The markets seem to be suffering from hyperkinetic activity generated from too much kudzu collateralization, securitization, credit overextension, and central banking intervention. This has resulted in impulsivity across credit markets and the result is a form of financial kudzu that could asphyxiate the markets. The weed known as kudzu can grow several inches overnight. It was introduced to North America in the late 1800s in order to prevent soil erosion. In the 1920s (the era of the roaring 20s) kudzu became the wonder plant. Books and clubs celebrating kudzu were proliferated. In the early 1930s the U.S. government paid workers to plant two million acres with kudzu. And then, the discovery was made: wherever kudzu grew all other plants died!

Kudzu was growing so fast that it was stealing the sunlight for the other plants to grow. By saving the soil, it was threatening the ecology. Since that discovery was made, the government has spent tens of millions of dollars trying to slow down or kill the spread of the kudzu. The killer plant still covers seven million acres of land.

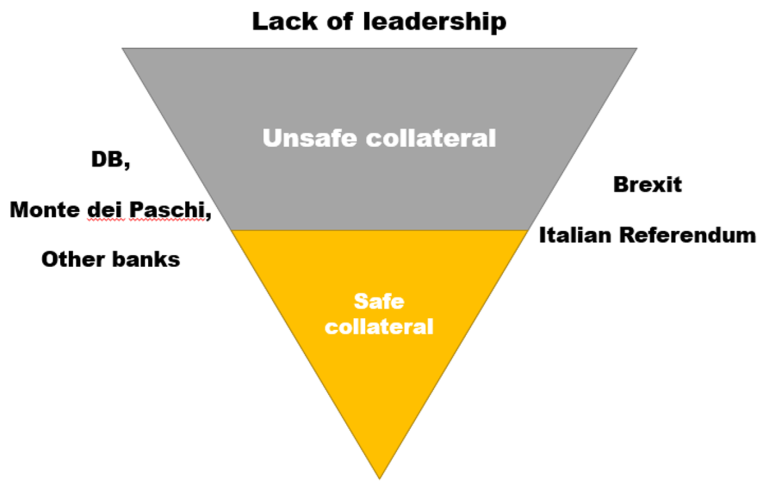

The EU faces an inverted kudzu pyramid which by default is unstable. The figure below portrays three main forces that make it unstable, namely: Lack of leadership; centrifugal forces such as Brexit and the forthcoming constitutional referendum in Italy; and a shaky banking sector.

The derivatives market is the financial kudzu that has been destabilizing the financial ecology. Deutsche Bank remains a leader in that market and its notional liabilities run in the trillions of dollars (DB has been a frequent topic in our commentaries due to its huge exposure to derivatives that make its finances shaky, and of course due to the bailouts it received from the Fed).

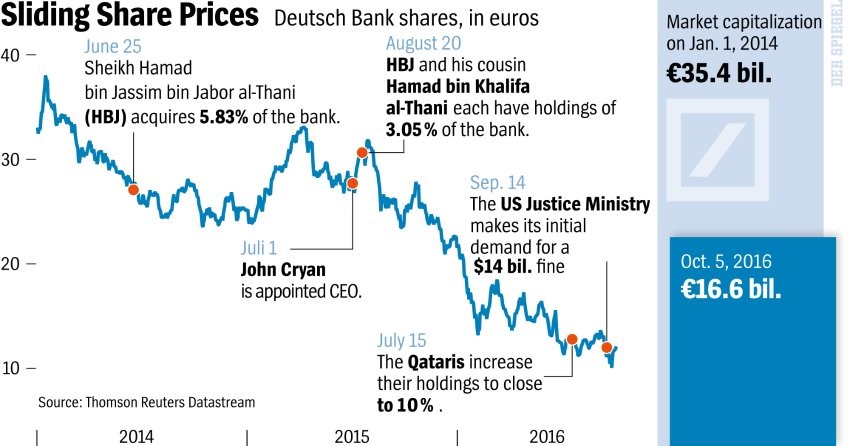

The graph below shows its share price since 2014 and its depleting capitalization as the Qataris contemplate increasing their share from 10 to 25% in order to provide another bailout, and DB is contemplating selling its asset management business in order to raise capital and entertain the existential threats it faces.

While DB tries to reassure the markets about its viability, Banca Monte dei Paschi’s shares continue falling as well as shown below (the bank is the oldest European financial institution and the third largest in Italy).

The EU rules require a bail-in procedure where bondholders will lose part of their capital investments, and if that does not suffice then savers will also lose part of their deposits. We have commented before on the cacophony produced by such bailout efforts in Italy and beyond, (see link below):

https://blacksummitfg.com/symphony-asset-management-caravaggio-meets-atlas-chameleon-age/

If such cacophony is accompanied by a rejection of the proposed constitutional amendments in the referendum planned for December 4th, then we could say that Brexit fears and the shakeup of the British pound will exacerbate throughout the Italian land and with little doubt throughout the land of the Eurocrats .

When central authorities plant kudzu, the financial equilibrium/ecology is disturbed. It takes years to undo the damage inflicted and sometimes the consequences could be dire. We only hope that investors take prudent steps in removing any kudzu from their portfolios.

Hyperkinesis and Financial Ecology: The EU and a Lesson from the Kudzu Weed

Author : John E. Charalambakis

Date : October 8, 2016

The markets seem to be suffering from hyperkinetic activity generated from too much kudzu collateralization, securitization, credit overextension, and central banking intervention. This has resulted in impulsivity across credit markets and the result is a form of financial kudzu that could asphyxiate the markets. The weed known as kudzu can grow several inches overnight. It was introduced to North America in the late 1800s in order to prevent soil erosion. In the 1920s (the era of the roaring 20s) kudzu became the wonder plant. Books and clubs celebrating kudzu were proliferated. In the early 1930s the U.S. government paid workers to plant two million acres with kudzu. And then, the discovery was made: wherever kudzu grew all other plants died!

Kudzu was growing so fast that it was stealing the sunlight for the other plants to grow. By saving the soil, it was threatening the ecology. Since that discovery was made, the government has spent tens of millions of dollars trying to slow down or kill the spread of the kudzu. The killer plant still covers seven million acres of land.

The EU faces an inverted kudzu pyramid which by default is unstable. The figure below portrays three main forces that make it unstable, namely: Lack of leadership; centrifugal forces such as Brexit and the forthcoming constitutional referendum in Italy; and a shaky banking sector.

The derivatives market is the financial kudzu that has been destabilizing the financial ecology. Deutsche Bank remains a leader in that market and its notional liabilities run in the trillions of dollars (DB has been a frequent topic in our commentaries due to its huge exposure to derivatives that make its finances shaky, and of course due to the bailouts it received from the Fed).

The graph below shows its share price since 2014 and its depleting capitalization as the Qataris contemplate increasing their share from 10 to 25% in order to provide another bailout, and DB is contemplating selling its asset management business in order to raise capital and entertain the existential threats it faces.

While DB tries to reassure the markets about its viability, Banca Monte dei Paschi’s shares continue falling as well as shown below (the bank is the oldest European financial institution and the third largest in Italy).

The EU rules require a bail-in procedure where bondholders will lose part of their capital investments, and if that does not suffice then savers will also lose part of their deposits. We have commented before on the cacophony produced by such bailout efforts in Italy and beyond, (see link below):

https://blacksummitfg.com/symphony-asset-management-caravaggio-meets-atlas-chameleon-age/

If such cacophony is accompanied by a rejection of the proposed constitutional amendments in the referendum planned for December 4th, then we could say that Brexit fears and the shakeup of the British pound will exacerbate throughout the Italian land and with little doubt throughout the land of the Eurocrats .

When central authorities plant kudzu, the financial equilibrium/ecology is disturbed. It takes years to undo the damage inflicted and sometimes the consequences could be dire. We only hope that investors take prudent steps in removing any kudzu from their portfolios.