While the markets enjoy historic highs and particular sectors experienced rallies (such as financial and healthcare) one of the questions that investors may have is whether value can be found in EU equities. From a valuation standpoint EU equities could be seen as more attractive than US-based equities. However, such valuation measures do not count for the structural inefficiencies, political sclerosis, and significant economic and financial challenges that the EU is facing. When those are taken into consideration, then an over-valued thesis might be drafted, which in turn would imply an under-weight approach to EU equities.

In our opinion hubris uplifted a condescending attitude and behavior in the political and economic circles of the EU, which in turn created unsustainable expectations that were financed through debt. The result has been stagnation, over-regulation, unfunded liabilities, non-performing loans, financial institutions that look like zombies, and a population so tired of the existing status quo that seeks hope in non-conformist movements and parties. In a nutshell, the situation resembles the wings made out of wax that Icarus put on and flew too close to the sun.

Brexit is one of the symptoms of these developments which eventually and based on the outcomes of the forthcoming Italian referendum, as well as the Austrian, Dutch, and French elections may exacerbate an identity crisis for the EU that could unravel a tidal wave of uncertainty in the midst of policy changes under the Trump administration. The hubris exhibited by EU Eurocrats remind me of Bruegel’s painting known as “The Fall of Icarus”, as can be seen below.

Bruegel’s painting exemplifies the consequences of a rebellion against nature, the cosmos, God, and the natural order of things. Icarus did not heed his father’s warning and in his arrogance experienced a legendary fall. Bruegel invites us to think of the consequences when we push too much beyond the boundaries of the natural order. The painting renders Icarus as a ridiculous figure shown only with his two legs drowning into the sea. Life will continue after the drowning, just like the farmer and the shepherd continue on with their tasks. What impressed me the most in Bruegel’s painting is the stoic approach of both the farmer and the shepherd. They know better than the hubristic attitude of Icarus. They are enveloped by a bay with a wood, mountains, a harbor, and the sun setting on the horizon and while contemplating how the mighty have fallen, they focus on what is important, that is creating a living and capital for themselves given that Icarus has destroyed the endowment entrusted to him by his father.

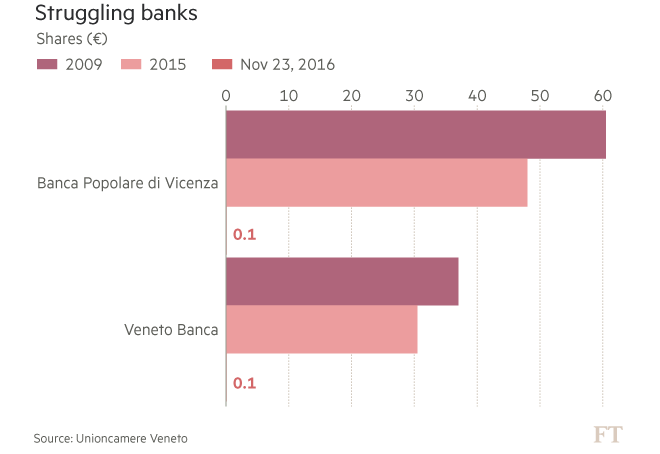

The Italian banking sector is undergoing through a major crisis. We have commented before about Banca Monte dei Paschi di Sienna. We should also add that other important banks in Italy (among others), such as Banca Popolare di Vicenza and Veneto Banca have recently failed. Both banks were linchpins of lending in the industrial heartland of Italy. However, the Eurocrats of ECB let them continue their hubristic lending which passed ECB’s stress tests. Here is how those mighty banks have fallen. Their share prices have dropped from €60 to about 10 cents for Vicenza and from €40 to also 10 cents for Veneto! Despite efforts to be bailed out, their failures are indicative of a bankrupt EU financial system whose hubris has created a pyramid where shareholders have used bank shares as collateral for more loans that were partially used to buy illiquid synthetic financial products which are now worthless. Of course the loans – whether used for such illiquid instruments or other purposes – are now non-performing.

The dam’s bursting in the Veneto region swept away many villages and the catastrophe is legendary. The investors (100,000 of them) in the two banks have lost over €5 billion. The Italian banking system suffers from over €350 billion of bad loans.

The postman will be approaching soon and my fear is that as he rings the bell, he may discover that he is facing not just issues of illiquidity but rather issues of solvency created by hubristic behavior by those who thought that natural laws are obsolete.

European Developments Meet Bruegel: The Icarus Effect

Author : John E. Charalambakis

Date : November 24, 2016

While the markets enjoy historic highs and particular sectors experienced rallies (such as financial and healthcare) one of the questions that investors may have is whether value can be found in EU equities. From a valuation standpoint EU equities could be seen as more attractive than US-based equities. However, such valuation measures do not count for the structural inefficiencies, political sclerosis, and significant economic and financial challenges that the EU is facing. When those are taken into consideration, then an over-valued thesis might be drafted, which in turn would imply an under-weight approach to EU equities.

In our opinion hubris uplifted a condescending attitude and behavior in the political and economic circles of the EU, which in turn created unsustainable expectations that were financed through debt. The result has been stagnation, over-regulation, unfunded liabilities, non-performing loans, financial institutions that look like zombies, and a population so tired of the existing status quo that seeks hope in non-conformist movements and parties. In a nutshell, the situation resembles the wings made out of wax that Icarus put on and flew too close to the sun.

Brexit is one of the symptoms of these developments which eventually and based on the outcomes of the forthcoming Italian referendum, as well as the Austrian, Dutch, and French elections may exacerbate an identity crisis for the EU that could unravel a tidal wave of uncertainty in the midst of policy changes under the Trump administration. The hubris exhibited by EU Eurocrats remind me of Bruegel’s painting known as “The Fall of Icarus”, as can be seen below.

Bruegel’s painting exemplifies the consequences of a rebellion against nature, the cosmos, God, and the natural order of things. Icarus did not heed his father’s warning and in his arrogance experienced a legendary fall. Bruegel invites us to think of the consequences when we push too much beyond the boundaries of the natural order. The painting renders Icarus as a ridiculous figure shown only with his two legs drowning into the sea. Life will continue after the drowning, just like the farmer and the shepherd continue on with their tasks. What impressed me the most in Bruegel’s painting is the stoic approach of both the farmer and the shepherd. They know better than the hubristic attitude of Icarus. They are enveloped by a bay with a wood, mountains, a harbor, and the sun setting on the horizon and while contemplating how the mighty have fallen, they focus on what is important, that is creating a living and capital for themselves given that Icarus has destroyed the endowment entrusted to him by his father.

The Italian banking sector is undergoing through a major crisis. We have commented before about Banca Monte dei Paschi di Sienna. We should also add that other important banks in Italy (among others), such as Banca Popolare di Vicenza and Veneto Banca have recently failed. Both banks were linchpins of lending in the industrial heartland of Italy. However, the Eurocrats of ECB let them continue their hubristic lending which passed ECB’s stress tests. Here is how those mighty banks have fallen. Their share prices have dropped from €60 to about 10 cents for Vicenza and from €40 to also 10 cents for Veneto! Despite efforts to be bailed out, their failures are indicative of a bankrupt EU financial system whose hubris has created a pyramid where shareholders have used bank shares as collateral for more loans that were partially used to buy illiquid synthetic financial products which are now worthless. Of course the loans – whether used for such illiquid instruments or other purposes – are now non-performing.

The dam’s bursting in the Veneto region swept away many villages and the catastrophe is legendary. The investors (100,000 of them) in the two banks have lost over €5 billion. The Italian banking system suffers from over €350 billion of bad loans.

The postman will be approaching soon and my fear is that as he rings the bell, he may discover that he is facing not just issues of illiquidity but rather issues of solvency created by hubristic behavior by those who thought that natural laws are obsolete.