The G-20 meeting took place last Saturday. We think it’s an oxymoron that world leaders try to address in one-day conferences serious problems that took years to be created.

The agenda was vast, but could be summarized into three main issues: First, the diverging views – especially between some EU members and the US – regarding the extent and appropriateness of austerity measures; second, the need for extensive financial regulation, a topic that seems to draw some consensus; and finally, global imbalances where nation-savers grow “at the expense of others”.

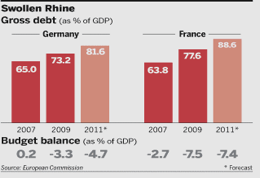

Starting with the first issue, it seems that the divergence regarding the depth and extent of the austerity measures originated within the EU circles. Germany’s Chancellor Angela Merkel, and France’s President Nicolas Sarkozy, may have drafted a joint letter regarding financial regulation in anticipation of the G-20 meeting, but that draft masked the deeper discord between those two and other members of the EU. That discord has to do with whether debt reduction needs to have higher priority than growth. In the midst of a fragile “recovery”, Germany demands belt-tightening austerity measures for the EU members (Germany itself implemented 80 billion Euros worth of such measures), measures that have already been adopted in the U.K., Greece, Spain, Portugal, Italy, France, etc. Those measures are anticipated to slowdown any projected growth, while increasing the costs of unemployment, social discontent, and business development. Germany believes that the deficit spending and stimulus programs will lead to inflation. As the inflation guardian of the EU, Germany believes that the European Central Bank (ECB) started betraying its Bundesbank roots when it dropped its monetarist orthodoxy and bought the bonds of member-states while lowering its standards of collateral taken in exchange for paper-money. The graph below shows that both Germany and France are “sinners”, since for years they violated the stability act of the EU. For both of them, their deficits and debts exceed the self-imposed limits (3% and 60% respectively).

U.S. President Barack Obama, is closer to the view that deficit spending is needed at this stage if “recovery” is to take root. The departure of his Budget Director Peter Orszag portrays a split within the White House regarding deficit spending.

We believe that the split – between Germany and France, as well as between the deficit hawks and the growth proponents – will not be reconciled. It will continue being the target of speculators and will plant the seeds of a monetary disunion and disintegration within the EU. The Euro prospects are bleak just because of that disunion, notwithstanding many other problems. Merkel declared that “if the euro fails, then Europe fails”. Guess what: It’s well on its way there… Our fear is that the current deficit spending is just the tip of the iceberg. The Titanic is heading straight for the iceberg and unfortunately has it no anchor to stop it. It’s not the cause but the symptom of a system that is building up liabilities without collateral. Another way of looking at this problem is looking at the construction of a building that has an adequate foundation to withstand the weight of five floors and we are now on floor #9, admiring the view from the penthouse. Guess what: unless we pour more concrete and firm up the foundations the building is coming down.

The second theme in the G-20 discussions dealt with financial regulation. For now, we would like to comment on three issues of the US bill – namely the Volcker Rule, leverage, and derivative issues – as well as on Basel III. We are strong supporters of the Volcker Rule. We have written elsewhere that the Volcker Rule could become the ultimate instrument of stopping the madness of accumulating liabilities without collateral and of speculating with financial instruments that intoxicated the global economy to the point of almost no return. A form of the Volcker Rule was adopted in the recent financial regulatory bill. The form that was adopted allowed some exceptions. The Chairman himself has said that exceptions are not desirable. The best ever Chairman of the Fed has proven his wisdom over the years. Why don’t we listen to him? A stronger version of the Volcker Rule was and still is needed.

In addition, we consider it a perpetuation of madness that almost no limits on leverage were allowed in that bill. Again, as we have written elsewhere – and prove it too with statistical and econometric analysis – the accumulation of liabilities via toxic “assets”, extended leverage and drove the global Titanic towards the iceberg. Institutionalizing unlimited leverage does nothing else but institutionalize instability.

As for derivatives regulation, we are of the opinion that the bill is directionally correct. We consider most of the derivatives to be instruments of mass deception; masking risks without adequate capital coverage.

On a global level, we consider it a scandal that banks seem to have won the battle for limits to Basel III. The latter was calling for capital and liquidity requirements that would have eased the risks of the impending crisis. The proposal that would have matched assets with liabilities seems to be shelved for now. The outrageous estimates by banks that funding costs would have increased substantially cannot be proven, while their claims that the return on capital would have been cut by 75% is preposterous. We are afraid that the drafting committee is a victim of those who are in the business of institutionalizing financial instability, especially with weak positions on leverage and pension deficits allowances. In the global financial village, pension viruses spread quickly via the bond market.

The third main issue of the G-20 agenda dealt with global imbalances. The latter is mainly viewed in terms of trade and current account deficits. Some want to blame China and its exchange rate policies for the latter two. In anticipation of the G-20 meeting, China announced a controlled flexibility of its currency (RMB). The forward markets have discounted that announcement, and do not expect the RMB to appreciate by more than 2-3% by year’s end. The Chinese need a cheap currency to promote their products in foreign markets. The tremors in China have already started, as we have explained elsewhere. A strong RMB while keeping inflationary pressures in check (to some extent) depresses exports which are the main growth venue in China.

Chinese leaders need the hot and speculative money inflows – that will fly to China in anticipation of a 20% RMB appreciation – similar to the one that took place between mid 2005 and mid 2008 – to face some liquidity concerns. It is needless to state that the minimal RMB flexibility does not address the issue of global imbalances.

The combination of austerity measures, targeting the wrong goals, and not addressing the collateralization and securitization issues will lead inevitably to another crisis, which will be much worse than the one we experienced in 2008.

Welcome to the world of institutionalizing instability.

Institutionalizing a Stable Instability

Author : John E. Charalambakis

Date : June 28, 2010

The G-20 meeting took place last Saturday. We think it’s an oxymoron that world leaders try to address in one-day conferences serious problems that took years to be created.

The agenda was vast, but could be summarized into three main issues: First, the diverging views – especially between some EU members and the US – regarding the extent and appropriateness of austerity measures; second, the need for extensive financial regulation, a topic that seems to draw some consensus; and finally, global imbalances where nation-savers grow “at the expense of others”.

Starting with the first issue, it seems that the divergence regarding the depth and extent of the austerity measures originated within the EU circles. Germany’s Chancellor Angela Merkel, and France’s President Nicolas Sarkozy, may have drafted a joint letter regarding financial regulation in anticipation of the G-20 meeting, but that draft masked the deeper discord between those two and other members of the EU. That discord has to do with whether debt reduction needs to have higher priority than growth. In the midst of a fragile “recovery”, Germany demands belt-tightening austerity measures for the EU members (Germany itself implemented 80 billion Euros worth of such measures), measures that have already been adopted in the U.K., Greece, Spain, Portugal, Italy, France, etc. Those measures are anticipated to slowdown any projected growth, while increasing the costs of unemployment, social discontent, and business development. Germany believes that the deficit spending and stimulus programs will lead to inflation. As the inflation guardian of the EU, Germany believes that the European Central Bank (ECB) started betraying its Bundesbank roots when it dropped its monetarist orthodoxy and bought the bonds of member-states while lowering its standards of collateral taken in exchange for paper-money. The graph below shows that both Germany and France are “sinners”, since for years they violated the stability act of the EU. For both of them, their deficits and debts exceed the self-imposed limits (3% and 60% respectively).

U.S. President Barack Obama, is closer to the view that deficit spending is needed at this stage if “recovery” is to take root. The departure of his Budget Director Peter Orszag portrays a split within the White House regarding deficit spending.

We believe that the split – between Germany and France, as well as between the deficit hawks and the growth proponents – will not be reconciled. It will continue being the target of speculators and will plant the seeds of a monetary disunion and disintegration within the EU. The Euro prospects are bleak just because of that disunion, notwithstanding many other problems. Merkel declared that “if the euro fails, then Europe fails”. Guess what: It’s well on its way there… Our fear is that the current deficit spending is just the tip of the iceberg. The Titanic is heading straight for the iceberg and unfortunately has it no anchor to stop it. It’s not the cause but the symptom of a system that is building up liabilities without collateral. Another way of looking at this problem is looking at the construction of a building that has an adequate foundation to withstand the weight of five floors and we are now on floor #9, admiring the view from the penthouse. Guess what: unless we pour more concrete and firm up the foundations the building is coming down.

The second theme in the G-20 discussions dealt with financial regulation. For now, we would like to comment on three issues of the US bill – namely the Volcker Rule, leverage, and derivative issues – as well as on Basel III. We are strong supporters of the Volcker Rule. We have written elsewhere that the Volcker Rule could become the ultimate instrument of stopping the madness of accumulating liabilities without collateral and of speculating with financial instruments that intoxicated the global economy to the point of almost no return. A form of the Volcker Rule was adopted in the recent financial regulatory bill. The form that was adopted allowed some exceptions. The Chairman himself has said that exceptions are not desirable. The best ever Chairman of the Fed has proven his wisdom over the years. Why don’t we listen to him? A stronger version of the Volcker Rule was and still is needed.

In addition, we consider it a perpetuation of madness that almost no limits on leverage were allowed in that bill. Again, as we have written elsewhere – and prove it too with statistical and econometric analysis – the accumulation of liabilities via toxic “assets”, extended leverage and drove the global Titanic towards the iceberg. Institutionalizing unlimited leverage does nothing else but institutionalize instability.

As for derivatives regulation, we are of the opinion that the bill is directionally correct. We consider most of the derivatives to be instruments of mass deception; masking risks without adequate capital coverage.

On a global level, we consider it a scandal that banks seem to have won the battle for limits to Basel III. The latter was calling for capital and liquidity requirements that would have eased the risks of the impending crisis. The proposal that would have matched assets with liabilities seems to be shelved for now. The outrageous estimates by banks that funding costs would have increased substantially cannot be proven, while their claims that the return on capital would have been cut by 75% is preposterous. We are afraid that the drafting committee is a victim of those who are in the business of institutionalizing financial instability, especially with weak positions on leverage and pension deficits allowances. In the global financial village, pension viruses spread quickly via the bond market.

The third main issue of the G-20 agenda dealt with global imbalances. The latter is mainly viewed in terms of trade and current account deficits. Some want to blame China and its exchange rate policies for the latter two. In anticipation of the G-20 meeting, China announced a controlled flexibility of its currency (RMB). The forward markets have discounted that announcement, and do not expect the RMB to appreciate by more than 2-3% by year’s end. The Chinese need a cheap currency to promote their products in foreign markets. The tremors in China have already started, as we have explained elsewhere. A strong RMB while keeping inflationary pressures in check (to some extent) depresses exports which are the main growth venue in China.

Chinese leaders need the hot and speculative money inflows – that will fly to China in anticipation of a 20% RMB appreciation – similar to the one that took place between mid 2005 and mid 2008 – to face some liquidity concerns. It is needless to state that the minimal RMB flexibility does not address the issue of global imbalances.

The combination of austerity measures, targeting the wrong goals, and not addressing the collateralization and securitization issues will lead inevitably to another crisis, which will be much worse than the one we experienced in 2008.

Welcome to the world of institutionalizing instability.