It seems that we are on a ship, that has lost its anchor, left the port for a journey in uncharted waters, and we suddenly discovered that the gorilla we were carrying on the vessel is out of his cage. The only good news is that the ship’s name is not Titanic!

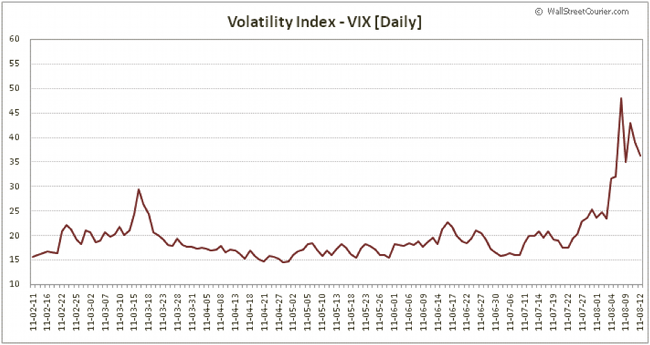

This past week exhibited schizophrenia, in terms of daily losses and gains, as demonstrated also by the market volatility shown below.

The turmoil and balkanization of the markets takes a form of uncertainty that is being shaped by fears of further downgrades of countries and major financial institutions, states’ shaky finances, streets’ riots from Israel to London, currency valuations, high unemployment, questionable future, leaderless political institutions in the EU, a debt overhang, and anesthetized assets that seems unable to be awaken to the calls for wealth creation.

In the EU officials decided to forbid short selling, given the significant declines in bank-stock shares. We will refer the reader to last week’s commentary that showed the hundreds of billions of Euros of unsecured financial debt that needs refinancing in 2011 as well as and in the next 2-3 years. We believe that this prohibition was another sign of confusion and of the band-aid measures when a deep surgery is needed.

In the US the most powerful financial institution on the planet (the Fed) pushed for further financial anesthetization by announcing that short-term interest rates will stay close to their zero level for the next two years. This pushed the yield of the ten-year note down to 2.24%. The result will be less income for those who depend on the returns of bonds, and these fixed-income downward pressures while enable the governments to refinance their debts at lower costs, at the same time repress returns and may destabilize markets via deflationary uncertainty, at a time when austerity measures are coming hard on the economies around the world.

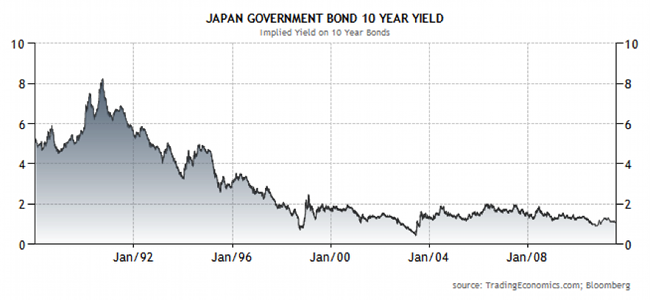

The graph below (yield on 10-year Treasuries) shows that this kind of financial repression – where pension plans and other institutional investors are paid very low and in several cases negative returns – has been tried before in the US, the UK, and of course in Japan, but has produce minimal – if any – positive result, in the most recent past where securitization and globalization forces shape outcomes more than domestic policies. Financial repression can indeed contribute to debt liquidation (via lower costs of servicing the debt in combination with moderate inflation), but cannot awake dormant assets.

The Japanese have tried this recipe which has contributed to stagnation for over two decades, as the following graph shows.

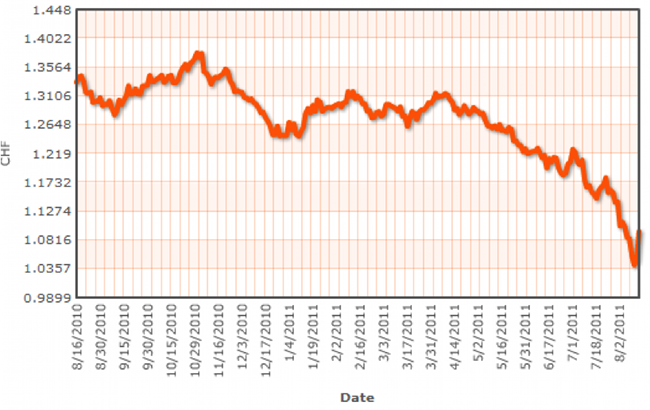

The near-zero returns of paper assets inject fear and cut aggregate demand. In addition, currency misalignments come at play in the funds’ journey for safety and possible higher yield. The former reduces profitability and growth prospects, while the latter will misallocate capital (see the Euro funds run to the Swiss Franc since last year, as the graph below demonstrates), and thus the combination of the two cannot revitalize other paper assets such as equities.

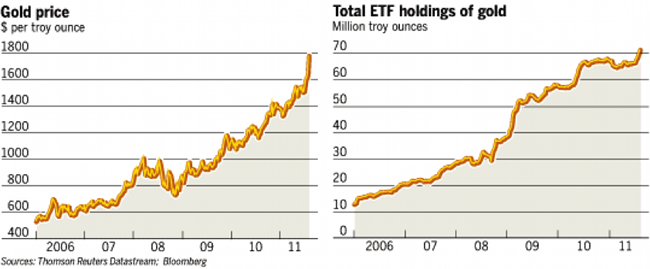

On the contrary demand for hard assets – see graph below – may rise which will exacerbate uncertainty and deflationary pressures while countries and institutional players deleverage their balance sheets.

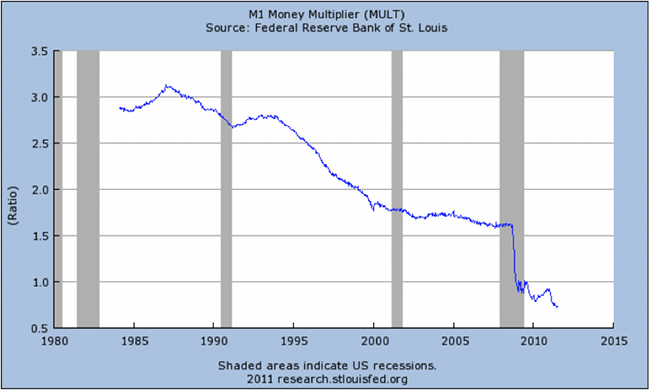

The economy seems that it needs a shot of inflationary expectations that will awake the deep-sleeping money multiplier, demonstrated in the following graph.

The recent purchases of Italian and Spanish bonds by the ECB, demonstrates that non-market players (i.e. central banks and GSEs) start dominating the bond markets, repressing returns, and nullifying in the process market dynamics since risk profiles are getting distorted. This distortion of risk profiles balkanizes returns, forces capital into non-productive uses and disallows a true market catharsis.

Macro-prudential regulation should aim not at repressing returns and/or guiding funds into particular paper assets that have no real-hard backing/collateral behind them, but rather at ensuring that growth prospects are real, which in turn enable money to be circulated in job creation mechanisms. The gorilla needs to be put back into his cage; the ship needs to find a safe port to return to, in order for an anchor to be built and the ship to start sailing in waters that await the passengers in order to reward them with exciting returns.

Ode to safe harbors!

P.S. Hint: If those safe ports cannot be found we better start building them.

From Anesthetization to Repression: On Market Balkanization, Part III

Author : John E. Charalambakis

Date : August 16, 2011

It seems that we are on a ship, that has lost its anchor, left the port for a journey in uncharted waters, and we suddenly discovered that the gorilla we were carrying on the vessel is out of his cage. The only good news is that the ship’s name is not Titanic!

This past week exhibited schizophrenia, in terms of daily losses and gains, as demonstrated also by the market volatility shown below.

The turmoil and balkanization of the markets takes a form of uncertainty that is being shaped by fears of further downgrades of countries and major financial institutions, states’ shaky finances, streets’ riots from Israel to London, currency valuations, high unemployment, questionable future, leaderless political institutions in the EU, a debt overhang, and anesthetized assets that seems unable to be awaken to the calls for wealth creation.

In the EU officials decided to forbid short selling, given the significant declines in bank-stock shares. We will refer the reader to last week’s commentary that showed the hundreds of billions of Euros of unsecured financial debt that needs refinancing in 2011 as well as and in the next 2-3 years. We believe that this prohibition was another sign of confusion and of the band-aid measures when a deep surgery is needed.

In the US the most powerful financial institution on the planet (the Fed) pushed for further financial anesthetization by announcing that short-term interest rates will stay close to their zero level for the next two years. This pushed the yield of the ten-year note down to 2.24%. The result will be less income for those who depend on the returns of bonds, and these fixed-income downward pressures while enable the governments to refinance their debts at lower costs, at the same time repress returns and may destabilize markets via deflationary uncertainty, at a time when austerity measures are coming hard on the economies around the world.

The graph below (yield on 10-year Treasuries) shows that this kind of financial repression – where pension plans and other institutional investors are paid very low and in several cases negative returns – has been tried before in the US, the UK, and of course in Japan, but has produce minimal – if any – positive result, in the most recent past where securitization and globalization forces shape outcomes more than domestic policies. Financial repression can indeed contribute to debt liquidation (via lower costs of servicing the debt in combination with moderate inflation), but cannot awake dormant assets.

The Japanese have tried this recipe which has contributed to stagnation for over two decades, as the following graph shows.

The near-zero returns of paper assets inject fear and cut aggregate demand. In addition, currency misalignments come at play in the funds’ journey for safety and possible higher yield. The former reduces profitability and growth prospects, while the latter will misallocate capital (see the Euro funds run to the Swiss Franc since last year, as the graph below demonstrates), and thus the combination of the two cannot revitalize other paper assets such as equities.

On the contrary demand for hard assets – see graph below – may rise which will exacerbate uncertainty and deflationary pressures while countries and institutional players deleverage their balance sheets.

The economy seems that it needs a shot of inflationary expectations that will awake the deep-sleeping money multiplier, demonstrated in the following graph.

The recent purchases of Italian and Spanish bonds by the ECB, demonstrates that non-market players (i.e. central banks and GSEs) start dominating the bond markets, repressing returns, and nullifying in the process market dynamics since risk profiles are getting distorted. This distortion of risk profiles balkanizes returns, forces capital into non-productive uses and disallows a true market catharsis.

Macro-prudential regulation should aim not at repressing returns and/or guiding funds into particular paper assets that have no real-hard backing/collateral behind them, but rather at ensuring that growth prospects are real, which in turn enable money to be circulated in job creation mechanisms. The gorilla needs to be put back into his cage; the ship needs to find a safe port to return to, in order for an anchor to be built and the ship to start sailing in waters that await the passengers in order to reward them with exciting returns.

Ode to safe harbors!

P.S. Hint: If those safe ports cannot be found we better start building them.