Resilient and liquid financial markets are essential to keeping the global economy going. A decade ago payments systems and capital markets seized up almost everywhere and a year later the world was facing a financial and economic abyss. The magnification of credit facilities and the rehypothecation of paper assets make the global financial system prone to a crisis and subsequently the global economy vulnerable to significant vibrations. Once a crisis erupts, it tends to spread rapidly and violently everywhere. That’s the nature of an open global system where asset prices’ shrinking leads to credit contraction, rising fears, and confidence decline. In such situations, a solid claim on a debt instrument could turn toxic in a matter of days.

Of course, the same thing could happen when slowly but steadily unwise and non-prudent geopolitical decisions are made that shake up the international order. As we recently described, we are of the opinion that such shake-up is in the works, which in turn could generate the same effects as described above. If that were to happen, then traditional fiscal and monetary tools may be ineffective since the global system will be off balance. In such a case, the rules established by the Basel Committee and the Financial Stability Board (FSB) will become obsolete. Hence, while systematic efforts have been made to bolster the risk-absorbing capital reserves of financial institutions, the latter may experience an exogenous shock that can turn things upside down. Needless to say, under such circumstances the derivatives and repo markets will be in a shock and what on the surface appears as financial stability quickly could relive the financial instability hypothesis.

The paragraph above could be summarized as follows: We live in an epoch characterized by risk migration. In this epoch, we focus on minimizing the once-experienced risks, but we fail to see the major dangers (exogenous shocks) that may be waiting for us down the road, because of geopolitical misalignments. As those misalignments unfold the Thucydides Trap may take the upper hand in which case the twin-engine model may start experiencing serious problems.

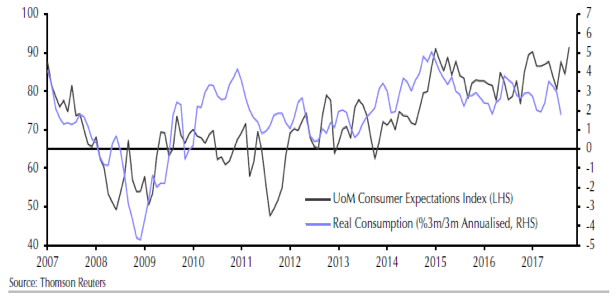

Our twin-engine model teaches us that consumption in the US and production in China mobilizes resources and capital, and the global engine moves forward. As the first graph below shows, consumer confidence in the US has been rising over the course of the last eight years and that upswing generates consumption and sales and uplifts profits. As the graph demonstrates, consumer confidence unexpectedly surged this month to levels not seen since 2004. Data tell us that the current level of consumer confidence reflects an annual growth rate in spending equivalent to 5%.

Consumer Confidence

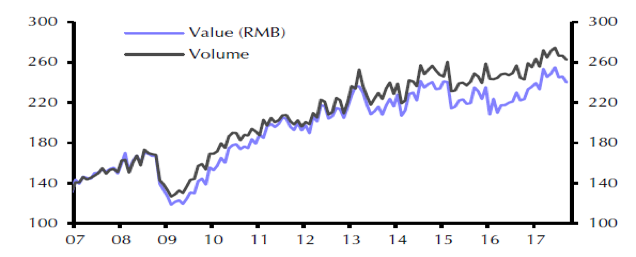

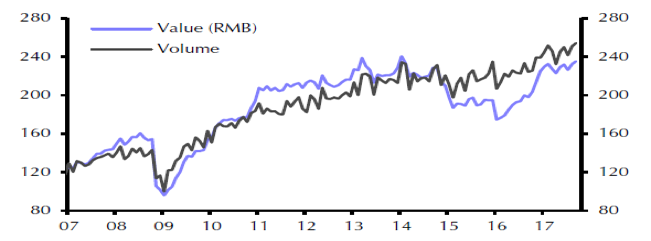

At the same time, and as the following two figures show, the second engine (Chinese exports and imports) still exhibit healthy vital signs.

Chinese Exports

Source: Capital Economics

Chinese Imports

Source: Capital Economics

Based on the above graphs we would say that on the surface the global financial and economic system holds up pretty well, and hence reasons for concerns (aside from the overvaluation of both equities and bonds) should not worry us so much.

I will let Cicero’s words serve as our concluding comment: “Endless money forms the sinews of war.”

Financial Stability and Business Cycle: Cicero on Risk Migration, Exogenous Shocks, and the Twin Engines

Author : John E. Charalambakis

Date : October 19, 2017

Resilient and liquid financial markets are essential to keeping the global economy going. A decade ago payments systems and capital markets seized up almost everywhere and a year later the world was facing a financial and economic abyss. The magnification of credit facilities and the rehypothecation of paper assets make the global financial system prone to a crisis and subsequently the global economy vulnerable to significant vibrations. Once a crisis erupts, it tends to spread rapidly and violently everywhere. That’s the nature of an open global system where asset prices’ shrinking leads to credit contraction, rising fears, and confidence decline. In such situations, a solid claim on a debt instrument could turn toxic in a matter of days.

Of course, the same thing could happen when slowly but steadily unwise and non-prudent geopolitical decisions are made that shake up the international order. As we recently described, we are of the opinion that such shake-up is in the works, which in turn could generate the same effects as described above. If that were to happen, then traditional fiscal and monetary tools may be ineffective since the global system will be off balance. In such a case, the rules established by the Basel Committee and the Financial Stability Board (FSB) will become obsolete. Hence, while systematic efforts have been made to bolster the risk-absorbing capital reserves of financial institutions, the latter may experience an exogenous shock that can turn things upside down. Needless to say, under such circumstances the derivatives and repo markets will be in a shock and what on the surface appears as financial stability quickly could relive the financial instability hypothesis.

The paragraph above could be summarized as follows: We live in an epoch characterized by risk migration. In this epoch, we focus on minimizing the once-experienced risks, but we fail to see the major dangers (exogenous shocks) that may be waiting for us down the road, because of geopolitical misalignments. As those misalignments unfold the Thucydides Trap may take the upper hand in which case the twin-engine model may start experiencing serious problems.

Our twin-engine model teaches us that consumption in the US and production in China mobilizes resources and capital, and the global engine moves forward. As the first graph below shows, consumer confidence in the US has been rising over the course of the last eight years and that upswing generates consumption and sales and uplifts profits. As the graph demonstrates, consumer confidence unexpectedly surged this month to levels not seen since 2004. Data tell us that the current level of consumer confidence reflects an annual growth rate in spending equivalent to 5%.

Consumer Confidence

At the same time, and as the following two figures show, the second engine (Chinese exports and imports) still exhibit healthy vital signs.

Chinese Exports

Source: Capital Economics

Chinese Imports

Source: Capital Economics

Based on the above graphs we would say that on the surface the global financial and economic system holds up pretty well, and hence reasons for concerns (aside from the overvaluation of both equities and bonds) should not worry us so much.

I will let Cicero’s words serve as our concluding comment: “Endless money forms the sinews of war.”