The securitization problems seem to be making another comeback in the form of “foreclosuregate”, as the Economist newspaper has labeled its latest phase.

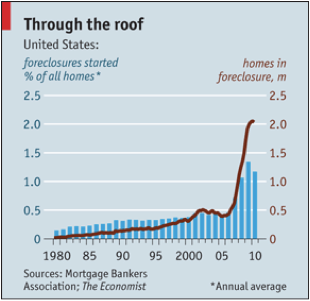

Banks seem to be admitting to subpar standards in not just approving loans but also proceeding with foreclosures. The result of those unprofessional activities (where foreclosures take place without proper documentation and procedures a.k.a. as “robo-signing”) could cost the industry $50+ billion. The political and judicial pressure is significant. More than two million homes are in foreclosure, as the following graph shows.

The housing inventory problems look even more problematic when we take into account that approximately 25% of real estate sales are those of foreclosed homes. The rush to securitize for the purpose of credit creation and expansion put dynamite in the underwriting process which also led to improper record-keeping. When deeds and titles are not properly recorded, who controls the mortgage-note could become a very significant problem that could force some banks to book the mortgages into their own books, which in turn means they need to make special provisions for bad loans. In the month of September foreclosures surpassed 100,000 homes, and if it continues at that rate, the housing industry could be blamed again for another round of credit crisis, which is absurd.

Moreover, to the above real problems, we also need to add the issue of those home-owners who are under water and whose property is now valued at less than their mortgages. That number reaches about 25% of all mortgages, which reduces wealth (let’s not forget that about 50% of bank lending is for real estate) and contributes to the rise of the loan-to-value ratio. As the ratio increases, standards are increasing too which leads to lower lending, and thus less spending and lower market activity in general.

We see then once again, that over-extension of credit eventually will send shock waves into the economies, which as they are going through the deleveraging process inflict pain to stakeholders through less spending, lower profitability, higher uncertainty, and higher unemployment. The State will also suffer since tax revenues decline, spending increases (as a buffer against the cyclical downturn), and unfunded liabilities grow bigger. The interest burden on the sovereign debt puts additional constraints on the available options and the possibility of a major implosion in the global monetary transmission mechanism will cause spreads to increase, and possibly debt auctions to fail. The combination of demographic factors, structural imbalances, and cyclical economic malfunctions will exacerbate the misallocation of capital, which in a case of financial instability will devalue paper money and cause the prices of real hard assets to increase substantially.

The following figure shows the deficit and maturing constraints that sovereign nations face until the end of next year. The message is subliminal, and in our opinion portrays a bunker philosophy. Let’s finance as much of long term debt now that we have the chance.

This subliminal message should be interpreted in the context of Quantitative Easing Part II (QE2). The goal of the latter is to manage inflationary expectations and advance the base of the credit pyramid (see Sisyphus commentary). The danger of such an exercise when applied in an environment of currency instability is that inflation may erupt – within 18 months – that will destabilize the economic base.

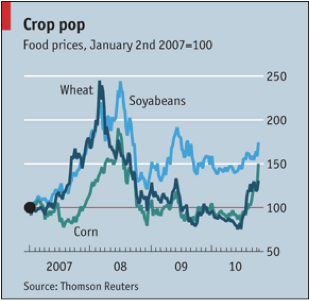

It seems to us that the recent price increases in agricultural commodities from wheat, to corn, to sugar and coffee could serve as the prelude to such pressures, as the following graph shows.

Are we dealing with a Sisyphus in reverse?

In the Land of Debt: Foreclosures, Commodities, and Quantitative Easing

Author : John E. Charalambakis

Date : October 25, 2010

The securitization problems seem to be making another comeback in the form of “foreclosuregate”, as the Economist newspaper has labeled its latest phase.

Banks seem to be admitting to subpar standards in not just approving loans but also proceeding with foreclosures. The result of those unprofessional activities (where foreclosures take place without proper documentation and procedures a.k.a. as “robo-signing”) could cost the industry $50+ billion. The political and judicial pressure is significant. More than two million homes are in foreclosure, as the following graph shows.

The housing inventory problems look even more problematic when we take into account that approximately 25% of real estate sales are those of foreclosed homes. The rush to securitize for the purpose of credit creation and expansion put dynamite in the underwriting process which also led to improper record-keeping. When deeds and titles are not properly recorded, who controls the mortgage-note could become a very significant problem that could force some banks to book the mortgages into their own books, which in turn means they need to make special provisions for bad loans. In the month of September foreclosures surpassed 100,000 homes, and if it continues at that rate, the housing industry could be blamed again for another round of credit crisis, which is absurd.

Moreover, to the above real problems, we also need to add the issue of those home-owners who are under water and whose property is now valued at less than their mortgages. That number reaches about 25% of all mortgages, which reduces wealth (let’s not forget that about 50% of bank lending is for real estate) and contributes to the rise of the loan-to-value ratio. As the ratio increases, standards are increasing too which leads to lower lending, and thus less spending and lower market activity in general.

We see then once again, that over-extension of credit eventually will send shock waves into the economies, which as they are going through the deleveraging process inflict pain to stakeholders through less spending, lower profitability, higher uncertainty, and higher unemployment. The State will also suffer since tax revenues decline, spending increases (as a buffer against the cyclical downturn), and unfunded liabilities grow bigger. The interest burden on the sovereign debt puts additional constraints on the available options and the possibility of a major implosion in the global monetary transmission mechanism will cause spreads to increase, and possibly debt auctions to fail. The combination of demographic factors, structural imbalances, and cyclical economic malfunctions will exacerbate the misallocation of capital, which in a case of financial instability will devalue paper money and cause the prices of real hard assets to increase substantially.

The following figure shows the deficit and maturing constraints that sovereign nations face until the end of next year. The message is subliminal, and in our opinion portrays a bunker philosophy. Let’s finance as much of long term debt now that we have the chance.

This subliminal message should be interpreted in the context of Quantitative Easing Part II (QE2). The goal of the latter is to manage inflationary expectations and advance the base of the credit pyramid (see Sisyphus commentary). The danger of such an exercise when applied in an environment of currency instability is that inflation may erupt – within 18 months – that will destabilize the economic base.

It seems to us that the recent price increases in agricultural commodities from wheat, to corn, to sugar and coffee could serve as the prelude to such pressures, as the following graph shows.

Are we dealing with a Sisyphus in reverse?