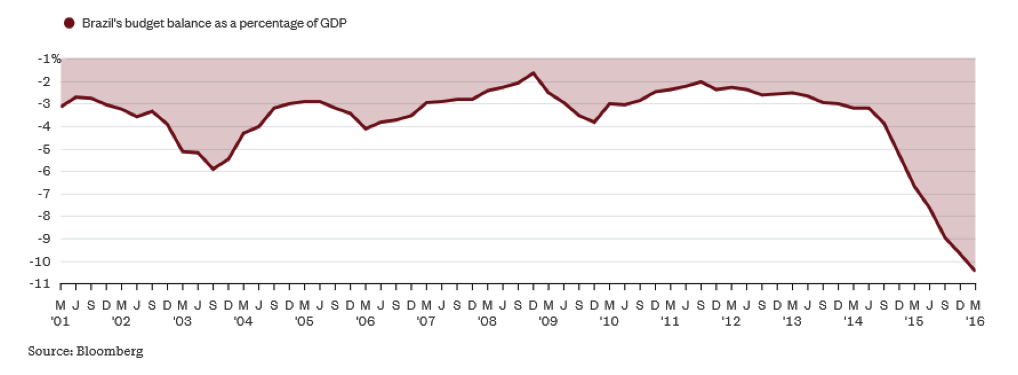

The external debt of developing economies has more than tripled in the last ten years. Brazil of all countries is selling notes to yield-hungry investors that mature in 2047! Where is the rationale to buy 2047 notes in a country whose current deficit exceeds 10% of its GDP, its total debt is over $670 billion, and its inflation rate is close to double digits?

The upcoming debt-repayment schedule for developing countries is very steep. Between now and 2018, close to $350 billion needs to be repaid. This is debt accumulated since 2010 and is close to 50% more than the debt that was payable in the last three years. Turkey, Brazil, and China are emerging as the most vulnerable countries. In situations like these banking crises are possible because when the flow of credit dries up, lending costs rise and refinancing becomes more difficult.

The upcoming debt-repayment schedule for developing countries is very steep. Between now and 2018, close to $350 billion needs to be repaid. This is debt accumulated since 2010 and is close to 50% more than the debt that was payable in the last three years. Turkey, Brazil, and China are emerging as the most vulnerable countries. In situations like these banking crises are possible because when the flow of credit dries up, lending costs rise and refinancing becomes more difficult.

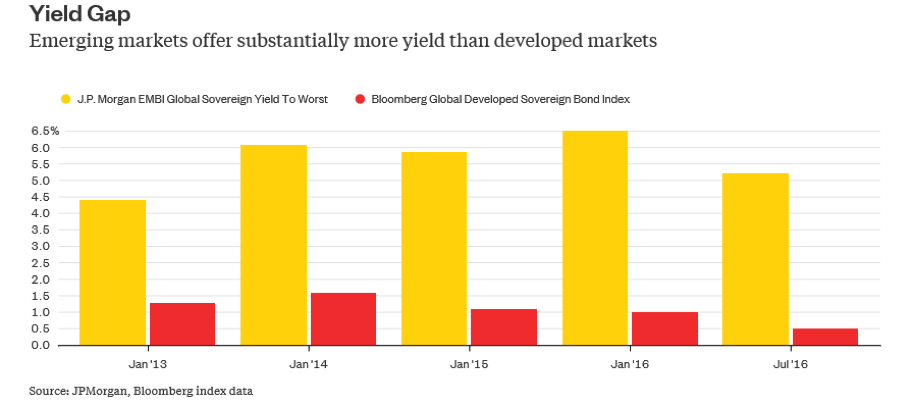

Investors who face financial repression in the West due to zero and negative rates seek higher yields in developing markets. The yield gap attracts capital to those markets, but when trouble starts brewing (due to a steep repayment schedule), then an inability to refinance existing debt may lead to a banking crisis. The situation is highly concerning because almost half of the emerging markets’ debt is in USD. Thus, if the dollar starts rising or if the dollar liquidity squeeze becomes worse, then a crisis may erupt. The graph below shows the yield gap that has distorted capital markets and flows and misallocated capital due to yield bias.

We should also note that a very significant portion of emerging market corporate debt is not even recorded in the corresponding balance sheets since it was raised offshore by affiliate companies. Liquidity generated in developed countries has been feeding a debt frenzy in developing countries which in turn stimulates yield-hungry investors.

We should also note that a very significant portion of emerging market corporate debt is not even recorded in the corresponding balance sheets since it was raised offshore by affiliate companies. Liquidity generated in developed countries has been feeding a debt frenzy in developing countries which in turn stimulates yield-hungry investors.

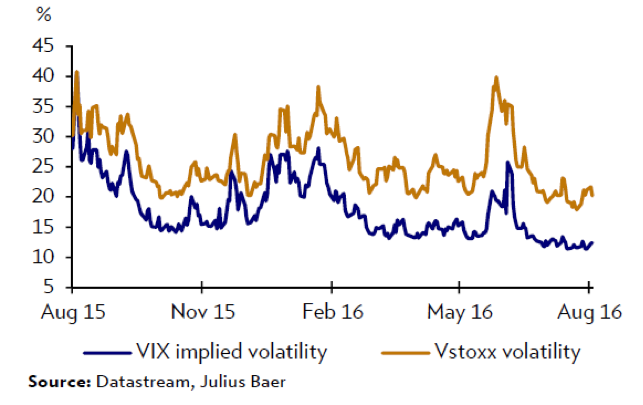

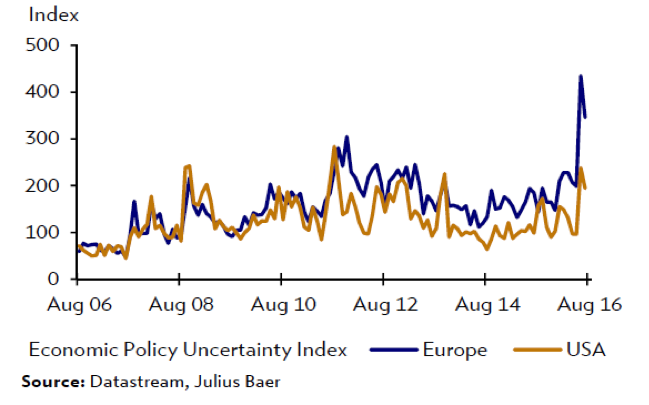

We are of the opinion that the extremely low volatility levels in combination with rising policy uncertainty (see related graphs below) signify the investors’ complacency and the possibility of market consolidation, especially if problems arise in developing countries.

In conclusion, we would say that in this unprecedented financial environment prudent portfolio anchoring and hedging is needed in order to avoid major pitfalls and corrections.

In conclusion, we would say that in this unprecedented financial environment prudent portfolio anchoring and hedging is needed in order to avoid major pitfalls and corrections.

Financial Stress, Valuations, and Realignment Risks: Is Uncertainty Looming?

Author : John E. Charalambakis

Date : August 29, 2016

The external debt of developing economies has more than tripled in the last ten years. Brazil of all countries is selling notes to yield-hungry investors that mature in 2047! Where is the rationale to buy 2047 notes in a country whose current deficit exceeds 10% of its GDP, its total debt is over $670 billion, and its inflation rate is close to double digits?

Investors who face financial repression in the West due to zero and negative rates seek higher yields in developing markets. The yield gap attracts capital to those markets, but when trouble starts brewing (due to a steep repayment schedule), then an inability to refinance existing debt may lead to a banking crisis. The situation is highly concerning because almost half of the emerging markets’ debt is in USD. Thus, if the dollar starts rising or if the dollar liquidity squeeze becomes worse, then a crisis may erupt. The graph below shows the yield gap that has distorted capital markets and flows and misallocated capital due to yield bias.

We are of the opinion that the extremely low volatility levels in combination with rising policy uncertainty (see related graphs below) signify the investors’ complacency and the possibility of market consolidation, especially if problems arise in developing countries.