Charalambakis

Date : September 1, 2017

The central bankers’ conference in Jackson Hole, Wyoming ended last week, and with it several questions arose as we reached the 10th anniversary of the financial crisis started showing its ugly face. During that period a number of assets classes have more than recovered their losses and enjoyed significant gains (S&P 500, gold, junk bonds, etc.), while others (EU equities, Euro, commodities) are still below crisis-era levels. The graph below demonstrates the All-World FTSE index in the last ten years.

As we reflect on the crisis, we cannot forget that the abnormal policies that were followed (both monetary and fiscal) saved the day, but they have also loaded the global economy with trillions of dollars of additional debt while suppressing interest rates, misallocating capital, and creating distortions in asset classes. Speaking of those policies we cannot neglect the fact that the global debt as a fraction of global GDP is about 330%, which by any standard is unsustainable, especially when we take into account two fundamental things: First, that normalization of interest rates could be an illusion; and second, the hundreds of billions of dollars of unfunded liabilities (mainly pensions and health care obligations) around the world.

Therefore, as central banks start debating the trimming of their balance sheets (QExit) and the normalization of monetary policies, we should be asking if we can afford normal/natural rates of interest, and if such QExit measures could trigger new imbalances in what we record as “assets” i.e. bonds which are nothing but third party liabilities. Any tremors in that asset class have the potential to derail the global economy.

A good-case scenario we could envision is the continuation of a market upswing based on four fundamental presuppositions, namely:

The growth rate of the GDP in both developed and emerging economies has room to improve (especially in the EU and Japan) which suggests that greater currency-hedged exposure in those markets may be warranted. However, the abnormality of policies over the last decade may have distorted the predictive power of the yield curve, which means that the latter may have lost its power to foretell of an impending recession.

We are of the opinion that the distortions introduced by the responses to the 2007 crisis may be justifying Aldus Huxley and his fear that the masses will be controlled by infusing lethargic pleasure rather than pain (George Orwell’s fear), creating a passive culture/society unable to think and unable to assess the dangers that such pathetic behavior encompasses.