The purpose of this commentary is not to convey our outlook for 2015. That will be forthcoming in two parts in the next couple of weeks. Rather its purpose is to express some concerns regarding clouds that are gathering in the investment horizon and which are molded into our outlook for next year.

The existential disruptor (oil) I wrote about in my previous posting took frontline seating in the last several days, and has obviously caused collateral damage to the ruble, pushing the currency to all-time lows against the dollar, and which in turn forced the Russian Central Bank to raise rates to 17% overnight last week. The news from Russia is certainly not good. Russia is expected to suffer from a recession that could hit her GDP by as much as 4.5%. Russia may soon be in a full-blown crisis where its banks will suffer significantly. The question is what will happen to the French, Italian , British, and German banks that have exposure to the Russian banking sector.

My concerns however, are not limited to Russia. They extend to China and what has been called “The Great Wall of Steroids.” China has big bubbles in its real estate sector, its banks, its municipalities, while the lack of market transparency and market benchmarks, as well as its easy money policies will come back and haunt her in the foreseeable future.

At the same time, Greek politics are on a trajectory to become messy for several months. When I add to these existential market disruptors facts such as over-confident US consumers and investors, credit extensions (based on the Fed’s reverse repos), Draghi’s determination to inflict pleasure (that will end up being painful eventually) via quantitative easing measures, an Oceania depending on the Chinese bubble, Canadian real estate issues, Mexico’s politics, ISIS and its threat to Middle east stability (especially if it invades Lebanon and Jordan), and as the olive in this cocktail I also take into account the shaky EU banks, then the optimism that I retained until late last month regarding 2015, has started retreating.

The latest news on China is that cranes are becoming idle, and that all major cities are experiencing price declines in the real estate sector. Directly and indirectly Chinese real estate sector contributes about 30% to its economic activity. If that sector gets into deeper trouble, I anticipate banks to be affected that could start a domino effect in local financial markets.

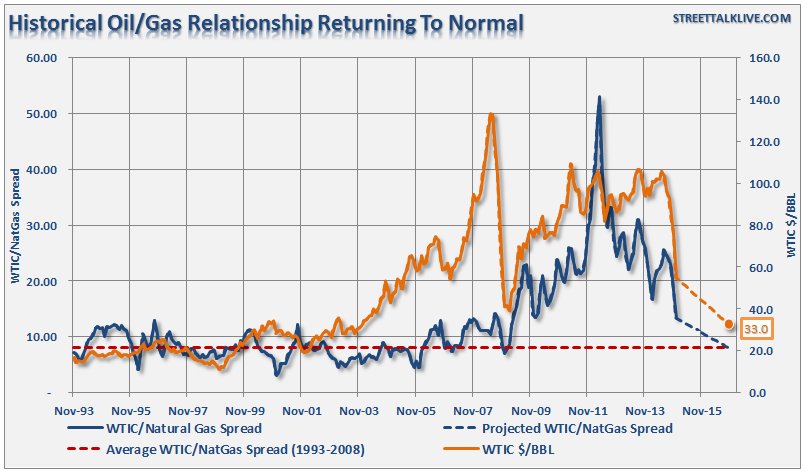

However, even if that does not take place in 2015 (eventually it will because all bubbles burst), the slowdown in Chinese economic activity will have effects around the world, including the energy markets which may see a ceiling in prices (not far from the current levels), while keeping down gas prices too, therefore making the historical price ratio between natural gas and oil a reality again, as shown below. If that takes place, then the circulation of petrodollars will suffer with the normal effects that such lower circulation has on global economic activity.

From there things may unravel rather quickly. The cheap loans (courtesy of central banks and the zero-bound policies) that financed the capital-intensive oil and gas sector may start becoming non-performing, forcing rates on junk bonds to much higher levels while causing shocks in the credit markets. Liquidity concerns will surface which will take credit markets to a temporary halt at a time when Greek politics will intensify to the point that Greece may be facing again cash shortfalls and people stash cash in their mattresses, raising concerns that its banks may suffer from runs similar to those seen in neighboring Bulgaria (also an EU member) last summer.

At that point rumors about deposits confiscation (similar to the one seen in Cyprus, which “is” another Eurozone country) in Greek banks for the sake of recapitalizing the banks may bring shock waves in the already shaky EU banks. The tremors in the EU banking sector will generate calls for liquidity injections at a time that EU banks try to figure out what will happen with the credit they have extended to Russian banks. The calls for liquidity will materialize and Mario Draghi finally will have an opportunity to demonstrate that he is no longer a day late and a Euro short. However, this time the reserves will be translated into real money supply (for the purpose also to fight the deflationary fears) with the result that the Euro will officially kick the currency games which the Chinese know to play well (let’s not forget that it was the Chinese devaluation of the yuan which kick-started the Asian crisis of the 1990s).

Welcome to the era of currency wars!

Should I be concerned then? For the most part I would like to retain the optimism I had about 2015, however the sample of the concerns expressed above naturally restrain such optimism.

Allow me to close with a few Christmas thoughts, as I usually do these days. This festive season may be clouded by other emotions that take center-stage. Tension, illnesses, relational turmoil, and stress have the tendency of stealing our joy. The magic of the humble manger comes into the picture and reminds us that an unwed mother in an atmosphere of self-righteous and legalistic crowds could have given up. After all, there was no room in the inn. She rather chose to focus on the prospects and the joy that the New Day her baby could inaugurate. It seems that she would rather choose her weak state of being rather than the strong hand of those who looked down on her. Somehow, she knew that majoring in the minors carries its own rewards where the victim emerges as the hero.

Merry Christmas

Existential Market Disruptors, Part II: Contemplating Credit and Currency Scenarios for 2015

Author : John E. Charalambakis

Date : December 23, 2014

The purpose of this commentary is not to convey our outlook for 2015. That will be forthcoming in two parts in the next couple of weeks. Rather its purpose is to express some concerns regarding clouds that are gathering in the investment horizon and which are molded into our outlook for next year.

The existential disruptor (oil) I wrote about in my previous posting took frontline seating in the last several days, and has obviously caused collateral damage to the ruble, pushing the currency to all-time lows against the dollar, and which in turn forced the Russian Central Bank to raise rates to 17% overnight last week. The news from Russia is certainly not good. Russia is expected to suffer from a recession that could hit her GDP by as much as 4.5%. Russia may soon be in a full-blown crisis where its banks will suffer significantly. The question is what will happen to the French, Italian , British, and German banks that have exposure to the Russian banking sector.

My concerns however, are not limited to Russia. They extend to China and what has been called “The Great Wall of Steroids.” China has big bubbles in its real estate sector, its banks, its municipalities, while the lack of market transparency and market benchmarks, as well as its easy money policies will come back and haunt her in the foreseeable future.

At the same time, Greek politics are on a trajectory to become messy for several months. When I add to these existential market disruptors facts such as over-confident US consumers and investors, credit extensions (based on the Fed’s reverse repos), Draghi’s determination to inflict pleasure (that will end up being painful eventually) via quantitative easing measures, an Oceania depending on the Chinese bubble, Canadian real estate issues, Mexico’s politics, ISIS and its threat to Middle east stability (especially if it invades Lebanon and Jordan), and as the olive in this cocktail I also take into account the shaky EU banks, then the optimism that I retained until late last month regarding 2015, has started retreating.

The latest news on China is that cranes are becoming idle, and that all major cities are experiencing price declines in the real estate sector. Directly and indirectly Chinese real estate sector contributes about 30% to its economic activity. If that sector gets into deeper trouble, I anticipate banks to be affected that could start a domino effect in local financial markets.

However, even if that does not take place in 2015 (eventually it will because all bubbles burst), the slowdown in Chinese economic activity will have effects around the world, including the energy markets which may see a ceiling in prices (not far from the current levels), while keeping down gas prices too, therefore making the historical price ratio between natural gas and oil a reality again, as shown below. If that takes place, then the circulation of petrodollars will suffer with the normal effects that such lower circulation has on global economic activity.

From there things may unravel rather quickly. The cheap loans (courtesy of central banks and the zero-bound policies) that financed the capital-intensive oil and gas sector may start becoming non-performing, forcing rates on junk bonds to much higher levels while causing shocks in the credit markets. Liquidity concerns will surface which will take credit markets to a temporary halt at a time when Greek politics will intensify to the point that Greece may be facing again cash shortfalls and people stash cash in their mattresses, raising concerns that its banks may suffer from runs similar to those seen in neighboring Bulgaria (also an EU member) last summer.

At that point rumors about deposits confiscation (similar to the one seen in Cyprus, which “is” another Eurozone country) in Greek banks for the sake of recapitalizing the banks may bring shock waves in the already shaky EU banks. The tremors in the EU banking sector will generate calls for liquidity injections at a time that EU banks try to figure out what will happen with the credit they have extended to Russian banks. The calls for liquidity will materialize and Mario Draghi finally will have an opportunity to demonstrate that he is no longer a day late and a Euro short. However, this time the reserves will be translated into real money supply (for the purpose also to fight the deflationary fears) with the result that the Euro will officially kick the currency games which the Chinese know to play well (let’s not forget that it was the Chinese devaluation of the yuan which kick-started the Asian crisis of the 1990s).

Welcome to the era of currency wars!

Should I be concerned then? For the most part I would like to retain the optimism I had about 2015, however the sample of the concerns expressed above naturally restrain such optimism.

Allow me to close with a few Christmas thoughts, as I usually do these days. This festive season may be clouded by other emotions that take center-stage. Tension, illnesses, relational turmoil, and stress have the tendency of stealing our joy. The magic of the humble manger comes into the picture and reminds us that an unwed mother in an atmosphere of self-righteous and legalistic crowds could have given up. After all, there was no room in the inn. She rather chose to focus on the prospects and the joy that the New Day her baby could inaugurate. It seems that she would rather choose her weak state of being rather than the strong hand of those who looked down on her. Somehow, she knew that majoring in the minors carries its own rewards where the victim emerges as the hero.

Merry Christmas