Cicero is famous for several things, among which is the “Dum Spiro Spero” quote, implying that hope dies last. For weeks now, my colleagues and I have been contemplating drafting an internal portfolio strategy-index.

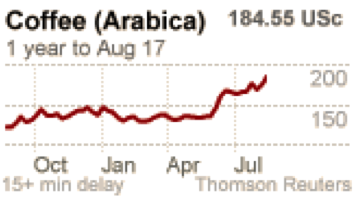

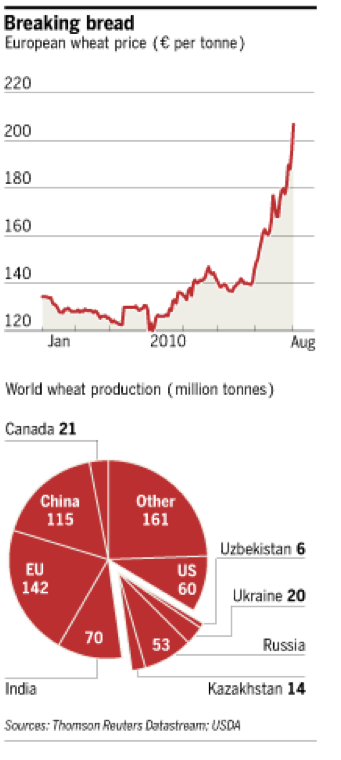

In the land of dismal growth where deflation knocks at the door, the markets are shaken by uncertainty and going sideways while some commodities are experiencing a resurgence. Wheat prices have increased by over 50% since early June. The ratio of stockpiles to consumption for sugar dropped to its lowest level for that last two decades. Coffee prices are risin, too. The following graphs of wheat and coffee tell the story of the upward trends.

Cocoa prices have reached a 33-year peak. Barry Callebaut’s CEO – the chocolatier supplying many top food outlets – was quoted recently stating that supply driven reasons are the main cause for the price increases. This has forced Armajaro, the London-based hedge fund, to take delivery of the biggest amount of physical cocoa since 1995, triggering complaints by cocoa processors.

Cocoa prices have reached a 33-year peak. Barry Callebaut’s CEO – the chocolatier supplying many top food outlets – was quoted recently stating that supply driven reasons are the main cause for the price increases. This has forced Armajaro, the London-based hedge fund, to take delivery of the biggest amount of physical cocoa since 1995, triggering complaints by cocoa processors.

Why would a hedge fund take physical delivery of cocoa? Does it tell us anything about the future of commodities? Last Thursday, we wrote about catharsis. We believe it is needed in order to cleanse the economic system’s arteries. We are of the opinion that such catharsis will be the next phase of the crisis, and we hope – Dum Spiro Spero – it will be the last phase. In an environment surrounded by the uncertainties that we have described over the course of several months, a portion of our portfolio strategy has to have a mixture of defensive measures, as well as offensive ones. A hybrid of measures will include steps taken that will enhance the portfolio and prepare it for the new era.

We will be writing a commentary soon on such portfolio construction where we state a few things on defensive and offensive measures. At this stage we will comment on the hybrid measures that will position portfolios for the new era. The hybrid measures are focused on commodities, which we believe will continue to be in the center of the next bullish wave. There is a new silk road that is under construction and goes through developing countries. The era that will unfold after the final phase of the catharsis will be similar to the one the world experienced when the baton passed from the British to the U.S. Our comments on Thursday regarding commodities in general and of copper in particular should be viewed in this greater context.

More than eight years ago in another publication and presentation, I made the claim that copper has a Ph.D. in economics. When we observe its trend, we could predict with some significant accuracy the overall economy’s trends. The copper market is experiencing tight supplies that resemble the ones of cocoa. Copper prices have risen by more than 20% since June. Red metal experts – from CEOs of the largest mining companies, to traders, and consultancies – are very bullish on the metal. The Escondida mine in Chile – the world’s largest and which is shown on the graph below – has reached peak production capacity. Experts are saying that it cannot even meet modest demand growth.

An increasing number of analysts state that they would not be surprised if copper hits $10,000/ton by 2012. The market tightness is supply driven. Output has dropped by more than 10% since 2009. Codelco, the Chilean miner is not predicting any increase for the remainder of the year.

Production targets have been undershot by more than 5% over the last five years, according to Brook Hunt, the metals consultancy. Inventories of the physical metal have dropped by more than 25% since the beginning of the year at the LME (London Metal Exchange) as the figure above shows. Lower quality ore, i.e. ore that is not rich in copper content, is part of the problem. As mining progresses, falling grades of copper content makes the enterprise more costly (see also graph above) while global demand is rising from developing nations (the new silk road).

It takes time to develop a copper mine and make it ready for production. The time required may be as much as 10-12 years. It seems that we may soon need copper in another form. In the midst of this tight situation, the portfolio index that we are constructing in anticipation of the next cathartic phase cries out…

DUM SPIRO SPERO!

Dum Spiro Spero in the Land of Commodities: The Case of Copper

Author : John E. Charalambakis

Date : August 23, 2010

Cicero is famous for several things, among which is the “Dum Spiro Spero” quote, implying that hope dies last. For weeks now, my colleagues and I have been contemplating drafting an internal portfolio strategy-index.

In the land of dismal growth where deflation knocks at the door, the markets are shaken by uncertainty and going sideways while some commodities are experiencing a resurgence. Wheat prices have increased by over 50% since early June. The ratio of stockpiles to consumption for sugar dropped to its lowest level for that last two decades. Coffee prices are risin, too. The following graphs of wheat and coffee tell the story of the upward trends.

Why would a hedge fund take physical delivery of cocoa? Does it tell us anything about the future of commodities? Last Thursday, we wrote about catharsis. We believe it is needed in order to cleanse the economic system’s arteries. We are of the opinion that such catharsis will be the next phase of the crisis, and we hope – Dum Spiro Spero – it will be the last phase. In an environment surrounded by the uncertainties that we have described over the course of several months, a portion of our portfolio strategy has to have a mixture of defensive measures, as well as offensive ones. A hybrid of measures will include steps taken that will enhance the portfolio and prepare it for the new era.

We will be writing a commentary soon on such portfolio construction where we state a few things on defensive and offensive measures. At this stage we will comment on the hybrid measures that will position portfolios for the new era. The hybrid measures are focused on commodities, which we believe will continue to be in the center of the next bullish wave. There is a new silk road that is under construction and goes through developing countries. The era that will unfold after the final phase of the catharsis will be similar to the one the world experienced when the baton passed from the British to the U.S. Our comments on Thursday regarding commodities in general and of copper in particular should be viewed in this greater context.

More than eight years ago in another publication and presentation, I made the claim that copper has a Ph.D. in economics. When we observe its trend, we could predict with some significant accuracy the overall economy’s trends. The copper market is experiencing tight supplies that resemble the ones of cocoa. Copper prices have risen by more than 20% since June. Red metal experts – from CEOs of the largest mining companies, to traders, and consultancies – are very bullish on the metal. The Escondida mine in Chile – the world’s largest and which is shown on the graph below – has reached peak production capacity. Experts are saying that it cannot even meet modest demand growth.

An increasing number of analysts state that they would not be surprised if copper hits $10,000/ton by 2012. The market tightness is supply driven. Output has dropped by more than 10% since 2009. Codelco, the Chilean miner is not predicting any increase for the remainder of the year.

Production targets have been undershot by more than 5% over the last five years, according to Brook Hunt, the metals consultancy. Inventories of the physical metal have dropped by more than 25% since the beginning of the year at the LME (London Metal Exchange) as the figure above shows. Lower quality ore, i.e. ore that is not rich in copper content, is part of the problem. As mining progresses, falling grades of copper content makes the enterprise more costly (see also graph above) while global demand is rising from developing nations (the new silk road).

It takes time to develop a copper mine and make it ready for production. The time required may be as much as 10-12 years. It seems that we may soon need copper in another form. In the midst of this tight situation, the portfolio index that we are constructing in anticipation of the next cathartic phase cries out…

DUM SPIRO SPERO!