One of the great joys of my job is to meet old and new friends who teach and/or remind me of marvelous concepts and ideas. One such incident happened about three weeks ago during an overseas trip. At a dinner I had had with I.K.M. – who had reminded me a few months ago of the ancient Sysachtheia topic – another friend, S.X. joined us. S.X. explained to us the great idea that prevailed in ancient times of Aisimnitia.

During turbulent times, the concept of Aisimnitia (Αισυμνητεία) meant that the affairs of the state were turned over to an individual (or a group of individuals) who by all standards were considered wise, prudent, selfless, just, and were known for their sound judgment regarding public affairs. Names such as Solon of Athens, Thalis of Miletus, Pittakos of Mytilene, are well-known for the public role they played in challenging times. With full responsibility and accountability they were the masters that orchestrated rescues for their city-states in times of crisis.

In a previous commentary titled “Alea Iacta Est” we wrote about the leadership gap that the European Union suffers from. To some extent the Euro problems are a symptom of such a leadership gap. We are of the opinion that the jury regarding the future of the Eurozone, the Euro and the EU in general, will remain out for the next 75-90 days. If the signs are positive and some leadership is exhibited, then the second half of 2011 will be shaped with a positive outlook for equities (with the Euro probably continuing its needed downward trend) in both the US and the EU. In such a case, medium-cap and small cap companies may outpace large cap firms, money will be spent on economic investments (plants, equipment, tools, machinery, R&D, inventories), GDP and incomes will rise, and we would not be surprised if we see a major uptick in the real estate sector in the second half of the year.

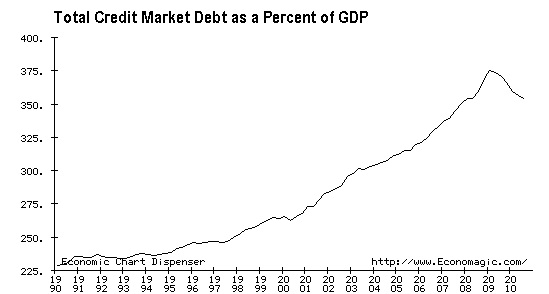

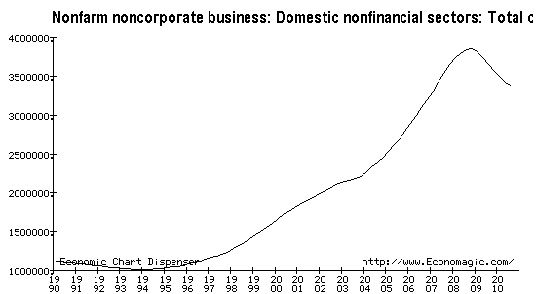

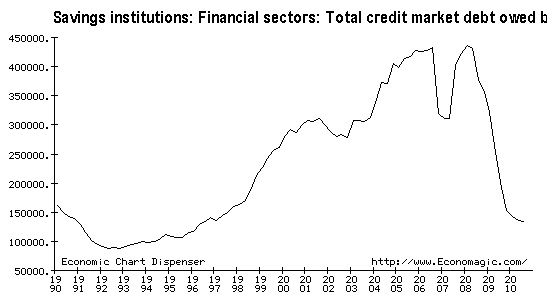

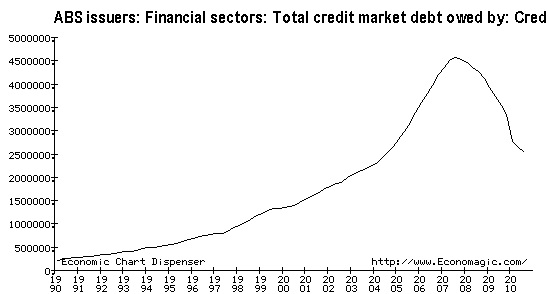

In the US – whether we agree or not with the actions taken – the Fed and the administration have exhibited some leadership, contrary to what is happening in the EU. We insist on our published opinion (see our commentary on Nov. 10, 2010) that the Fed’s QE2 was a pre-emptive strike against our own and the EU’s financial problems, a move that injected liquidity in a system where money supply – that is endogenously driven by demand for credit – shrinks. The following four figures demonstrate exactly that reality of deleveraging. Without a doubt, this is healthy; however the deleveraging process keeps growth below optimal, and thus unemployment remains at levels well-above normal.

The figures above show the financial, nonfinancial and household deleveraging process. As a result money supply contracts and an unearthing of the credit mechanism is at work, including the limiting capacity of the shadow banking system to generate credit (thus the relevant drop from $20 trillion to $16 trillion of credit in the last several months). Once additional unearthing takes place, new money that is sitting in the sidelines (e.g. the cash that the corporations have accumulated in excess of $1.3 trillion, the money-market funds, and possibly offshore funds too) will come into play advancing growth, investment opportunities, and employment prospects. However, many things will depend on the leadership exhibited in the U.S., the E.U. and the pertinent coordination between the two players.

In the “Alea Iacta Est” piece we advocated the position that it is an illusion in the EU to have a monetary union without a fiscal union. In the last ten days, even Germany has publicly admitted that eventually that might be part of the solution. Thus, while it has been rejecting the concept of the joint EU bonds a.k.a. Eurobonds, it admitted that if all other measures fail (including the weak European Support Mechanism, ESM) the EU will have no other option but to revert back to a revision and a redrafting of its Treaties in order to start the fiscal unification cycle.

However, such a move might prove to be to be too little and too late due to the globalization of finance that has taken place in the last ten years. How in the world do we expect to have global financial markets that design and price global securities without the proper global authority and regulatory structure? Regional regulatory authorities are obsolete nowadays. As we wrote elsewhere – with small pieces in this site too over the course of the last 18 months – the collateralization and securitization of paper “assets,” including derivatives, created pyramids/tranches of debt instruments without real backing. When that part of the scheme was completed in the shadow parts of the financial markets things evolved as follows: Central banks accepted the new reality, extended credit and kept rates low creating bubbles in conventional asset markets. The over-extension of credit and the cheap financing made every kind of project “profitable” and with the help of artificial valuations and appraisals the “collateral” for the conventional banking sector was present and available. Hence, capital was misallocated, wasteful projects were funded, and overcapacity was built into the economic system. The boom in the shadow and the conventional monetary system became the seed for the bust. When the bust prevailed all around the world governments were forced to pick up the pieces and replace insufficient private demand in order to avoid another depression. The explosion of deficits and the growing national debts became the new normal. Before we start seeing the bust of nations and the default that accompanies them, we need to think hard about the need for Aisimnitia.

As we have written and publicly lectured before, and with all due respect to President Reagan, we believe that if it were not for Chairman Volcker the 1980s would have been a dismal decade. Therefore, times like these call for an Aisiminitis like Paul Volcker, who could command the respect of both sides of the Atlantic and who could bring into the global picture the necessary anchors and coordination that the credit mechanism is in need for.

Ode to the Aisimnitis!

Illusions, Economic Reality, & Aisimnitia in Times of Uncertainty: Do we and the EU Need Chairman Volcker Back?

Author : John E. Charalambakis

Date : December 13, 2010

One of the great joys of my job is to meet old and new friends who teach and/or remind me of marvelous concepts and ideas. One such incident happened about three weeks ago during an overseas trip. At a dinner I had had with I.K.M. – who had reminded me a few months ago of the ancient Sysachtheia topic – another friend, S.X. joined us. S.X. explained to us the great idea that prevailed in ancient times of Aisimnitia.

During turbulent times, the concept of Aisimnitia (Αισυμνητεία) meant that the affairs of the state were turned over to an individual (or a group of individuals) who by all standards were considered wise, prudent, selfless, just, and were known for their sound judgment regarding public affairs. Names such as Solon of Athens, Thalis of Miletus, Pittakos of Mytilene, are well-known for the public role they played in challenging times. With full responsibility and accountability they were the masters that orchestrated rescues for their city-states in times of crisis.

In a previous commentary titled “Alea Iacta Est” we wrote about the leadership gap that the European Union suffers from. To some extent the Euro problems are a symptom of such a leadership gap. We are of the opinion that the jury regarding the future of the Eurozone, the Euro and the EU in general, will remain out for the next 75-90 days. If the signs are positive and some leadership is exhibited, then the second half of 2011 will be shaped with a positive outlook for equities (with the Euro probably continuing its needed downward trend) in both the US and the EU. In such a case, medium-cap and small cap companies may outpace large cap firms, money will be spent on economic investments (plants, equipment, tools, machinery, R&D, inventories), GDP and incomes will rise, and we would not be surprised if we see a major uptick in the real estate sector in the second half of the year.

In the US – whether we agree or not with the actions taken – the Fed and the administration have exhibited some leadership, contrary to what is happening in the EU. We insist on our published opinion (see our commentary on Nov. 10, 2010) that the Fed’s QE2 was a pre-emptive strike against our own and the EU’s financial problems, a move that injected liquidity in a system where money supply – that is endogenously driven by demand for credit – shrinks. The following four figures demonstrate exactly that reality of deleveraging. Without a doubt, this is healthy; however the deleveraging process keeps growth below optimal, and thus unemployment remains at levels well-above normal.

The figures above show the financial, nonfinancial and household deleveraging process. As a result money supply contracts and an unearthing of the credit mechanism is at work, including the limiting capacity of the shadow banking system to generate credit (thus the relevant drop from $20 trillion to $16 trillion of credit in the last several months). Once additional unearthing takes place, new money that is sitting in the sidelines (e.g. the cash that the corporations have accumulated in excess of $1.3 trillion, the money-market funds, and possibly offshore funds too) will come into play advancing growth, investment opportunities, and employment prospects. However, many things will depend on the leadership exhibited in the U.S., the E.U. and the pertinent coordination between the two players.

In the “Alea Iacta Est” piece we advocated the position that it is an illusion in the EU to have a monetary union without a fiscal union. In the last ten days, even Germany has publicly admitted that eventually that might be part of the solution. Thus, while it has been rejecting the concept of the joint EU bonds a.k.a. Eurobonds, it admitted that if all other measures fail (including the weak European Support Mechanism, ESM) the EU will have no other option but to revert back to a revision and a redrafting of its Treaties in order to start the fiscal unification cycle.

However, such a move might prove to be to be too little and too late due to the globalization of finance that has taken place in the last ten years. How in the world do we expect to have global financial markets that design and price global securities without the proper global authority and regulatory structure? Regional regulatory authorities are obsolete nowadays. As we wrote elsewhere – with small pieces in this site too over the course of the last 18 months – the collateralization and securitization of paper “assets,” including derivatives, created pyramids/tranches of debt instruments without real backing. When that part of the scheme was completed in the shadow parts of the financial markets things evolved as follows: Central banks accepted the new reality, extended credit and kept rates low creating bubbles in conventional asset markets. The over-extension of credit and the cheap financing made every kind of project “profitable” and with the help of artificial valuations and appraisals the “collateral” for the conventional banking sector was present and available. Hence, capital was misallocated, wasteful projects were funded, and overcapacity was built into the economic system. The boom in the shadow and the conventional monetary system became the seed for the bust. When the bust prevailed all around the world governments were forced to pick up the pieces and replace insufficient private demand in order to avoid another depression. The explosion of deficits and the growing national debts became the new normal. Before we start seeing the bust of nations and the default that accompanies them, we need to think hard about the need for Aisimnitia.

As we have written and publicly lectured before, and with all due respect to President Reagan, we believe that if it were not for Chairman Volcker the 1980s would have been a dismal decade. Therefore, times like these call for an Aisiminitis like Paul Volcker, who could command the respect of both sides of the Atlantic and who could bring into the global picture the necessary anchors and coordination that the credit mechanism is in need for.

Ode to the Aisimnitis!