It seems that we are on the verge of a new reality that could resemble the developments of the early 1970s. The global rules and order that were established in July 1944 at the Bretton Woods Conference came apart between summer of 1971 (abandonment of the gold standard) and mid 1973 (abandonment of fixed exchange rates). The moral, economic, geopolitical, and financial leadership that the US has been providing since 1944 has come into question, and in the midst of Asian rising powers, unsustainable debts, geostrategic tensions, and uncertainty, the model of global order and cooperation seems to be in the process of devolution and disintegration.

Globalization, free trade, cooperation, decades-old commitments, political parties of old, alliances, even NATO clauses are being questioned. The global landscape of international relations is in a state of flux. And all of these developments take place at a time of enormous change in technology, biotechnology and medicine, with increasing social divisions, rising inequalities, diminishing mobility, ageing populations, and wars, or the threat of new wars.

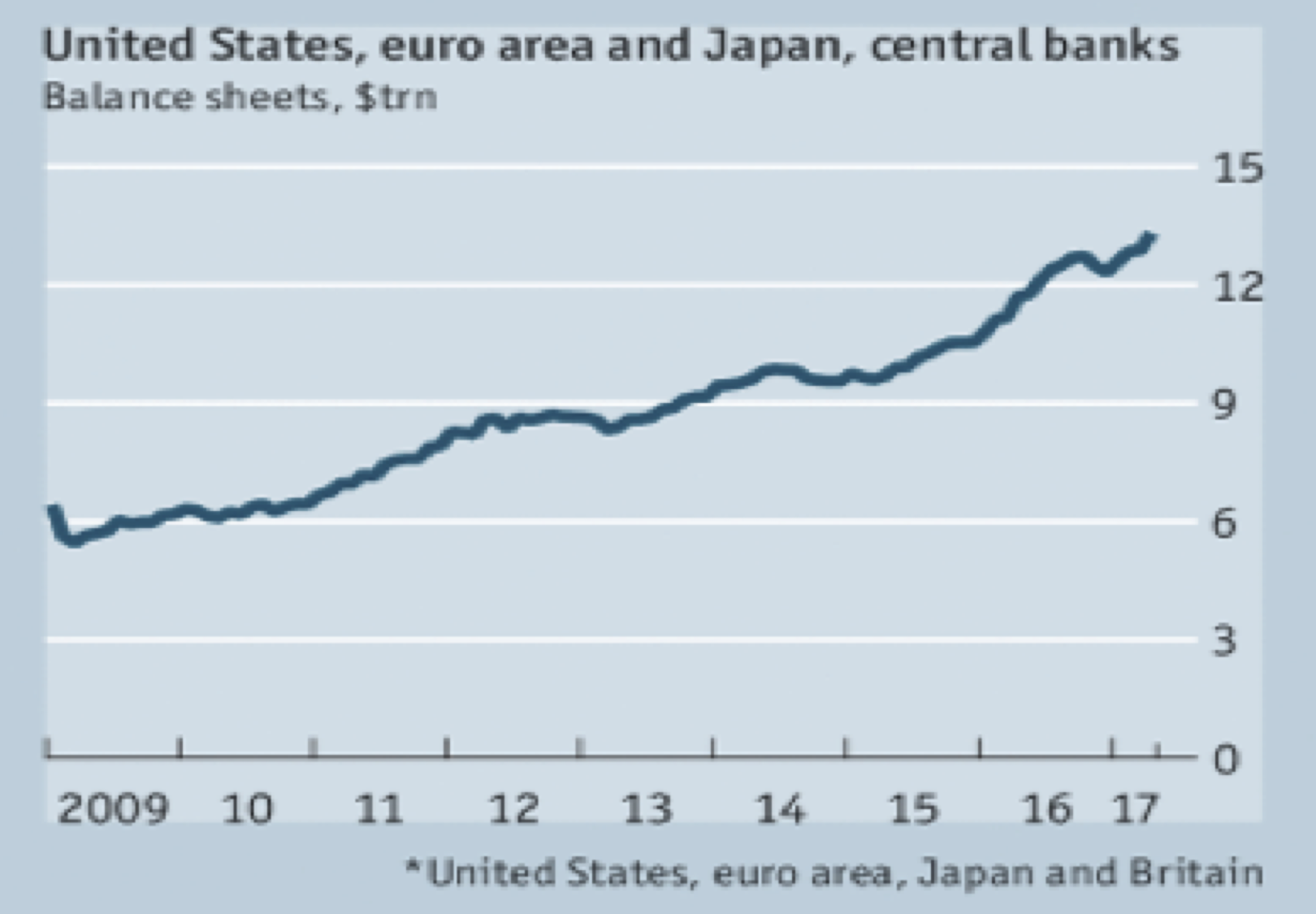

Since the financial crisis of 2008, the institutions that have run the show and bailed out the world – which was on the edge of another depression – have been the central banks. As the graph below shows, the assets of central banks have grown by more than 125% since 2009. The result has been the accumulation of debts, declining productivity, the kicking of the can down the road, asset bubbles, and the proliferation of unsustainable policies that may make the next crisis much worse.

In the midst of all these developments we are confronting the development of a significant rift among members of the GCC (Gulf Cooperation Council), where Qatar is marginalized and cut off based on allegations that it is supporting terrorism. We need to note here that coincidentally this development takes place on the 50th anniversary of the Six Day War in the Middle East, which certainly changed the landscape and the dynamics and created a new reality which 50 years later still has not been fully addressed.

It is our belief that particular assets, such as gold, oil, and gas, are intertwined with changing the course of world history. We may be entering into such pivotal point in our global discourse. We view the particular incident in the GCC as a vehicle to pressure Qatar to line up with the foreign policy agenda of Saudi Arabia and to contribute – through its wealth fund – to the deficits run by some of the countries that are trying to to isolate Qatar, which happens to be the third wealthiest country in the world (based on GDP/capita). We also anticipate that Al Jazeera’s programming – which to some extent has been a thorn in the flesh to some powers in the area – will be curtailed as old rivalries – including the main one between Saudi Arabia and Iran – take a new turn. It would be very unfortunate if this development suppresses the need for reforms in the GCC.

Needless to say, Qatar has of course made some very serious mistakes in its foreign policy and there is very little doubt that it has funded some very questionable and radical entities. However, Qatar hosts the U.S. Al Udeid air base, which is critical to U.S. operations in the Middle East and Asia. No wonder then that the Pentagon issued a statement reassuring that it stands with Qatar, directly contradicting the President. Indirectly of course, the Pentagon wanted to remind everybody that the US troops are in Qatar because they were kicked out of Saudi Arabia. Qatar’s special military relationship with the US has enabled the country to follow an independent foreign policy.

At the heart of the matter, then, is an unfolding dispute related to gas exports, the future development of gas fields, and the role that natural gas reserves and liquefied natural gas will play in energy developments in the next several years. In the global game of power and asset play, Qatar plays a significant role given its vast gas reserves. (Cyprus is destined to play an equally important role in the next ten years.)

We are witnessing a structural shift in which function and utilitarianism overwhelms traditional measures of value. Historically speaking, in most of the instances when this has happened, markets bifurcate and then decisively move towards safe havens. The paradigm shift is dangerous because it degrades timeless attributes such as the formation of a character (personal, national, policy-oriented) that seeks truth, justice, aspirations, and missions that are necessary to hold together societies through an intellect and a spirit that rebukes slothfulness of manner and thought and encourages emulation.

Sic transit gloria mundi…

Disintegration in the Age of Discontent: Unraveling Realities and the Market

Author : John E. Charalambakis

Date : June 8, 2017

It seems that we are on the verge of a new reality that could resemble the developments of the early 1970s. The global rules and order that were established in July 1944 at the Bretton Woods Conference came apart between summer of 1971 (abandonment of the gold standard) and mid 1973 (abandonment of fixed exchange rates). The moral, economic, geopolitical, and financial leadership that the US has been providing since 1944 has come into question, and in the midst of Asian rising powers, unsustainable debts, geostrategic tensions, and uncertainty, the model of global order and cooperation seems to be in the process of devolution and disintegration.

Globalization, free trade, cooperation, decades-old commitments, political parties of old, alliances, even NATO clauses are being questioned. The global landscape of international relations is in a state of flux. And all of these developments take place at a time of enormous change in technology, biotechnology and medicine, with increasing social divisions, rising inequalities, diminishing mobility, ageing populations, and wars, or the threat of new wars.

Since the financial crisis of 2008, the institutions that have run the show and bailed out the world – which was on the edge of another depression – have been the central banks. As the graph below shows, the assets of central banks have grown by more than 125% since 2009. The result has been the accumulation of debts, declining productivity, the kicking of the can down the road, asset bubbles, and the proliferation of unsustainable policies that may make the next crisis much worse.

In the midst of all these developments we are confronting the development of a significant rift among members of the GCC (Gulf Cooperation Council), where Qatar is marginalized and cut off based on allegations that it is supporting terrorism. We need to note here that coincidentally this development takes place on the 50th anniversary of the Six Day War in the Middle East, which certainly changed the landscape and the dynamics and created a new reality which 50 years later still has not been fully addressed.

It is our belief that particular assets, such as gold, oil, and gas, are intertwined with changing the course of world history. We may be entering into such pivotal point in our global discourse. We view the particular incident in the GCC as a vehicle to pressure Qatar to line up with the foreign policy agenda of Saudi Arabia and to contribute – through its wealth fund – to the deficits run by some of the countries that are trying to to isolate Qatar, which happens to be the third wealthiest country in the world (based on GDP/capita). We also anticipate that Al Jazeera’s programming – which to some extent has been a thorn in the flesh to some powers in the area – will be curtailed as old rivalries – including the main one between Saudi Arabia and Iran – take a new turn. It would be very unfortunate if this development suppresses the need for reforms in the GCC.

Needless to say, Qatar has of course made some very serious mistakes in its foreign policy and there is very little doubt that it has funded some very questionable and radical entities. However, Qatar hosts the U.S. Al Udeid air base, which is critical to U.S. operations in the Middle East and Asia. No wonder then that the Pentagon issued a statement reassuring that it stands with Qatar, directly contradicting the President. Indirectly of course, the Pentagon wanted to remind everybody that the US troops are in Qatar because they were kicked out of Saudi Arabia. Qatar’s special military relationship with the US has enabled the country to follow an independent foreign policy.

At the heart of the matter, then, is an unfolding dispute related to gas exports, the future development of gas fields, and the role that natural gas reserves and liquefied natural gas will play in energy developments in the next several years. In the global game of power and asset play, Qatar plays a significant role given its vast gas reserves. (Cyprus is destined to play an equally important role in the next ten years.)

We are witnessing a structural shift in which function and utilitarianism overwhelms traditional measures of value. Historically speaking, in most of the instances when this has happened, markets bifurcate and then decisively move towards safe havens. The paradigm shift is dangerous because it degrades timeless attributes such as the formation of a character (personal, national, policy-oriented) that seeks truth, justice, aspirations, and missions that are necessary to hold together societies through an intellect and a spirit that rebukes slothfulness of manner and thought and encourages emulation.

Sic transit gloria mundi…