In his 1984 Shareholder Letter, Warren Buffett wrote: “The corpse is supposed to file the death certificate. Under this ‘honor system’ of mortality, the corpse sometimes gives itself the benefit of the doubt”. This is an example of a magnificent delusion unfortunately adopted by investors who jump on a bandwagon, whether telecoms (recall the MCI case where $80 billion of operating expenses were booked as capital expenditures), real estate, or derivatives.

The inability to account for risks and for the pertinent risk-adjusted returns also creates illusions regarding the bottom line as well as hidden dangers that undermine the prospects of companies and nations alike (think of the inability to account for healthcare and pension liabilities for the future). In this week’s commentary we chose to discuss indicators that signal rising financial distress.

When we look at traditional indicators for individual equities we cannot but mention Benjamin Graham’s fundamental signal which states that the debt/equity ratio should not be more than 50 percent: “own at least twice what they owe” as he put it. To that single indicator, we also need to add the coverage ratio (the higher the better, since it signifies the ability of the firm to meet debt obligations with the current year’s free cash flow from operations, defined as free cash flow divided by debt obligations), the retained earnings over total assets ratio (which shows whether growth is funded by debt, and hence the higher the ratio the better the company stands to experience net gains), or the total assets turnover ratio (which measures the sales generated by each dollar of assets). Of course, we could use a comprehensive measure like Altman’s Z-score, or a logistic regression model (a.k.a. binary model) that encompasses different characteristics/variables from cash flow, to earnings, and from market capitalization to the stock’s volatility and deviation from book value, in order to project the financial distress of stocks.

However, the problem with those measures (which are great and should be used) is that they project the financial distress of a security independently from the macroeconomic environment. The over-correlation of holdings (including international ones) with the general market index is a sign of dependency, and therefore a portfolio needs to have three elements that distinguish it but also advance its chances for capital preservation and growth. Those three elements in our opinion are:

- Uncorrelated holdings

- Hedging strategies that would limit potential downturns

- Anchoring the portfolio

Speaking of correlation we cannot but mention that the correlation of equities and bonds (including high yield bonds) in the post-crisis era exceeds 90%, which makes the case for uncorrelated assets even stronger. As for hedging, the traditional short/long strategies certainly need enhancement with new tools that can limit downward pressure and preserve capital. Regarding the anchoring of a portfolio (a subject of a forthcoming commentary), at this stage we could say that it should incorporate at least three elements, namely: avoiding catastrophic losses, enhancing overall intrinsic value of the portfolio, amd adding to the total long-term return of the investment corpus.

The fragility of the financial system is at the core of financial distress. That fragility is highly correlated with macroeconomic cycles and it also highlights debt liquidation. The return to a stable disequilibrium (see http://stage.blacksummitfg.com/3228) may require the liquidation of an over-indebtedness position while limiting the access to credit funds of higher risk profile companies (a.k.a. limited high yield options). As debt gets liquidated, monetary liabilities are contracted, and a slowdown in asset velocity is taking place. The latter may result in an economic slowdown while it could deteriorate market and business confidence.

When we look at recent signs of this macro-fragility/financial distress picture, we observe that well-known investment banks like Goldman Sachs and J.P. Morgan Chase “are struggling to sell $1.2 billion of loans backing the leverage buyout …” as the Wall Street Journal recently stated (see http://www.wsj.com/article_email/goldman-j-p-morgan-struggle-to-sell-loans-backing-a-buyout-1444157502-lMyQjAxMTI1NzEyNDgxMjQwWj) . Of course, the same thing happened in the spring of 2008 when Citibank tried to unload $12 billion of leveraged loans, offering them at deep discounts.

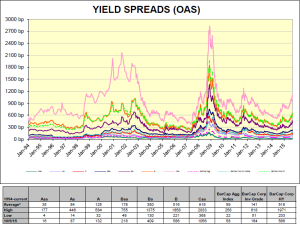

Moreover, when we look closely into the spreads (between high yield bonds and Treasury Notes or between investment grade bonds and Treasuries), we observe a picture of rising spreads that could signify overall rising distressed levels.

In conclusion, it is a good idea to identify the company-related distress levels (by employing one of the measures mentioned above), but it is also useful to observe the macro-distress level that has the potential of unraveling the whole market, in which case hedging and anchoring the portfolio becomes an issue of primary importance.

Financial Distress: Infatuations and Magnificent Illusions

Author : John E. Charalambakis

Date : October 14, 2015

In his 1984 Shareholder Letter, Warren Buffett wrote: “The corpse is supposed to file the death certificate. Under this ‘honor system’ of mortality, the corpse sometimes gives itself the benefit of the doubt”. This is an example of a magnificent delusion unfortunately adopted by investors who jump on a bandwagon, whether telecoms (recall the MCI case where $80 billion of operating expenses were booked as capital expenditures), real estate, or derivatives.

The inability to account for risks and for the pertinent risk-adjusted returns also creates illusions regarding the bottom line as well as hidden dangers that undermine the prospects of companies and nations alike (think of the inability to account for healthcare and pension liabilities for the future). In this week’s commentary we chose to discuss indicators that signal rising financial distress.

When we look at traditional indicators for individual equities we cannot but mention Benjamin Graham’s fundamental signal which states that the debt/equity ratio should not be more than 50 percent: “own at least twice what they owe” as he put it. To that single indicator, we also need to add the coverage ratio (the higher the better, since it signifies the ability of the firm to meet debt obligations with the current year’s free cash flow from operations, defined as free cash flow divided by debt obligations), the retained earnings over total assets ratio (which shows whether growth is funded by debt, and hence the higher the ratio the better the company stands to experience net gains), or the total assets turnover ratio (which measures the sales generated by each dollar of assets). Of course, we could use a comprehensive measure like Altman’s Z-score, or a logistic regression model (a.k.a. binary model) that encompasses different characteristics/variables from cash flow, to earnings, and from market capitalization to the stock’s volatility and deviation from book value, in order to project the financial distress of stocks.

However, the problem with those measures (which are great and should be used) is that they project the financial distress of a security independently from the macroeconomic environment. The over-correlation of holdings (including international ones) with the general market index is a sign of dependency, and therefore a portfolio needs to have three elements that distinguish it but also advance its chances for capital preservation and growth. Those three elements in our opinion are:

Speaking of correlation we cannot but mention that the correlation of equities and bonds (including high yield bonds) in the post-crisis era exceeds 90%, which makes the case for uncorrelated assets even stronger. As for hedging, the traditional short/long strategies certainly need enhancement with new tools that can limit downward pressure and preserve capital. Regarding the anchoring of a portfolio (a subject of a forthcoming commentary), at this stage we could say that it should incorporate at least three elements, namely: avoiding catastrophic losses, enhancing overall intrinsic value of the portfolio, amd adding to the total long-term return of the investment corpus.

The fragility of the financial system is at the core of financial distress. That fragility is highly correlated with macroeconomic cycles and it also highlights debt liquidation. The return to a stable disequilibrium (see http://stage.blacksummitfg.com/3228) may require the liquidation of an over-indebtedness position while limiting the access to credit funds of higher risk profile companies (a.k.a. limited high yield options). As debt gets liquidated, monetary liabilities are contracted, and a slowdown in asset velocity is taking place. The latter may result in an economic slowdown while it could deteriorate market and business confidence.

When we look at recent signs of this macro-fragility/financial distress picture, we observe that well-known investment banks like Goldman Sachs and J.P. Morgan Chase “are struggling to sell $1.2 billion of loans backing the leverage buyout …” as the Wall Street Journal recently stated (see http://www.wsj.com/article_email/goldman-j-p-morgan-struggle-to-sell-loans-backing-a-buyout-1444157502-lMyQjAxMTI1NzEyNDgxMjQwWj) . Of course, the same thing happened in the spring of 2008 when Citibank tried to unload $12 billion of leveraged loans, offering them at deep discounts.

Moreover, when we look closely into the spreads (between high yield bonds and Treasury Notes or between investment grade bonds and Treasuries), we observe a picture of rising spreads that could signify overall rising distressed levels.

In conclusion, it is a good idea to identify the company-related distress levels (by employing one of the measures mentioned above), but it is also useful to observe the macro-distress level that has the potential of unraveling the whole market, in which case hedging and anchoring the portfolio becomes an issue of primary importance.