China has been in the news again recently, and hence we would like to offer an update on our previous writings on the subject. However, before we do so, allow us first a few brief comments on gold and precious metals. We started selling a significant position of our clients’ holdings in precious metals on August 21. Our main concerns were as follows: First, we wanted to start taking profits. Second, we believe that parabolic increases are not sustainable and quite unhealthy. Third, it seems that that the tale (futures gold market) is wagging the dog (the real physical spot market). Fourth, the Chinese will soon start their own gold exchange called PAGE (Pan Asian Gold Exchange) that will be fully-backed, denominated in RMB, may dislocate gold sales, and may create some other side-effects. We actually, may recommend in the future investments in PAGE. Finally, we are becoming even more convinced that holding physical bullion is a better option where feasible.

Now, as for the Chinese performance, we shorted China in some portfolios and the graph below shows the results over the last few months.

At the same time, we invested in some portfolios in the Chinese currency (RMB), and the graph below shows the results.

Investing in the RMB is not exactly a hedging strategy. However, we believe that if China starts feeling significant tremors due to the slowdown of its exports (caused by the debt hangover in the West), it may allow a revaluation of the RMB in order to sustain growth in its internal markets. In addition, by allowing the strengthening of the RMB, the inflationary fears may recede. Furthermore, the Chinese desire to play a significant role in international monetary affairs which in combination of the PAGE (see above), necessitate the strengthening of the RMB. The upcoming power transition in 2012, also points to a potential upward trend in the RMB.

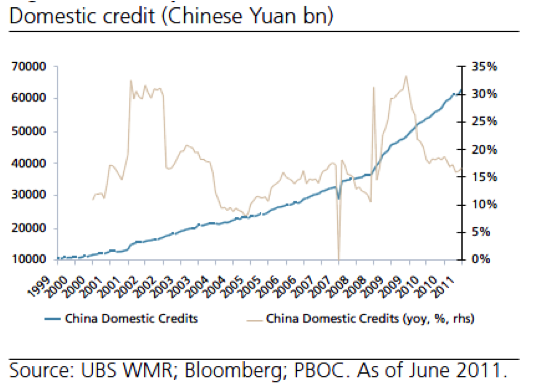

Yesterday, it was reported that the Chinese manufacturing Index fell to a 29-month low. The upcoming new tightening in Chinese credit (due to higher reserves) indicates a slowdown in their growth prospects. This tightening is necessary due to its unhealthy growth in the last several years (see figure below) and in order to avoid a hard landing and the disaster of inflation.

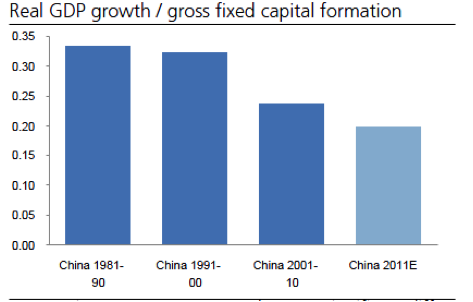

A major concern in China is that it takes more and more dollars every year in order to generate an increase of 1% in the GDP. This points to capital inefficiency (see figure below) and misallocations, and we all know what the final outcome of such a story will be.

Source: UBS

At the same time, in major Chinese banks such as the Bank of China, and ICBC bad loans grew on average by 35% in the last quarter. Furthermore, more than 60% of new bank loans were given to local governments for projects whose NPV is questionable and which is doubtful that they can generate positive cash flows. How would those loans be repaid?

Now, when we think of the Western debt hangover, the undercapitalized EU banks, and the Chinese wall of steroids, we also think of potential solutions in the name of inflation, mergers, and currency revaluation respectively.

Anyone said, sic transit Gloria mundi?

How the Mighty May Fall: On Chinese Tremors

Author : John E. Charalambakis

Date : September 2, 2011

China has been in the news again recently, and hence we would like to offer an update on our previous writings on the subject. However, before we do so, allow us first a few brief comments on gold and precious metals. We started selling a significant position of our clients’ holdings in precious metals on August 21. Our main concerns were as follows: First, we wanted to start taking profits. Second, we believe that parabolic increases are not sustainable and quite unhealthy. Third, it seems that that the tale (futures gold market) is wagging the dog (the real physical spot market). Fourth, the Chinese will soon start their own gold exchange called PAGE (Pan Asian Gold Exchange) that will be fully-backed, denominated in RMB, may dislocate gold sales, and may create some other side-effects. We actually, may recommend in the future investments in PAGE. Finally, we are becoming even more convinced that holding physical bullion is a better option where feasible.

Now, as for the Chinese performance, we shorted China in some portfolios and the graph below shows the results over the last few months.

At the same time, we invested in some portfolios in the Chinese currency (RMB), and the graph below shows the results.

Investing in the RMB is not exactly a hedging strategy. However, we believe that if China starts feeling significant tremors due to the slowdown of its exports (caused by the debt hangover in the West), it may allow a revaluation of the RMB in order to sustain growth in its internal markets. In addition, by allowing the strengthening of the RMB, the inflationary fears may recede. Furthermore, the Chinese desire to play a significant role in international monetary affairs which in combination of the PAGE (see above), necessitate the strengthening of the RMB. The upcoming power transition in 2012, also points to a potential upward trend in the RMB.

Yesterday, it was reported that the Chinese manufacturing Index fell to a 29-month low. The upcoming new tightening in Chinese credit (due to higher reserves) indicates a slowdown in their growth prospects. This tightening is necessary due to its unhealthy growth in the last several years (see figure below) and in order to avoid a hard landing and the disaster of inflation.

A major concern in China is that it takes more and more dollars every year in order to generate an increase of 1% in the GDP. This points to capital inefficiency (see figure below) and misallocations, and we all know what the final outcome of such a story will be.

Source: UBS

At the same time, in major Chinese banks such as the Bank of China, and ICBC bad loans grew on average by 35% in the last quarter. Furthermore, more than 60% of new bank loans were given to local governments for projects whose NPV is questionable and which is doubtful that they can generate positive cash flows. How would those loans be repaid?

Now, when we think of the Western debt hangover, the undercapitalized EU banks, and the Chinese wall of steroids, we also think of potential solutions in the name of inflation, mergers, and currency revaluation respectively.

Anyone said, sic transit Gloria mundi?