The late Milton Friedman used to ask his students at the University of Chicago whether money matters. Of course, the classic answer that he was expecting from them was: “Only money matters!”

Whether someone subscribes or not to this strict monetarist view, the following graph may be considered indicative that money does matter, at least for the equities market.

The figure above shows that after the market collapsed in late 2008 and early 2009, it was QE1 that moved it to higher levels. By mid-summer 2010 the Fed’s balance sheet had stopped its expansionary blow up path, and had reached a plateau at about $2.34 trillion. The market retreated and lost nearly 9%, when all of a sudden QE2 was announced. Like an addict who needs a shot, the market started its upswing again, blowing up bubbles in equities and bonds.

With all due respect this reminds us of someone who shows up and says: “Good morning, we are from the Fed and our job is the manipulation of the stock and bond markets.”

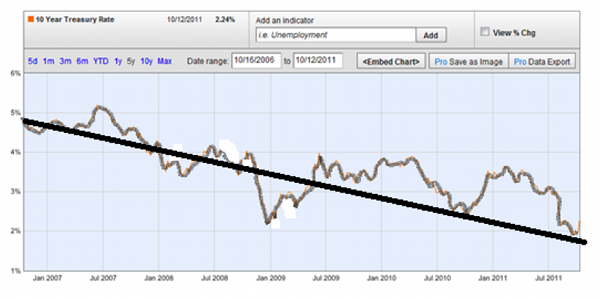

The result of all these manipulative efforts can also be seen in the financial repression of the ten-year Treasury yield, as shown below. The prices of safe-haven bonds have steadily moving into the stratosphere of premiums. At zero short-term Federal Reserve rates, the bond markets around the world look like bubbles to us. We do not know when they will burst, but we do know that they will burst.

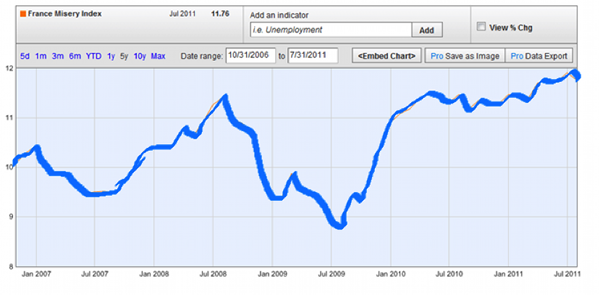

At the same time we are holding our position that the Euro is overvalued. The misery index in France, as reported by the OECD and shown below, is reaching its highest level, exceeding the level it reached in the midst of the 2008 financial collapse.

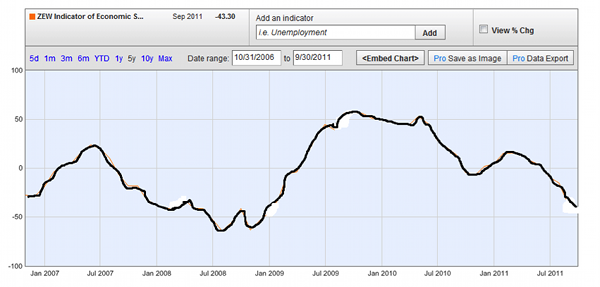

As for Germany, the Index for Economic Sentiment as reported by the Center for European Economic Research keeps declining, as shown below. Now the leaders of France and Germany are promising to put together a package to enhance the finances of the EFSF (the EU’s bailout fund) in order to purchase directly – or in the secondary market – the bonds of countries that face difficulties, as well as to enlarge it – using leverage – and use the funds to recapitalize the banks whose position is pretty shaky due to toxic assets in their balance sheets, as well as due to paper that they have circulated and needs refinancing. Our question remains the same: What is the undisputable collateral asset that is capable of the EFSF’s enhancement?

The market cheerleaders seem to be persuaded that something marvelous will take place, if we judge from the risk-on approach seen in the markets last week. We are of the opinion that the quest for returns will disappoint many because in a world full of toxic paper, with high volatility, and geopolitical uncertainty the only certain thing about forecasting is that it will be wrong.

Ode to catharsis from the toxic paper!

Does Money Matter? Blowing (Bubbles) in the Wind

Author : John E. Charalambakis

Date : October 17, 2011

The late Milton Friedman used to ask his students at the University of Chicago whether money matters. Of course, the classic answer that he was expecting from them was: “Only money matters!”

Whether someone subscribes or not to this strict monetarist view, the following graph may be considered indicative that money does matter, at least for the equities market.

The figure above shows that after the market collapsed in late 2008 and early 2009, it was QE1 that moved it to higher levels. By mid-summer 2010 the Fed’s balance sheet had stopped its expansionary blow up path, and had reached a plateau at about $2.34 trillion. The market retreated and lost nearly 9%, when all of a sudden QE2 was announced. Like an addict who needs a shot, the market started its upswing again, blowing up bubbles in equities and bonds.

With all due respect this reminds us of someone who shows up and says: “Good morning, we are from the Fed and our job is the manipulation of the stock and bond markets.”

The result of all these manipulative efforts can also be seen in the financial repression of the ten-year Treasury yield, as shown below. The prices of safe-haven bonds have steadily moving into the stratosphere of premiums. At zero short-term Federal Reserve rates, the bond markets around the world look like bubbles to us. We do not know when they will burst, but we do know that they will burst.

At the same time we are holding our position that the Euro is overvalued. The misery index in France, as reported by the OECD and shown below, is reaching its highest level, exceeding the level it reached in the midst of the 2008 financial collapse.

As for Germany, the Index for Economic Sentiment as reported by the Center for European Economic Research keeps declining, as shown below. Now the leaders of France and Germany are promising to put together a package to enhance the finances of the EFSF (the EU’s bailout fund) in order to purchase directly – or in the secondary market – the bonds of countries that face difficulties, as well as to enlarge it – using leverage – and use the funds to recapitalize the banks whose position is pretty shaky due to toxic assets in their balance sheets, as well as due to paper that they have circulated and needs refinancing. Our question remains the same: What is the undisputable collateral asset that is capable of the EFSF’s enhancement?

The market cheerleaders seem to be persuaded that something marvelous will take place, if we judge from the risk-on approach seen in the markets last week. We are of the opinion that the quest for returns will disappoint many because in a world full of toxic paper, with high volatility, and geopolitical uncertainty the only certain thing about forecasting is that it will be wrong.

Ode to catharsis from the toxic paper!