There are good chances that the EU – as we know it – may be headed towards its last tango, made in Berlin. It seems that the EU has lost its innocent anonymity and is disillusioned to the point of not just encouraging capital misallocation but rather losing its identity. Twenty years ago next month, the disintegration of the then Europe-wide ERM (Exchange Rate Mechanism) shook the markets just in time before the US election. The last tango – as any tango – requires a partner, and thus Berlin is searching for one. Chances are that the partner will be of Manchurian nature, trying to revitalize a dynasty that has served its purpose and its times.

The ERM’s objective was to limit currency risks. Back then, Berlin looked at her own self-interest and by insisting on high interest rates it deprived of capital other countries, while its interest rate policies imposed recessionary conditions on member states of the ERM. Out of the ashes of the ERM, the Euro was born. The convergence criteria for membership in the Eurozone were necessary but not sufficient for the long-term survival of the new currency. The destructive creation mass remained in the new currency’s DNA. It was just a matter of time until that mass obtained the necessary critical value in order to demonstrate again its destructive force. Lacking a common Treasury, a federal union, political cohesiveness and unity, a true central bank (in the sense of a lender of last resort whose ultimate fiduciary responsibility is financial stability), the critical mass was destined to be found much sooner than the usual time that it takes for fiat money to meet its maker.

The EU-wide banking system’s entropy was destined to follow a J curve. In the initial phases the ephemeral reduction in risks allowed debt accumulation by both the public and the private sector. The banking sector had plenty of partners to dance a variety of tango styles. Borrowing was cheap. The room to borrow was plentiful. The innocence of the debt culture was too young to reveal its ugly face. The party was an ongoing festival of prosperity bought on credit. This was the best of times, since things were going well. The J curve for the private was on its way down.

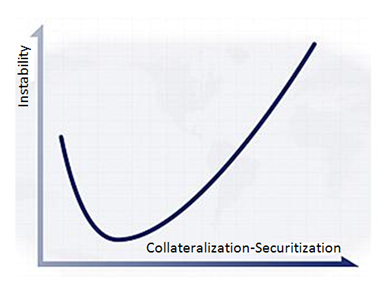

Financial “innovations” in the form of exotic synthetic instruments – that few understood their lethal makeup – allowed collateralization standards to be cheapened while the securitization process was able to identify fools who bought them, given the brand names affiliated with those instruments of mass deception. Ultimate regulators a.k.a. central bankers abdicated their role as guardians of financial stability. Celebratory times blinded institutional players and the temporary “successes” created a culture of vested interests with a political clientele basis addicted to credit. The hangover time was approaching.

As instability started rising, a realization which described that payback might be difficult was sinking in. The music was slowing and the tango participants slowed their pace too. The banks that orchestrated the show felt the first signs of the hangover. States that were protagonists in the in political expediency games start experiencing higher interest rates in refinancing their unsustainable debts. Their tango partners (i.e. the banks) who used to buy their paper (bonds) start feeling the squeeze. A decision to bailout the financial sector was thought to be a must. The rationale run like this: If banks collapse, the private sector will be unable to function. When the private sector cannot function, a myriad of non-performing loans will accumulate while unemployment will start its upward trend. As companies default banks would be unable to purchase government bonds, thus states may default. The entropy however, cannot be reversed, once it starts. Instability becomes inherent in this process and can only go up, and as it does the visible or invisible hand will exclude some states from refinancing their debts. It’s bailout time.

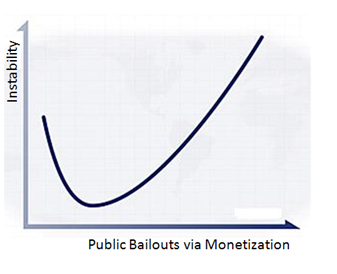

Hence, “solutions” were found in the establishment of mechanisms (such as the EFSF) and in the liquidity infusions by the ECB. Those “solutions” together amounted in the trillions of dollars. The unfortunate thing is that it was not realized that once you socialize the costs of the private sector eventually you transfer the risks in the public sector (via government implied guarantees, actual payments and higher deficits, and central banks balance sheet explosion), and ultimately instability will not be limited to those that generated the securitization process but now will be economy-wide and much higher. The figure below shows the public sector instability as public sector institutions monetized the debt of the private sector.

Therefore, the magnitude of the instability is multiplied. Temporarily, instability drops (as it has every time a bailout is announced, QE measures are implemented, bond-buying program takes effect, or liquidity assistance provisions are expanded), only to increase at a later time. We are reaching boiling point, where capital flight may create currency disequilibria.

We assume that central banks may still have room for expansion in their balance sheets therefore we might see again acts of that play where debt monetization infuses relief. We may even see measures that target debt mutualization, EU-wide banking insurance, etc. We wish those possible measures to succeed in inflating the debt away. The fear is that unless a form of controlled disintegration and debt moratorium/jubilee takes place (as we have been advocating from these commentaries for a few months now) then, the dues of the deus ex machina may be called in, in a form that is unknown at this point in time.

European Disintegration and the Mystery of Institutional Hangover: Living in the Times of Capital Flight

Author : John E. Charalambakis

Date : August 14, 2012

There are good chances that the EU – as we know it – may be headed towards its last tango, made in Berlin. It seems that the EU has lost its innocent anonymity and is disillusioned to the point of not just encouraging capital misallocation but rather losing its identity. Twenty years ago next month, the disintegration of the then Europe-wide ERM (Exchange Rate Mechanism) shook the markets just in time before the US election. The last tango – as any tango – requires a partner, and thus Berlin is searching for one. Chances are that the partner will be of Manchurian nature, trying to revitalize a dynasty that has served its purpose and its times.

The ERM’s objective was to limit currency risks. Back then, Berlin looked at her own self-interest and by insisting on high interest rates it deprived of capital other countries, while its interest rate policies imposed recessionary conditions on member states of the ERM. Out of the ashes of the ERM, the Euro was born. The convergence criteria for membership in the Eurozone were necessary but not sufficient for the long-term survival of the new currency. The destructive creation mass remained in the new currency’s DNA. It was just a matter of time until that mass obtained the necessary critical value in order to demonstrate again its destructive force. Lacking a common Treasury, a federal union, political cohesiveness and unity, a true central bank (in the sense of a lender of last resort whose ultimate fiduciary responsibility is financial stability), the critical mass was destined to be found much sooner than the usual time that it takes for fiat money to meet its maker.

The EU-wide banking system’s entropy was destined to follow a J curve. In the initial phases the ephemeral reduction in risks allowed debt accumulation by both the public and the private sector. The banking sector had plenty of partners to dance a variety of tango styles. Borrowing was cheap. The room to borrow was plentiful. The innocence of the debt culture was too young to reveal its ugly face. The party was an ongoing festival of prosperity bought on credit. This was the best of times, since things were going well. The J curve for the private was on its way down.

Financial “innovations” in the form of exotic synthetic instruments – that few understood their lethal makeup – allowed collateralization standards to be cheapened while the securitization process was able to identify fools who bought them, given the brand names affiliated with those instruments of mass deception. Ultimate regulators a.k.a. central bankers abdicated their role as guardians of financial stability. Celebratory times blinded institutional players and the temporary “successes” created a culture of vested interests with a political clientele basis addicted to credit. The hangover time was approaching.

As instability started rising, a realization which described that payback might be difficult was sinking in. The music was slowing and the tango participants slowed their pace too. The banks that orchestrated the show felt the first signs of the hangover. States that were protagonists in the in political expediency games start experiencing higher interest rates in refinancing their unsustainable debts. Their tango partners (i.e. the banks) who used to buy their paper (bonds) start feeling the squeeze. A decision to bailout the financial sector was thought to be a must. The rationale run like this: If banks collapse, the private sector will be unable to function. When the private sector cannot function, a myriad of non-performing loans will accumulate while unemployment will start its upward trend. As companies default banks would be unable to purchase government bonds, thus states may default. The entropy however, cannot be reversed, once it starts. Instability becomes inherent in this process and can only go up, and as it does the visible or invisible hand will exclude some states from refinancing their debts. It’s bailout time.

Hence, “solutions” were found in the establishment of mechanisms (such as the EFSF) and in the liquidity infusions by the ECB. Those “solutions” together amounted in the trillions of dollars. The unfortunate thing is that it was not realized that once you socialize the costs of the private sector eventually you transfer the risks in the public sector (via government implied guarantees, actual payments and higher deficits, and central banks balance sheet explosion), and ultimately instability will not be limited to those that generated the securitization process but now will be economy-wide and much higher. The figure below shows the public sector instability as public sector institutions monetized the debt of the private sector.

Therefore, the magnitude of the instability is multiplied. Temporarily, instability drops (as it has every time a bailout is announced, QE measures are implemented, bond-buying program takes effect, or liquidity assistance provisions are expanded), only to increase at a later time. We are reaching boiling point, where capital flight may create currency disequilibria.

We assume that central banks may still have room for expansion in their balance sheets therefore we might see again acts of that play where debt monetization infuses relief. We may even see measures that target debt mutualization, EU-wide banking insurance, etc. We wish those possible measures to succeed in inflating the debt away. The fear is that unless a form of controlled disintegration and debt moratorium/jubilee takes place (as we have been advocating from these commentaries for a few months now) then, the dues of the deus ex machina may be called in, in a form that is unknown at this point in time.