In our posting last week we pointed to the fact that while monetary reserves are rising, money supply is contracting due to the inability of banks to identify credit-worthy customers, and/or due to the anorexia of customers to accumulate more debt. The debt explosion via the business of securitizing debt instruments (such as worthless CDOs, CLOs, CDSs, etc) is at the core of the financial crisis.

The balance sheets of the banks were full of these worthless assets, and thus those banks had to be bailed out by governments and central banks around the world.

Since the summer of 2007 when the tremors and the crisis started central banks have become the buyers of last resort of these paper “assets”. They buy these toxic assets in exchange for cash reserves credited to the banks’ balance sheets. The cash-rich banks also play a nice carry- trade game by buying government bonds using zero rate loans obtained from central banks.

No wonder their profits are increasing. Our young kids can make money this way! It’s called a truly free lunch that inevitably will lead to a “tragedy of the commons,” where the fatter cows will eat the thinner ones. This time seems to be truly different!

The Securitization Forum in Europe published some astonishing numbers last week. Before the crisis started, Eurozone banks were buying 95% of those securitized instruments. Now, they are buying less than 5%.Who buys the rest 95%? You guessed right. The European Central Bank (ECB)!

Moreover, while prior to the crisis the securitization business in Europe approximated $700 billion (roughly 500 billion Euros at the then exchange rate), nowadays the securitization business barely reaches $37 billion. The market for securitization remains frozen, and we have not seen anything yet. The combination of over-extended customers, customers’ anorexia for debt instruments, austerity programs, the impending central banks’ suspension of acquiring toxic assets, as well as an environment of bubble awareness and risk-aversion, will inevitably lead to frozen credit markets, possibly as early as late summer of this year or as late as mid 2011.

In the United States, the picture seems to be pretty much the same. The Fed has bought over $1.25 trillion of securitized instruments. Estimates are that the securitization business touched every “asset” and transformed it into an instrument. No wonder that trillions of dollars were securitized, sliced and sold as AAA instruments to a hungry public (both institutional and private) that was seeking alternative investments and possibly better returns. Cheap credit was flowing around. The credit was used to buy those instruments which in turn fueled the creation of more paper “assets” that could be used as collateral for loans, which in turn were securitized and sold as tranches to investors who… (I am sure you get the picture). Prosperity has been bought on credit until the postman rings the bell for a second time and possibly a third time.

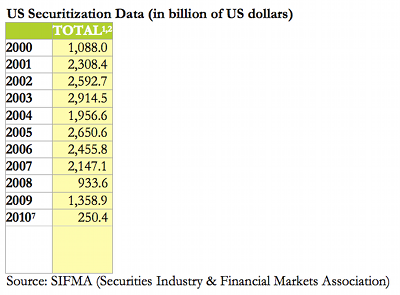

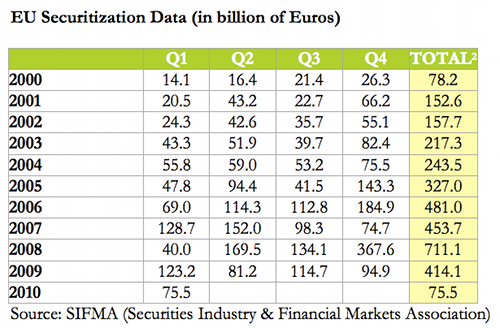

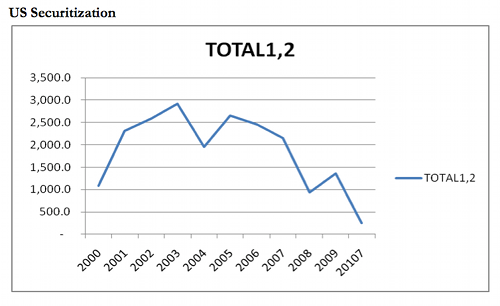

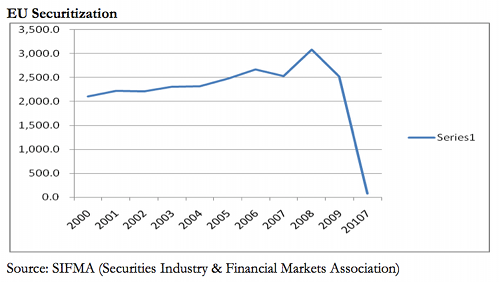

The following tables and graphs show the securitization data for the US and the EU for the last decade.

We believe the story is clear. The securitization market is frozen and things will get worse as governments implement austerity measures and as central banks suspend their acquisitions of toxic assets. The flight to quality helps governments to refinance their debts (at least some of them); however, to our Chinese concerns expressed on p.1 of our June newsletter, we would add the following: The re-introduced controlled-flexibility of the Chinese currency (RMB) may provide incentives for speculative capital to flow into China in anticipation of a RMB revaluation, similar to the one experienced between mid 2005 and July 2008, when the RMB appreciated by more than 20% against the dollar. Such an inflow may destabilize the Chinese economy, create further bubbles in those markets, and also become a source of inflationary pressures. The speculative capital bets on the assumption that the RMB is undervalued. The flood of speculative capital may undermine the Chinese central bank’s monetary policy. Between mid 2005 and July 2008, more than 600 billion dollars worth of speculative capital flooded the Chinese market (this was in addition to the $500 billion that was already flowing due to exports). In such a scenario, Chinese currency reserves will explode, creating asset allocation problems, inflating prices, and distorting capital decisions.

The Chinese central bank is sending messages that the RMB flexibility is a two-way bet implying that it may actually depreciate against the dollar (as it did on Tuesday June 22), thus trying to mitigate the risk of a speculative flood of hot money. We reckon that the Chinese need the funds in order to stabilize a shaky market in equities, real estate, and business spending. If the global economy goes into recession, China may devalue, funds will start flowing out of China, deflating its economy and growth prospects while tightening its credit and liquidity positions, and as things worsen, create havoc for those fund managers that rushed into the Chinese market. The ensuing outflows from China could destabilize the global economy.

It is shaping up as an exciting ride!

Securitization, Credit Constraints, and the Chinese Dilemma

Author : John E. Charalambakis

Date : July 1, 2010

In our posting last week we pointed to the fact that while monetary reserves are rising, money supply is contracting due to the inability of banks to identify credit-worthy customers, and/or due to the anorexia of customers to accumulate more debt. The debt explosion via the business of securitizing debt instruments (such as worthless CDOs, CLOs, CDSs, etc) is at the core of the financial crisis.

The balance sheets of the banks were full of these worthless assets, and thus those banks had to be bailed out by governments and central banks around the world.

Since the summer of 2007 when the tremors and the crisis started central banks have become the buyers of last resort of these paper “assets”. They buy these toxic assets in exchange for cash reserves credited to the banks’ balance sheets. The cash-rich banks also play a nice carry- trade game by buying government bonds using zero rate loans obtained from central banks.

No wonder their profits are increasing. Our young kids can make money this way! It’s called a truly free lunch that inevitably will lead to a “tragedy of the commons,” where the fatter cows will eat the thinner ones. This time seems to be truly different!

The Securitization Forum in Europe published some astonishing numbers last week. Before the crisis started, Eurozone banks were buying 95% of those securitized instruments. Now, they are buying less than 5%.Who buys the rest 95%? You guessed right. The European Central Bank (ECB)!

Moreover, while prior to the crisis the securitization business in Europe approximated $700 billion (roughly 500 billion Euros at the then exchange rate), nowadays the securitization business barely reaches $37 billion. The market for securitization remains frozen, and we have not seen anything yet. The combination of over-extended customers, customers’ anorexia for debt instruments, austerity programs, the impending central banks’ suspension of acquiring toxic assets, as well as an environment of bubble awareness and risk-aversion, will inevitably lead to frozen credit markets, possibly as early as late summer of this year or as late as mid 2011.

In the United States, the picture seems to be pretty much the same. The Fed has bought over $1.25 trillion of securitized instruments. Estimates are that the securitization business touched every “asset” and transformed it into an instrument. No wonder that trillions of dollars were securitized, sliced and sold as AAA instruments to a hungry public (both institutional and private) that was seeking alternative investments and possibly better returns. Cheap credit was flowing around. The credit was used to buy those instruments which in turn fueled the creation of more paper “assets” that could be used as collateral for loans, which in turn were securitized and sold as tranches to investors who… (I am sure you get the picture). Prosperity has been bought on credit until the postman rings the bell for a second time and possibly a third time.

The following tables and graphs show the securitization data for the US and the EU for the last decade.

We believe the story is clear. The securitization market is frozen and things will get worse as governments implement austerity measures and as central banks suspend their acquisitions of toxic assets. The flight to quality helps governments to refinance their debts (at least some of them); however, to our Chinese concerns expressed on p.1 of our June newsletter, we would add the following: The re-introduced controlled-flexibility of the Chinese currency (RMB) may provide incentives for speculative capital to flow into China in anticipation of a RMB revaluation, similar to the one experienced between mid 2005 and July 2008, when the RMB appreciated by more than 20% against the dollar. Such an inflow may destabilize the Chinese economy, create further bubbles in those markets, and also become a source of inflationary pressures. The speculative capital bets on the assumption that the RMB is undervalued. The flood of speculative capital may undermine the Chinese central bank’s monetary policy. Between mid 2005 and July 2008, more than 600 billion dollars worth of speculative capital flooded the Chinese market (this was in addition to the $500 billion that was already flowing due to exports). In such a scenario, Chinese currency reserves will explode, creating asset allocation problems, inflating prices, and distorting capital decisions.

The Chinese central bank is sending messages that the RMB flexibility is a two-way bet implying that it may actually depreciate against the dollar (as it did on Tuesday June 22), thus trying to mitigate the risk of a speculative flood of hot money. We reckon that the Chinese need the funds in order to stabilize a shaky market in equities, real estate, and business spending. If the global economy goes into recession, China may devalue, funds will start flowing out of China, deflating its economy and growth prospects while tightening its credit and liquidity positions, and as things worsen, create havoc for those fund managers that rushed into the Chinese market. The ensuing outflows from China could destabilize the global economy.

It is shaping up as an exciting ride!