People are wondering these days: “Where is the stock market going?” Analysts look at charts, at P/E ratios, at profit margins and several other figures and try to make pronouncements as to the market’s direction. We think things might be a bit more complex than that. Our limited understanding of things is that the amount of cash available is insufficient to meet all the debt obligations. Hence, the market has to experience a major contraction in order to reduce the debt levels, unless the ultimate monetary authorities decide to dump a lot of cash in the market to meet those debt obligations, which of course will devalue currencies and paper holdings.

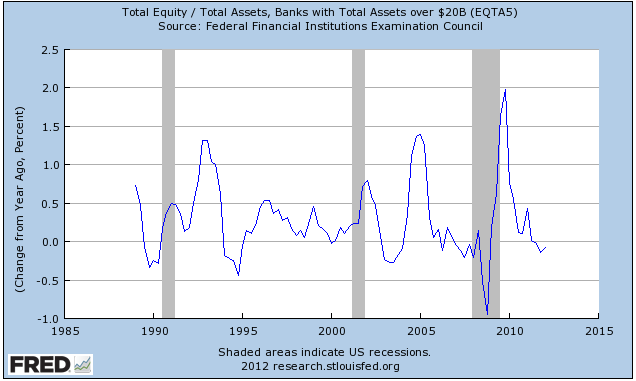

Our opinion is that we are reaching an inflection point for the banking sector, which cries for disintegration and the breakup of the big banks. The graph below shows that their overextension in terms of leverage is huge, to the point that their equity will evaporate with a mild shock.

The overleveraged economies will soon experience the turned off spigots of credit, and as that happens real interest rates will fall dramatically. That fall will be followed by a rush to safe havens. We believe that we shall see initially a flight to US dollars, to be followed by a flight to precious metals. If that comes to be true, then we will not be surprised if exponential gains are observed in the precious metals markets. The graph below shows that when real interest rates decline, gold prices experience more than significant gains.

In a global economy that unfortunately has taught the younger generations to call “assets” paper holdings that are nothing but third party liabilities, we humbly submit our cry:

Let the disintegration begin!

From Dreaming to Screaming: Strategic Disintegration Part V

Author : John E. Charalambakis

Date : July 12, 2012

People are wondering these days: “Where is the stock market going?” Analysts look at charts, at P/E ratios, at profit margins and several other figures and try to make pronouncements as to the market’s direction. We think things might be a bit more complex than that. Our limited understanding of things is that the amount of cash available is insufficient to meet all the debt obligations. Hence, the market has to experience a major contraction in order to reduce the debt levels, unless the ultimate monetary authorities decide to dump a lot of cash in the market to meet those debt obligations, which of course will devalue currencies and paper holdings.

Our opinion is that we are reaching an inflection point for the banking sector, which cries for disintegration and the breakup of the big banks. The graph below shows that their overextension in terms of leverage is huge, to the point that their equity will evaporate with a mild shock.

The overleveraged economies will soon experience the turned off spigots of credit, and as that happens real interest rates will fall dramatically. That fall will be followed by a rush to safe havens. We believe that we shall see initially a flight to US dollars, to be followed by a flight to precious metals. If that comes to be true, then we will not be surprised if exponential gains are observed in the precious metals markets. The graph below shows that when real interest rates decline, gold prices experience more than significant gains.

In a global economy that unfortunately has taught the younger generations to call “assets” paper holdings that are nothing but third party liabilities, we humbly submit our cry:

Let the disintegration begin!