Last Thursday (March 28) professor Simon Johnson of the MIT (former chief economist of the IMF) published an excellent piece in his blog (http://economix.blogs.nytimes.com/2013/03/28/the-debate-on-bank-size-is-over/#postComment). Needless to say that nothing else could be expected. In that piece professor Johnson explains why the era of big banks is over. “The debate is over” as he writes, and “the decision to cap the size of the largest banks has been made.”

Professor Johnson cites the Cypriot case and the damage inflicted by its two over-sized banks (Laiki and Bank of Cyprus) to the nation. As further evidence he cites the fact that our Senate unanimously ended the funding advantages of megabanks.

It is our belief that the Cypriot case of a bail-in could serve as the pilot for similar bail-ins around the world, especially for undercapitalized banks. Those bail-ins may include money market funds due to the distortions they create in the commercial paper market. From that perspective, I would say that the case has been closed and the matter of the structure for the next bailout has been pre-determined. “It is finished” and the assumed safety is gone.

Financial institutions are vital to the stability of the economic system. Over-elastic monetary policies (especially when reserves start leaking and become money supply) plant the seeds of destruction. To recall Ludwig von Mises: “There is no means of avoiding the final collapse of a boom brought about by credit extension. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit extension, or later as a final and total catastrophe of the currency system involved.”

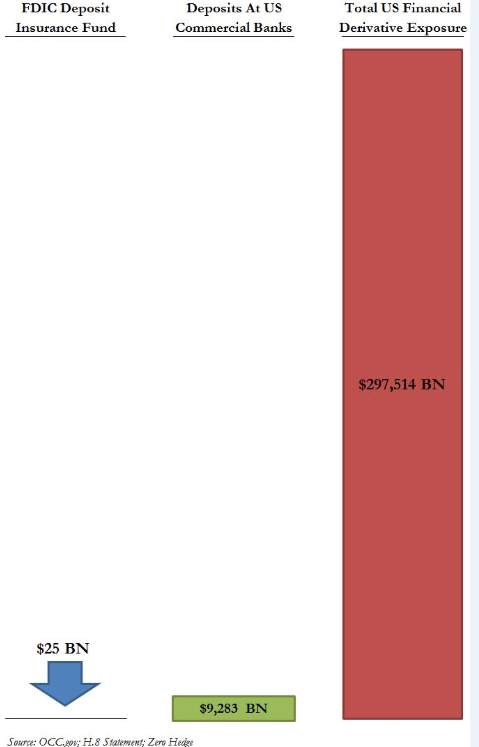

The unfortunate thing is that around the world the assets and especially the capital of the financial institutions dwarf in size relative to their derivative exposure. This unstable capital structure demands a resolution where creditors and depositors are destined to lose. When losses are imposed a depression-like scenario will unfold which in combination with unfunded liabilities and exploding debts may shake the foundations of faith in the credit system and freeze the markets.

The graph below shows the size of the underlying risks and the credit dislocations which are at hand when we take into account the counter-party risks among financial institutions. The data from the Comptroller of the Currency tell us a story where $25 billion support bank deposits of 9,283 billion, and the top 25 holding companies of those banks have derivative “assets” (how someone else’s liability is baptized an asset still puzzles me) that reach almost 300,000 billion.

Should we worry that we have over-sized banks? Are there concerns that the next crisis may unleash the forces envisioned by Dantes when he “visited” the Inferno a.k.a. Hades?

Allow me to close with a thought in observance of the Easter season celebrated in the West this weekend. In the time between Jesus’ words “it is finished” proclaimed on Good Friday and Easter Sunday, he visited Hades in order to proclaim liberation given that the work of atonement had been completed. Let’s hope that the financial institutions will not keep the world in Hades when the next crisis hits.

“It is Finished”: Financial Institutions, Economic Stability, and Hades

Author : John E. Charalambakis

Date : March 29, 2013

Last Thursday (March 28) professor Simon Johnson of the MIT (former chief economist of the IMF) published an excellent piece in his blog (http://economix.blogs.nytimes.com/2013/03/28/the-debate-on-bank-size-is-over/#postComment). Needless to say that nothing else could be expected. In that piece professor Johnson explains why the era of big banks is over. “The debate is over” as he writes, and “the decision to cap the size of the largest banks has been made.”

Professor Johnson cites the Cypriot case and the damage inflicted by its two over-sized banks (Laiki and Bank of Cyprus) to the nation. As further evidence he cites the fact that our Senate unanimously ended the funding advantages of megabanks.

It is our belief that the Cypriot case of a bail-in could serve as the pilot for similar bail-ins around the world, especially for undercapitalized banks. Those bail-ins may include money market funds due to the distortions they create in the commercial paper market. From that perspective, I would say that the case has been closed and the matter of the structure for the next bailout has been pre-determined. “It is finished” and the assumed safety is gone.

Financial institutions are vital to the stability of the economic system. Over-elastic monetary policies (especially when reserves start leaking and become money supply) plant the seeds of destruction. To recall Ludwig von Mises: “There is no means of avoiding the final collapse of a boom brought about by credit extension. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit extension, or later as a final and total catastrophe of the currency system involved.”

The unfortunate thing is that around the world the assets and especially the capital of the financial institutions dwarf in size relative to their derivative exposure. This unstable capital structure demands a resolution where creditors and depositors are destined to lose. When losses are imposed a depression-like scenario will unfold which in combination with unfunded liabilities and exploding debts may shake the foundations of faith in the credit system and freeze the markets.

The graph below shows the size of the underlying risks and the credit dislocations which are at hand when we take into account the counter-party risks among financial institutions. The data from the Comptroller of the Currency tell us a story where $25 billion support bank deposits of 9,283 billion, and the top 25 holding companies of those banks have derivative “assets” (how someone else’s liability is baptized an asset still puzzles me) that reach almost 300,000 billion.

Should we worry that we have over-sized banks? Are there concerns that the next crisis may unleash the forces envisioned by Dantes when he “visited” the Inferno a.k.a. Hades?

Allow me to close with a thought in observance of the Easter season celebrated in the West this weekend. In the time between Jesus’ words “it is finished” proclaimed on Good Friday and Easter Sunday, he visited Hades in order to proclaim liberation given that the work of atonement had been completed. Let’s hope that the financial institutions will not keep the world in Hades when the next crisis hits.