About two weeks ago, we were assured by the government in Spain that they only needed about €50 billion for their banks. All of a sudden the €50 billion became €100 billion and we are still counting. Welcome to the new math where besides addition through subtraction via extreme austerity measures that lack rationale and growth prospects, 50 equals 100 in the minds of unelected Euro bureaucrats. In the meantime the bankrupt banking system in the EU periphery (a symptom of the EU-wide shaky financial system) survives only due to the cash infusions from the ELA program of the ECB.

The ELA program lacks transparency but four things are certain: First, banks that tap the program have no more “good” collateral to pledge (of course we need to recall that by “good” we mean pledging third-party liabilities a.k.a. bonds, hence “good” is a relative term), and thus they would already have gone bust unless it was for ELA. Second, the obligations borne are carried by the local central banks. Third, if a country leaves the Euro zone, then the local central bank will be unable to meet its Euro obligations, which translates that other central banks will bear the burden and ultimately the ECB will be the one on the hook for those unpaid liabilities of the local central banks. Fourth, when the system’s nakedness is exposed a run on the banks would be the normal effect.

In the meantime, in elections such as in Greece fear mongering runs amok. Idiotic dilemmas are presented to the electorate, such as staying in the Euro or leaving the Euro. The Euro zone is sinking deep in the abyss and some maestros insist that the orchestra should keep playing! The numbers simply do not add up and it is our humble opinion that no matter who is elected the trend to return to national currencies would be very difficult to be reversed. Therefore, the electorate is treated one more time as useful idiots.

The solutions proposed range from Euro-wide banking union, to mutualization of debt a.k.a. Eurobonds, to a growth pact via special purpose bonds. Needless to say that none of those proposals creates wealth or is capable to extract value out of dormant resources i.e. to create capital which in turn creates jobs, incomes and prosperity. On the contrary via mechanisms that celebrate a debt culture, the proposals will continue enslaving future generations of youngsters and destroy wealth and human capital.

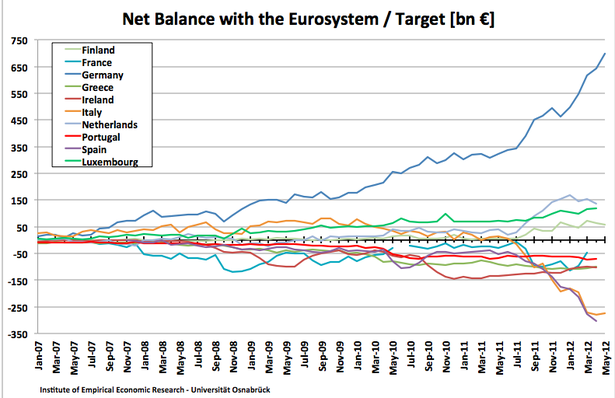

The lack of real hard assets that can be collateralized and the appetite for unqualified leverage via re-hypothecation of paper assets has convoluted the credit mechanism of the Eurosystem, with the result being imbalances that would be very difficult if not impossible to fix. The figure below, portrays those imbalances. It is clear to us that since last fall the system has broke down and possibly only through a controlled disintegration of the whole Euro project the worst can be avoided.

A controlled disintegration of the Euro project would have started with a monetary anchor that would guide credit creation, and would have continued with breaking apart the top banks that caused the crisis, while advancing value and wealth creation by awakening dormant assets.

The shrinking EU peripheral economies, the higher yields and spreads on their bonds, the very high levels of unemployment, the political stubbornness of some, the general lack of vision and asset-based action, and the fixation on fiat money that destabilize the system do have the potential of derailing the global economy.

Time is running out for a controlled disintegration that will enforce balances and will honor sustain hope.

Emergency Liquidity Assistance (ELA) and Financial Tremors: Useful Idiots Part III

Author : John E. Charalambakis

Date : June 16, 2012

About two weeks ago, we were assured by the government in Spain that they only needed about €50 billion for their banks. All of a sudden the €50 billion became €100 billion and we are still counting. Welcome to the new math where besides addition through subtraction via extreme austerity measures that lack rationale and growth prospects, 50 equals 100 in the minds of unelected Euro bureaucrats. In the meantime the bankrupt banking system in the EU periphery (a symptom of the EU-wide shaky financial system) survives only due to the cash infusions from the ELA program of the ECB.

The ELA program lacks transparency but four things are certain: First, banks that tap the program have no more “good” collateral to pledge (of course we need to recall that by “good” we mean pledging third-party liabilities a.k.a. bonds, hence “good” is a relative term), and thus they would already have gone bust unless it was for ELA. Second, the obligations borne are carried by the local central banks. Third, if a country leaves the Euro zone, then the local central bank will be unable to meet its Euro obligations, which translates that other central banks will bear the burden and ultimately the ECB will be the one on the hook for those unpaid liabilities of the local central banks. Fourth, when the system’s nakedness is exposed a run on the banks would be the normal effect.

In the meantime, in elections such as in Greece fear mongering runs amok. Idiotic dilemmas are presented to the electorate, such as staying in the Euro or leaving the Euro. The Euro zone is sinking deep in the abyss and some maestros insist that the orchestra should keep playing! The numbers simply do not add up and it is our humble opinion that no matter who is elected the trend to return to national currencies would be very difficult to be reversed. Therefore, the electorate is treated one more time as useful idiots.

The solutions proposed range from Euro-wide banking union, to mutualization of debt a.k.a. Eurobonds, to a growth pact via special purpose bonds. Needless to say that none of those proposals creates wealth or is capable to extract value out of dormant resources i.e. to create capital which in turn creates jobs, incomes and prosperity. On the contrary via mechanisms that celebrate a debt culture, the proposals will continue enslaving future generations of youngsters and destroy wealth and human capital.

The lack of real hard assets that can be collateralized and the appetite for unqualified leverage via re-hypothecation of paper assets has convoluted the credit mechanism of the Eurosystem, with the result being imbalances that would be very difficult if not impossible to fix. The figure below, portrays those imbalances. It is clear to us that since last fall the system has broke down and possibly only through a controlled disintegration of the whole Euro project the worst can be avoided.

A controlled disintegration of the Euro project would have started with a monetary anchor that would guide credit creation, and would have continued with breaking apart the top banks that caused the crisis, while advancing value and wealth creation by awakening dormant assets.

The shrinking EU peripheral economies, the higher yields and spreads on their bonds, the very high levels of unemployment, the political stubbornness of some, the general lack of vision and asset-based action, and the fixation on fiat money that destabilize the system do have the potential of derailing the global economy.

Time is running out for a controlled disintegration that will enforce balances and will honor sustain hope.