We are crossing correction territory (a drop of more than 10%) for some equity markets in developed countries around the world. This has brought questions about the possibility of a secular bear market (a drop of more than 20%) that will wipe out stocks. The causes for the recent market turmoil – as we have noted in previous commentaries – are concerns about a Chinese hard landing, low oil prices, high yield markets, and the possibility of the end of the credit cycle.

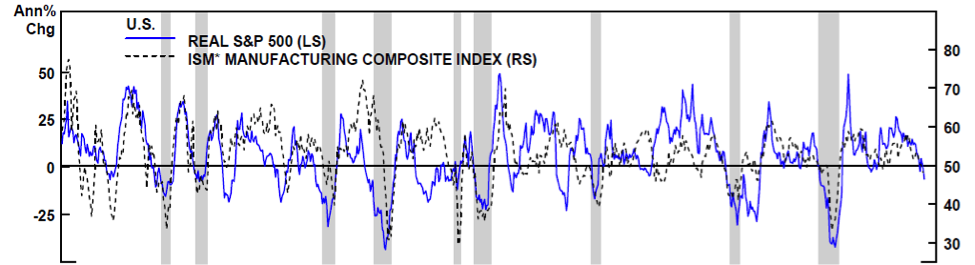

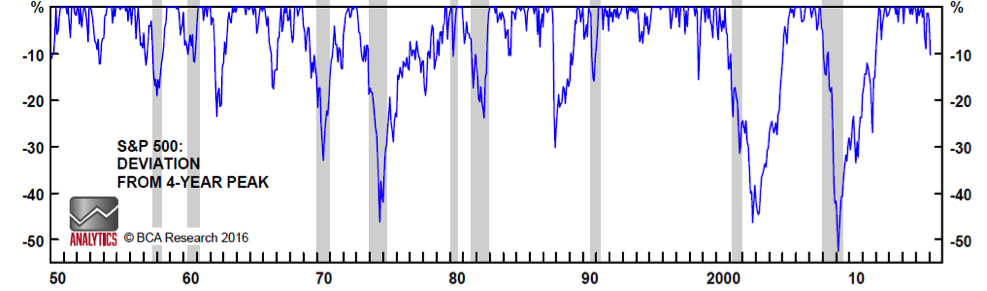

One major characteristic of a modern bear market is that it is associated with a recession. The latter are caused by the implosion of structural imbalances (such as current/trade account deficits, inflationary pressures, credit overextensions, financial institutions’ bust, etc.). As the figure below shows, the recession and bear markets of the 1970s-2009 were related to one or more shocks associated with a structural imbalance (high oil prices in the 1970s, S&L crisis, dot.com bubble, real estate bubble/credit overextension, etc.).

Source: BCA Research

At this historical juncture the existing imbalances can be stretched over time and do not point to an implosion. Therefore, we do not see a bear market nor a recession on the horizon (see explanation below) unless for reasons of a self-fulfilled prophecy where talks about recession and a bear market lead to equities sales for the fear of declining economic activity.

As we have noted before, neither the low correlation between US and Chinese growth justifies fears of a global recession due to contagion reasons, nor do low oil prices cause a global recession. Therefore, an aberration where low oil prices coincide with a healthy Chinese slowdown should be considered a rebalancing act that allows some cleansing to take place through a correction. In turn, abnormalities and unnatural trends would be corrected and opportunities created.

Those opportunities could arise from the supply side of the economy where lower production, operating, and distribution expenses translate into higher profits and business opportunities, which will uplift investment. These investments can compensate for the declining capital expenditures from the energy sector in the medium term.

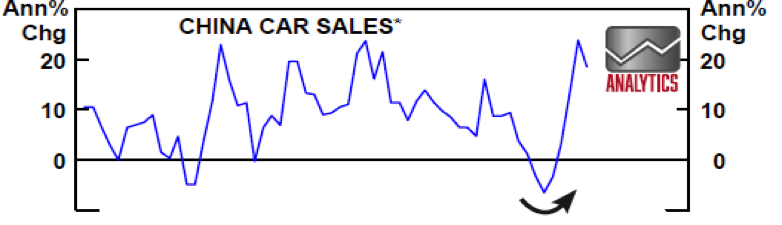

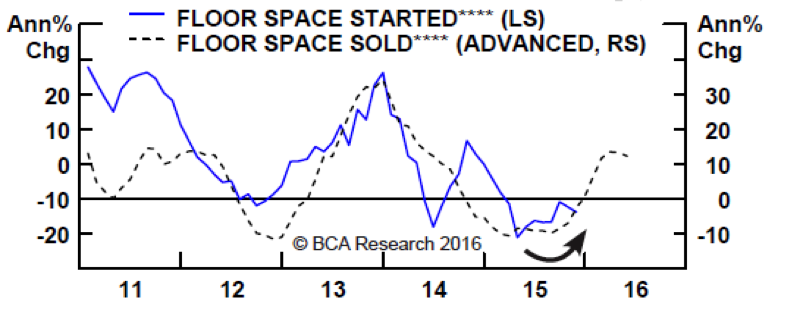

We anticipate that the above-mentioned readjustments will occur, oil prices will bottom out and experience a small upward trend in the next few months, and Chinese markets to identify their stable disequilibrium position (first signs of Chinese readjustments can be seen below in the form of higher car sales, higher money supply and higher real estate sales).

Source: BCA Research

In conclusion, we would state that we do not believe that there are either signs of a bear market or of an impending recession and therefore as the markets readjust investment opportunities arise.

Is a Secular Bear Knocking at Market’s Door? The Escalator of Spending

Author : John E. Charalambakis

Date : January 19, 2016

We are crossing correction territory (a drop of more than 10%) for some equity markets in developed countries around the world. This has brought questions about the possibility of a secular bear market (a drop of more than 20%) that will wipe out stocks. The causes for the recent market turmoil – as we have noted in previous commentaries – are concerns about a Chinese hard landing, low oil prices, high yield markets, and the possibility of the end of the credit cycle.

One major characteristic of a modern bear market is that it is associated with a recession. The latter are caused by the implosion of structural imbalances (such as current/trade account deficits, inflationary pressures, credit overextensions, financial institutions’ bust, etc.). As the figure below shows, the recession and bear markets of the 1970s-2009 were related to one or more shocks associated with a structural imbalance (high oil prices in the 1970s, S&L crisis, dot.com bubble, real estate bubble/credit overextension, etc.).

Source: BCA Research

At this historical juncture the existing imbalances can be stretched over time and do not point to an implosion. Therefore, we do not see a bear market nor a recession on the horizon (see explanation below) unless for reasons of a self-fulfilled prophecy where talks about recession and a bear market lead to equities sales for the fear of declining economic activity.

As we have noted before, neither the low correlation between US and Chinese growth justifies fears of a global recession due to contagion reasons, nor do low oil prices cause a global recession. Therefore, an aberration where low oil prices coincide with a healthy Chinese slowdown should be considered a rebalancing act that allows some cleansing to take place through a correction. In turn, abnormalities and unnatural trends would be corrected and opportunities created.

Those opportunities could arise from the supply side of the economy where lower production, operating, and distribution expenses translate into higher profits and business opportunities, which will uplift investment. These investments can compensate for the declining capital expenditures from the energy sector in the medium term.

We anticipate that the above-mentioned readjustments will occur, oil prices will bottom out and experience a small upward trend in the next few months, and Chinese markets to identify their stable disequilibrium position (first signs of Chinese readjustments can be seen below in the form of higher car sales, higher money supply and higher real estate sales).

Source: BCA Research

In conclusion, we would state that we do not believe that there are either signs of a bear market or of an impending recession and therefore as the markets readjust investment opportunities arise.