In 1979, a movie came out starring Jack Lemmon, Jane Fonda, and Michael Douglas. The title of the movie was The China Syndrome. The movie – in the spirit of those days- desired to expose the consequences of a nuclear reactor going bad. It also dealt with the cover-ups related to the explosion.

It is our opinion that we are in for another kind of nuclear explosion, this time truly made in China. The explosion we are talking about might be the third – and hopefully last – phase of the current financial crisis. In our newsletter this month, which will be posted on this website by week’s end, we explore and discuss the causes of what might be an impending crisis, namely: credit, real estate, infrastructure, investment, and foreign reserves bubbles that have gone to stratospheric levels in China.

However, the Chinese case is unique. China is projected to be within 20-30 years the #1 economic power in the world. That will not be a new position for China. They’ve had the prize before. Moreover, China has achieved some truly impressive economic miracles in a short 30 year period. Even more importantly, China has tremendous assets all over the world. It positions herself not to antagonize American power, but to ride its coattails towards greater prosperity and influence. China has geostrategic objectives of trade agreements around the globe and she is positioned as the great naval power that will control major routes and ports. These facts point to a bright future when a new Silk Road that goes again through China and other developing countries will be operational and dynamic.

Thus, we believe that that our readers need to see the full picture of what might be unfolding. The present state (what we call Act I) of Chinese holdings and its prospects are based upon demographics, assets, trade agreements, as well as comparative strengths relative to a tired structure in the West.

Act II, is outlined in our September issue, where we contemplate a Chinese collapse.

Act III, on which our next commentary will be written, discusses the “Day After” the collapse. In the latter, we envision that the developing countries will be exhibiting a much greater role and influence, but at the same time, those who benefited from the third phase of the crisis will also be playing a very significant role.

Let the acts then unfold.

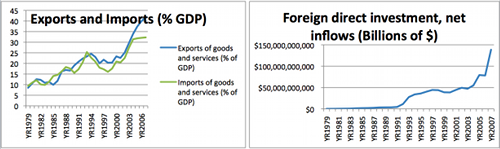

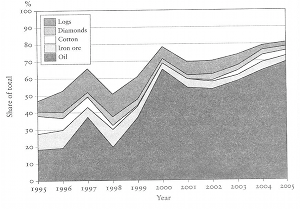

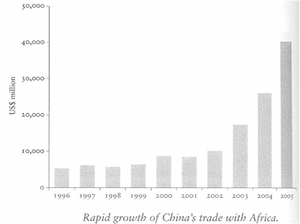

The 1990s saw China use their coastal regions as hubs for foreign capital seeking higher returns, lower costs, or diversification. China’s export oriented growth gave the country its role in the great drama of globalization. In exchange for exposure to international capital markets, massive investment, technological innovation, trade partners, and other resources, China would use its abundance of cheap labor to fuel the appetite for cheap goods while absorbing whatever financial engineers cooked up in terms of financial instruments – which potentially could be leveraged for credit creation – in addition to U.S. Treasury bonds. The result was a towering rate of growth which gave the Chinese regime political legitimacy on the back of its trade with the world. Thus maintaining high rates of growth became the chief interest of China’s political and economic officials leading to the pursuit of securing raw materials and other international resources. This dynamic need has brought China in contact with various parts of the globe only now as a sender of capital and resources instead of strictly a receiver. The following graphs from the World Bank shows that dynamic.

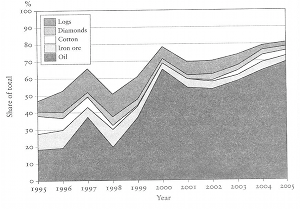

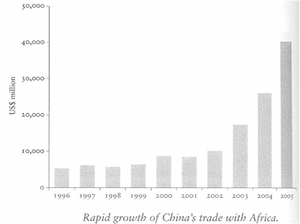

The most dramatic example of China’s external hunger is its relations with Africa, a continent long neglected by the international community but with a wealth of assets that China, and others, most desperately need. China’s involvement in Africa undermines Western aid and resources by not placing conditionality, such as adjusting trade policies, on African nations. In exchange for minerals, oil, and other resources (often extracted by Chinese companies) China constructs infrastructure, schools, hospitals and other institutions on top of monetary obligations for the commodities themselves.

The above two graphs that portray the Chinese involvement in Africa were taken from the book When China Rules the World by Martin Jaques.

The result of this Chinese-African collaboration has been an explosion of trade with Africa over the past 15 years. But China’s hunt for securing resources also spreads to the Middle East, Central Asia, and the Pacific where oil, natural gas, and other resources are known to exist. China thus has expanded its acquisition of vital strategic assets through foreign partnerships and participation in international organizations giving it access to a wealth of resources. This trend will only continue as China’s partners not only enjoy doing business with the rising giant but also China still has a ways to go to developing its enormous population.

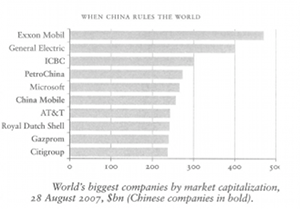

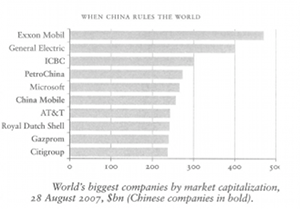

China will also play a dynamic role on the international stage thanks to its culture of high savings. A savings rate of 30% for a Chinese household is nothing out of the ordinary- compare that to the U.S. where the rate hit negative before the crisis. For a population of over 1 billion, high savings goes a long way and China has been putting it to use the past decade. Overseas investment from China grew on average at a rate of 60% per year from 2001-2006, a figure that’s truly unfathomable. By investing in overseas financial institutions,  tech companies, and other corporations China is covering its bases in a variety of sectors that any great power needs. In 2006, it passed Japan as the number two in R&D and of course just recently passed Japan as the # 2 economy. Its rise in supercomputers, also reported earlier this year, demonstrates China’s technological prowess as does its booming corporate identity.

tech companies, and other corporations China is covering its bases in a variety of sectors that any great power needs. In 2006, it passed Japan as the number two in R&D and of course just recently passed Japan as the # 2 economy. Its rise in supercomputers, also reported earlier this year, demonstrates China’s technological prowess as does its booming corporate identity.

And yet despite all this China is still very much a restrictive country. Its capital account and domestic markets are difficult to access. Its currency is grossly undervalued and isolated as a medium of exchange. Private individuals and entrepreneurs are shut off from credit and capital in favor of SOEs (state-owned enterprises) and urban strongholds. Bank deposits pay negative interest when accounted for inflation. Its rural provinces are still very poor and corruption is a growing problem.

Yet if the history of geopolitical shifts has proven anything it’s that crises create awareness and opportunities. The crisis of 2008 has brought a realization that an international financial system based upon the liquidity of a single currency/market can be prone to imbalances. The opportunity presented before China and the rest of the globe is the construction of a new economic regime with various buffers of liquidity tied to the collateralization of hard assets, assets which China has access.

The real question is: will China have to come to a state of awareness regarding its own internal issues?

Financial Crisis, Part III: This Time Made in China; Act I: The Day Before

Author : John E. Charalambakis

Date : August 30, 2010

In 1979, a movie came out starring Jack Lemmon, Jane Fonda, and Michael Douglas. The title of the movie was The China Syndrome. The movie – in the spirit of those days- desired to expose the consequences of a nuclear reactor going bad. It also dealt with the cover-ups related to the explosion.

It is our opinion that we are in for another kind of nuclear explosion, this time truly made in China. The explosion we are talking about might be the third – and hopefully last – phase of the current financial crisis. In our newsletter this month, which will be posted on this website by week’s end, we explore and discuss the causes of what might be an impending crisis, namely: credit, real estate, infrastructure, investment, and foreign reserves bubbles that have gone to stratospheric levels in China.

However, the Chinese case is unique. China is projected to be within 20-30 years the #1 economic power in the world. That will not be a new position for China. They’ve had the prize before. Moreover, China has achieved some truly impressive economic miracles in a short 30 year period. Even more importantly, China has tremendous assets all over the world. It positions herself not to antagonize American power, but to ride its coattails towards greater prosperity and influence. China has geostrategic objectives of trade agreements around the globe and she is positioned as the great naval power that will control major routes and ports. These facts point to a bright future when a new Silk Road that goes again through China and other developing countries will be operational and dynamic.

Thus, we believe that that our readers need to see the full picture of what might be unfolding. The present state (what we call Act I) of Chinese holdings and its prospects are based upon demographics, assets, trade agreements, as well as comparative strengths relative to a tired structure in the West.

Act II, is outlined in our September issue, where we contemplate a Chinese collapse.

Act III, on which our next commentary will be written, discusses the “Day After” the collapse. In the latter, we envision that the developing countries will be exhibiting a much greater role and influence, but at the same time, those who benefited from the third phase of the crisis will also be playing a very significant role.

Let the acts then unfold.

The 1990s saw China use their coastal regions as hubs for foreign capital seeking higher returns, lower costs, or diversification. China’s export oriented growth gave the country its role in the great drama of globalization. In exchange for exposure to international capital markets, massive investment, technological innovation, trade partners, and other resources, China would use its abundance of cheap labor to fuel the appetite for cheap goods while absorbing whatever financial engineers cooked up in terms of financial instruments – which potentially could be leveraged for credit creation – in addition to U.S. Treasury bonds. The result was a towering rate of growth which gave the Chinese regime political legitimacy on the back of its trade with the world. Thus maintaining high rates of growth became the chief interest of China’s political and economic officials leading to the pursuit of securing raw materials and other international resources. This dynamic need has brought China in contact with various parts of the globe only now as a sender of capital and resources instead of strictly a receiver. The following graphs from the World Bank shows that dynamic.

The most dramatic example of China’s external hunger is its relations with Africa, a continent long neglected by the international community but with a wealth of assets that China, and others, most desperately need. China’s involvement in Africa undermines Western aid and resources by not placing conditionality, such as adjusting trade policies, on African nations. In exchange for minerals, oil, and other resources (often extracted by Chinese companies) China constructs infrastructure, schools, hospitals and other institutions on top of monetary obligations for the commodities themselves.

The above two graphs that portray the Chinese involvement in Africa were taken from the book When China Rules the World by Martin Jaques.

The result of this Chinese-African collaboration has been an explosion of trade with Africa over the past 15 years. But China’s hunt for securing resources also spreads to the Middle East, Central Asia, and the Pacific where oil, natural gas, and other resources are known to exist. China thus has expanded its acquisition of vital strategic assets through foreign partnerships and participation in international organizations giving it access to a wealth of resources. This trend will only continue as China’s partners not only enjoy doing business with the rising giant but also China still has a ways to go to developing its enormous population.

China will also play a dynamic role on the international stage thanks to its culture of high savings. A savings rate of 30% for a Chinese household is nothing out of the ordinary- compare that to the U.S. where the rate hit negative before the crisis. For a population of over 1 billion, high savings goes a long way and China has been putting it to use the past decade. Overseas investment from China grew on average at a rate of 60% per year from 2001-2006, a figure that’s truly unfathomable. By investing in overseas financial institutions, tech companies, and other corporations China is covering its bases in a variety of sectors that any great power needs. In 2006, it passed Japan as the number two in R&D and of course just recently passed Japan as the # 2 economy. Its rise in supercomputers, also reported earlier this year, demonstrates China’s technological prowess as does its booming corporate identity.

tech companies, and other corporations China is covering its bases in a variety of sectors that any great power needs. In 2006, it passed Japan as the number two in R&D and of course just recently passed Japan as the # 2 economy. Its rise in supercomputers, also reported earlier this year, demonstrates China’s technological prowess as does its booming corporate identity.

And yet despite all this China is still very much a restrictive country. Its capital account and domestic markets are difficult to access. Its currency is grossly undervalued and isolated as a medium of exchange. Private individuals and entrepreneurs are shut off from credit and capital in favor of SOEs (state-owned enterprises) and urban strongholds. Bank deposits pay negative interest when accounted for inflation. Its rural provinces are still very poor and corruption is a growing problem.

Yet if the history of geopolitical shifts has proven anything it’s that crises create awareness and opportunities. The crisis of 2008 has brought a realization that an international financial system based upon the liquidity of a single currency/market can be prone to imbalances. The opportunity presented before China and the rest of the globe is the construction of a new economic regime with various buffers of liquidity tied to the collateralization of hard assets, assets which China has access.

The real question is: will China have to come to a state of awareness regarding its own internal issues?