There is a sense of a cyclical recovery around the world. The shocks of the last 8-10 years (financial crisis, EU debt crisis, commodities downturn) seem to be fading, and in their place we observe rising expectations regarding growth. The latest IMF report on the global economic outlook predicts higher growth and rising incomes, relative to our experiences in the last few years.

As confidence returns, a spirit of complacency and optimism has been taking the equity markets to high valuation levels, under the assumption that output gaps will be closing, and the economies will be going through a period of above average growth rate. However, such view ignores three – among others – basic facts: First, that the stock markets have been sustained by extraordinary monetary and unorthodox policies, some of which were designed with the mentality that monetary gravity forces can be suspended. The reality is that those policies are coming to an end and a return to more normal monetary policies is in the works.

Second, we have not experienced a recession and a market correction for quite some time, and this is abnormal. It’s nice to build each other up with stories of secular upswings, but reality says that on a long journey spares are needed, especially when productivity growth rates are not improving. Let’s not forget the glory days of Southeast Asia in the mid 1990s when on the surface things were looking great but the foundations were cracking due to lack of productivity growth.

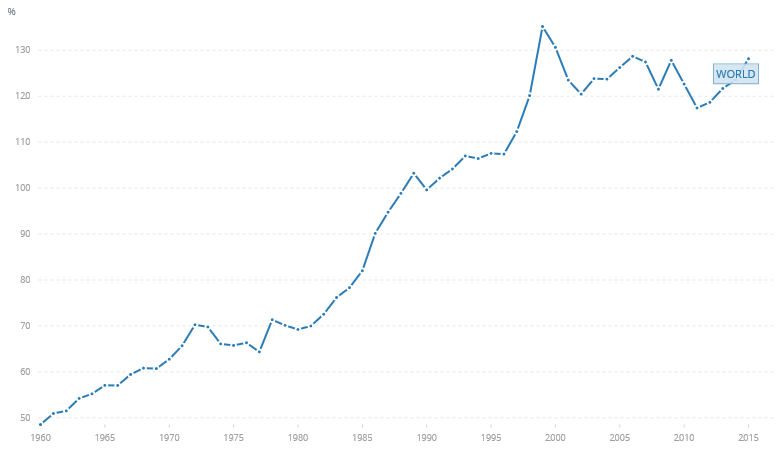

This brings us to the third and very vital issue, debt. When we look just at the total credit to the private sector – excluding the debts of governments which as we know are unsustainable – we observe as the figure below shows that again we have reached the high levels and percentage (as a fraction of the GDP) that we saw twice since the beginning of the 21st century.

The high debt levels in the private sector become an impediment to productivity growth and require more and more credit in order to service the debt. Moreover, these unsustainable debt levels that ignore unfunded government liabilities require cyclical buffers which unfortunately do not exist. The absence of those cyclical buffers – needed in case of a major downturn – will make the output gap (difference between potential and actual GDP) much wider in case of an unexpected shock. The latter can take the form of a declining trade volume, a breakdown in global trade cooperation, a conflict that points to a war, a set of disappointing earnings, not to mention a Chinese tremor, or a credit freeze that prohibits the rollover of debts.

So for the short term, the cyclical recovery that seems to be underway may support existing valuations which could go even higher, however unless productivity growth rate occurs, the ephemeral upswing could be just that, a temporary satisfaction that undermines long term sustainable growth, whose goal should also be debt reduction.

The Fading of Shocks and the Complacency Spirit: A Realistic Midterm/Longterm View

Author : John E. Charalambakis

Date : April 26, 2017

There is a sense of a cyclical recovery around the world. The shocks of the last 8-10 years (financial crisis, EU debt crisis, commodities downturn) seem to be fading, and in their place we observe rising expectations regarding growth. The latest IMF report on the global economic outlook predicts higher growth and rising incomes, relative to our experiences in the last few years.

As confidence returns, a spirit of complacency and optimism has been taking the equity markets to high valuation levels, under the assumption that output gaps will be closing, and the economies will be going through a period of above average growth rate. However, such view ignores three – among others – basic facts: First, that the stock markets have been sustained by extraordinary monetary and unorthodox policies, some of which were designed with the mentality that monetary gravity forces can be suspended. The reality is that those policies are coming to an end and a return to more normal monetary policies is in the works.

Second, we have not experienced a recession and a market correction for quite some time, and this is abnormal. It’s nice to build each other up with stories of secular upswings, but reality says that on a long journey spares are needed, especially when productivity growth rates are not improving. Let’s not forget the glory days of Southeast Asia in the mid 1990s when on the surface things were looking great but the foundations were cracking due to lack of productivity growth.

This brings us to the third and very vital issue, debt. When we look just at the total credit to the private sector – excluding the debts of governments which as we know are unsustainable – we observe as the figure below shows that again we have reached the high levels and percentage (as a fraction of the GDP) that we saw twice since the beginning of the 21st century.

The high debt levels in the private sector become an impediment to productivity growth and require more and more credit in order to service the debt. Moreover, these unsustainable debt levels that ignore unfunded government liabilities require cyclical buffers which unfortunately do not exist. The absence of those cyclical buffers – needed in case of a major downturn – will make the output gap (difference between potential and actual GDP) much wider in case of an unexpected shock. The latter can take the form of a declining trade volume, a breakdown in global trade cooperation, a conflict that points to a war, a set of disappointing earnings, not to mention a Chinese tremor, or a credit freeze that prohibits the rollover of debts.

So for the short term, the cyclical recovery that seems to be underway may support existing valuations which could go even higher, however unless productivity growth rate occurs, the ephemeral upswing could be just that, a temporary satisfaction that undermines long term sustainable growth, whose goal should also be debt reduction.