The second phase of the global economic crisis (fiscal and consequently sovereign debt) is rearing its ugly head again. News broke on Friday that the government of Ireland would stand behind Anglo Irish Bank with liquidity injections. The bailout of this too-big-to-fail bank will raise the Irish budget deficit to an absurd 32% for fiscal 2010, and this is not a joke.

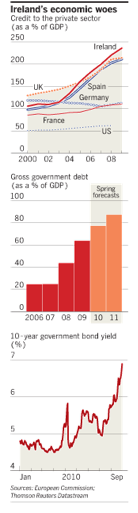

That may be the worst thing to Irish economic analysis is the vacuum through which many are examining this topic. Optimists point to the fact that the government hasn’t needed to go to the bond markets for financing yet as a positive indicator that Ireland will be OK. However, I don’t know what’s so exciting about having your sovereign bond rates jumping from 5% to 7% in the span of a month (and spreads over German debt at record levels) or pushing public debt levels to 99% of GDP. If you would like a second opinion ask HSBC, Hypo Real Estate, RBS, BNP Paribas, and Landesbank Baden-Württemberg (Germany’s largest public bank). All have significant exposure to Irish debt, with RBS’ exposure standing at over $4 billion. Do these analysts forget that Ireland’s GDP contracted in the second quarter of this year? Do they not remember Simon Johnson’s warning regarding the UK? Ireland has reached a point of crisis in confidence not just in the markets but in the domestic markets and population. Crafting policy is as much a game of confidence as it is prudence. The coming austerity proposal in December will be such a test of confidence for Ireland but the early indications is that the public’s appetite is limited.

That may be the worst thing to Irish economic analysis is the vacuum through which many are examining this topic. Optimists point to the fact that the government hasn’t needed to go to the bond markets for financing yet as a positive indicator that Ireland will be OK. However, I don’t know what’s so exciting about having your sovereign bond rates jumping from 5% to 7% in the span of a month (and spreads over German debt at record levels) or pushing public debt levels to 99% of GDP. If you would like a second opinion ask HSBC, Hypo Real Estate, RBS, BNP Paribas, and Landesbank Baden-Württemberg (Germany’s largest public bank). All have significant exposure to Irish debt, with RBS’ exposure standing at over $4 billion. Do these analysts forget that Ireland’s GDP contracted in the second quarter of this year? Do they not remember Simon Johnson’s warning regarding the UK? Ireland has reached a point of crisis in confidence not just in the markets but in the domestic markets and population. Crafting policy is as much a game of confidence as it is prudence. The coming austerity proposal in December will be such a test of confidence for Ireland but the early indications is that the public’s appetite is limited.

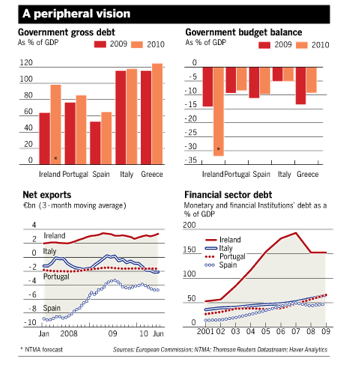

Exports account for 50% of Irish GDP. In the beginning of 2009 exports contracted by over 10% and the economy by 8% for the whole year. That’s without touching one of the lowest corporate tax rates in Europe, something that may be unsustainable and which would further hamper competitiveness. Ireland’s banks have received 15% of ECB funding. As we have pointed out in numerous commentaries and newsletters in the past, what’s coming for Europe over the next 24 months will make the continent long for 2009. Huge amounts of short-term debt will need to be rolled over in the rest of 2010 and up until 2012.Given that few European countries have an outlook in the near term resembling any form of growth, bond yields will spike.

The consequences are clear: banks’ balance sheets will take a hit, credit markets will tighten as the quality of assets will be scarce and deteriorated, the deficits will remain intact, and demand will take another hit (hence the importance of exports in Ireland). The Economist’s official stance is that Greece will default in 2012 (let’s not forget that the bailout package was an indirect admission of default). Moreover, the ECB will be forced to extend its emergency credit facilities later this year, which will intensify the pressures on starting the currency wars, where currencies will be devalued against hard assets and precious metals, as we have been saying for a long time now. While this will be praised throughout the economic community (with some merit), what’s overlooked is the excessive reliance on these mechanisms for the most of those dire economies. When the rumblings from Greece, Portugal, and Spain reappear, the vulnerable banks in France and Spain (which have been reliant on these credit lines in the past) will be scrambling for liquidity. Spain had its debt rating cut by Moody’s and announced that 2007 revenues won’t be matched for another 6 years. Portugal’s budget deficit is set to grow compared to last year.

The European economies, headlined by the periphery nations, are testing the patience of markets, labor forces, and various international institutions. These periodic spikes in insuring debt and refinancing costs, along with intermittent announcements from various finance ministers that new liquidity measures are needed put the various economies on thin ice.

But what may be just as crucial to Europe’s future isn’t just the markets will to swallow pain again, but the increasing scarcity of any notion of political fortitude to do anything. A few weeks ago EU meetings got derailed of their original agenda due to France’s deportation of the Roma population. In the spring of 2009 the EU was poised to proceed on economic stability measures while abandoning the East. EU ministers fumbled the Greek bailout situation before setting up a package for the continent as a whole. Austerity protests are handicapping the policy prospects’ of the EU leaders.

The inaction and apprehension on behalf of EU leaders is sending a clear message, even if it is inadvertent: a synergy of mentalities and goals is becoming divergent. In the context of a monetary union this paradigm is slowly killing two birds with one stone: the sustainability of the union and the prosperity of the nation.

We continue singing ode to hard assets!

Here we go again.

Author : John E. Charalambakis

Date : October 5, 2010

The second phase of the global economic crisis (fiscal and consequently sovereign debt) is rearing its ugly head again. News broke on Friday that the government of Ireland would stand behind Anglo Irish Bank with liquidity injections. The bailout of this too-big-to-fail bank will raise the Irish budget deficit to an absurd 32% for fiscal 2010, and this is not a joke.

Exports account for 50% of Irish GDP. In the beginning of 2009 exports contracted by over 10% and the economy by 8% for the whole year. That’s without touching one of the lowest corporate tax rates in Europe, something that may be unsustainable and which would further hamper competitiveness. Ireland’s banks have received 15% of ECB funding. As we have pointed out in numerous commentaries and newsletters in the past, what’s coming for Europe over the next 24 months will make the continent long for 2009. Huge amounts of short-term debt will need to be rolled over in the rest of 2010 and up until 2012.Given that few European countries have an outlook in the near term resembling any form of growth, bond yields will spike.

The consequences are clear: banks’ balance sheets will take a hit, credit markets will tighten as the quality of assets will be scarce and deteriorated, the deficits will remain intact, and demand will take another hit (hence the importance of exports in Ireland). The Economist’s official stance is that Greece will default in 2012 (let’s not forget that the bailout package was an indirect admission of default). Moreover, the ECB will be forced to extend its emergency credit facilities later this year, which will intensify the pressures on starting the currency wars, where currencies will be devalued against hard assets and precious metals, as we have been saying for a long time now. While this will be praised throughout the economic community (with some merit), what’s overlooked is the excessive reliance on these mechanisms for the most of those dire economies. When the rumblings from Greece, Portugal, and Spain reappear, the vulnerable banks in France and Spain (which have been reliant on these credit lines in the past) will be scrambling for liquidity. Spain had its debt rating cut by Moody’s and announced that 2007 revenues won’t be matched for another 6 years. Portugal’s budget deficit is set to grow compared to last year.

The European economies, headlined by the periphery nations, are testing the patience of markets, labor forces, and various international institutions. These periodic spikes in insuring debt and refinancing costs, along with intermittent announcements from various finance ministers that new liquidity measures are needed put the various economies on thin ice.

But what may be just as crucial to Europe’s future isn’t just the markets will to swallow pain again, but the increasing scarcity of any notion of political fortitude to do anything. A few weeks ago EU meetings got derailed of their original agenda due to France’s deportation of the Roma population. In the spring of 2009 the EU was poised to proceed on economic stability measures while abandoning the East. EU ministers fumbled the Greek bailout situation before setting up a package for the continent as a whole. Austerity protests are handicapping the policy prospects’ of the EU leaders.

The inaction and apprehension on behalf of EU leaders is sending a clear message, even if it is inadvertent: a synergy of mentalities and goals is becoming divergent. In the context of a monetary union this paradigm is slowly killing two birds with one stone: the sustainability of the union and the prosperity of the nation.

We continue singing ode to hard assets!