This commentary is a continuation of our theme that hard/real assets that are no one else’s liabilities – in contrast to financial “assets” – represent anchors in portfolios. It also serves as a prelude to our upcoming newsletters about infrastructure, international real estate, and water.

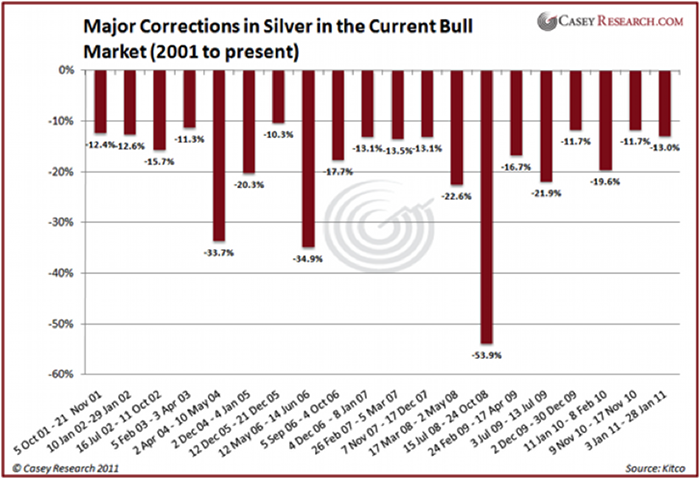

Last week we observed a significant correction in silver. As we wrote before, we started buying silver when it was at $17/oz (see also our newsletter dated July 2010). Our technical analysis has assisted us in moving in and out of some sliver positions since then, and as the following graph shows, silver is known for its volatility. Despite the latter, we cannot deny the fact that its finite quantities, its industrial uses, and its precious nature, will probably move it higher in the medium term.

Exchanging real assets and stuff for fiat/paper money has its finite point, and the third act of the drama (see our commentary on April 8) can hardly be avoided to be the debasement of paper money.

The overextension of credit that has taken place, based on IOUs and unfunded liabilities circulated a.k.a. as bonds and promises, will meet its maker, as has happened so many times in the past. A prudent person/institution, prepares for that inevitable trajectory, and chooses wisely among available choices.

We are of the opinion that hard asset choices – besides the precious metals and energy – could expand and include infrastructure options in an environment – such as the US – where the rebuilding of infrastructure is a must. At the same time infrastructure development will be the major winner if our assumption of a New Silk Road (meaning that peaceful growth will come via developing middles classes in emerging markets) that passes through N. Africa and the New Middle East, proves to be accurate.

The wonderful thing is that if the above scenario materializes, it could also serve as the Deus ex machina that could buy out time and reroute the endgame. Moreover, our research has identified plays within the infrastructure options with great dividend yields.

Speaking of dividend yields within our strategic sectors – such as pipelines – we have been investigating international real estate assets that also pay good dividends, as well as timberland options with good dividend yields.

We will close this brief prelude stating that we are seriously researching water as an asset class, and we anticipate publishing our results in the July-August newsletter.

Once again: Ode to hard assets!

Inflating into Oblivion: Hard Asset Investments are Just …Precious

Author : John E. Charalambakis

Date : May 9, 2011

This commentary is a continuation of our theme that hard/real assets that are no one else’s liabilities – in contrast to financial “assets” – represent anchors in portfolios. It also serves as a prelude to our upcoming newsletters about infrastructure, international real estate, and water.

Last week we observed a significant correction in silver. As we wrote before, we started buying silver when it was at $17/oz (see also our newsletter dated July 2010). Our technical analysis has assisted us in moving in and out of some sliver positions since then, and as the following graph shows, silver is known for its volatility. Despite the latter, we cannot deny the fact that its finite quantities, its industrial uses, and its precious nature, will probably move it higher in the medium term.

Exchanging real assets and stuff for fiat/paper money has its finite point, and the third act of the drama (see our commentary on April 8) can hardly be avoided to be the debasement of paper money.

The overextension of credit that has taken place, based on IOUs and unfunded liabilities circulated a.k.a. as bonds and promises, will meet its maker, as has happened so many times in the past. A prudent person/institution, prepares for that inevitable trajectory, and chooses wisely among available choices.

We are of the opinion that hard asset choices – besides the precious metals and energy – could expand and include infrastructure options in an environment – such as the US – where the rebuilding of infrastructure is a must. At the same time infrastructure development will be the major winner if our assumption of a New Silk Road (meaning that peaceful growth will come via developing middles classes in emerging markets) that passes through N. Africa and the New Middle East, proves to be accurate.

The wonderful thing is that if the above scenario materializes, it could also serve as the Deus ex machina that could buy out time and reroute the endgame. Moreover, our research has identified plays within the infrastructure options with great dividend yields.

Speaking of dividend yields within our strategic sectors – such as pipelines – we have been investigating international real estate assets that also pay good dividends, as well as timberland options with good dividend yields.

We will close this brief prelude stating that we are seriously researching water as an asset class, and we anticipate publishing our results in the July-August newsletter.

Once again: Ode to hard assets!