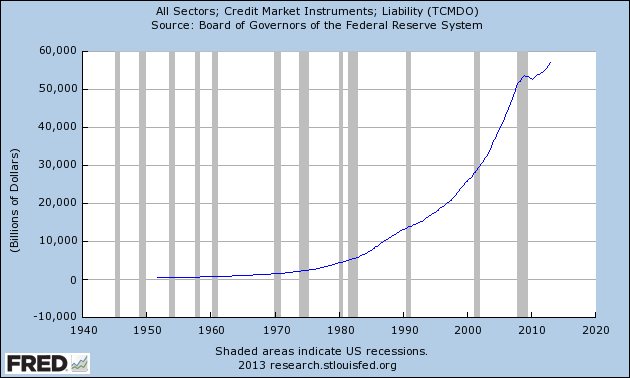

For a crisis to culminate and show its true face, time is critical in the sense that it should enter a saturation phase which in turn will signify that the downturn is inevitable. It is my opinion that the next two years will be that saturation phase that may produce a crisis that will change the financial and economic landscape forever, unless an out-of-the-box solution is applied to the total global credit issues. In the meantime on the street called “Desire” the game of paper gains may roll out nice returns as a façade that allows the cover up of the real risks that encircle the economy. Of course, we cannot exclude the possibility that in a system where the total credit market debt (TCMD) has reached over 300% of GDP (just in the US as the graph below shows), the system could implode anytime.

The graph above has three inflection points in 1982, 1993, and 2004. The first one coincides with the stock market rally that introduced financial innovations. The second one coincides with geopolitical events that accompanied the fall of the iron curtain and allowed credit to be extended in new territories. The last one coincides with the explosion of the time-bomb called derivatives and the role that China plays in the credit and collateralization games.

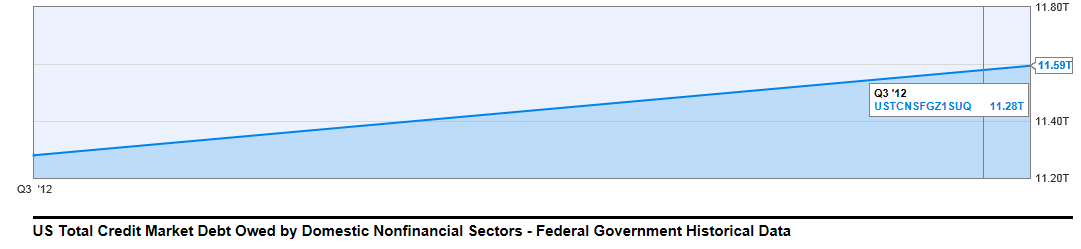

The US credit for the nonfinancial sector grew by 11% over the last twelve months, as the following graph demonstrates. This is sufficient to boost liquidity, spending, and sentiments, and thus the market rally in the last several months. This trend is expected to continue for at least another 18 months, as is explained in the next paragraph.

It is a fact that the global futures and options volume fell by 15.3% in 2012, however it seems that the most recent data show a reversal of last year’s trend which will also speed up the growth rate of credit extension and thus advance the overall market sentiment and momentum. As the average daily volume of derivatives picks up speed, liquidity is advanced, which in turn lubricates the engine of spending and hence the ephemeral measures of GDP, employment, and paper gains.

The risks in this environment are more geopolitical (uncertainty in the Middle East, instability in the Southern frontier of the EU) than financial. However, as Machiavelli demonstrated in The Prince the establishment has no moral restraints and can place technical tools-“solutions” at the disposal of liberators and despots. As this Hegelian tragedy of centralized power is being unfolded through credit manipulations, it is not the realist view that will reign supreme (and which calls for the breakup of the big banks that perpetrate this madness called credit over-extension) but rather the Staatsraison (raison d’ etat,) view that calls for the unfolding of any scheme capable of postponing the inevitable downfall and “winning” the war, no matter what the means are. The problem is that credit will eventually become an orphan and Dire Straits lyrics Money for Nothing will sound loud and clear when the music stops.

Man we could have some fun

And he’s up there, what’s that? Hawaiian noises?

Bangin’ on the bongoes like a chimpanzee

That ain’t workin’ that’s the way you do it

Get your money for nothin’ …

Credit Orphans on the Street Called “Money for Nothing”

Author : John E. Charalambakis

Date : August 3, 2013

For a crisis to culminate and show its true face, time is critical in the sense that it should enter a saturation phase which in turn will signify that the downturn is inevitable. It is my opinion that the next two years will be that saturation phase that may produce a crisis that will change the financial and economic landscape forever, unless an out-of-the-box solution is applied to the total global credit issues. In the meantime on the street called “Desire” the game of paper gains may roll out nice returns as a façade that allows the cover up of the real risks that encircle the economy. Of course, we cannot exclude the possibility that in a system where the total credit market debt (TCMD) has reached over 300% of GDP (just in the US as the graph below shows), the system could implode anytime.

The graph above has three inflection points in 1982, 1993, and 2004. The first one coincides with the stock market rally that introduced financial innovations. The second one coincides with geopolitical events that accompanied the fall of the iron curtain and allowed credit to be extended in new territories. The last one coincides with the explosion of the time-bomb called derivatives and the role that China plays in the credit and collateralization games.

The US credit for the nonfinancial sector grew by 11% over the last twelve months, as the following graph demonstrates. This is sufficient to boost liquidity, spending, and sentiments, and thus the market rally in the last several months. This trend is expected to continue for at least another 18 months, as is explained in the next paragraph.

It is a fact that the global futures and options volume fell by 15.3% in 2012, however it seems that the most recent data show a reversal of last year’s trend which will also speed up the growth rate of credit extension and thus advance the overall market sentiment and momentum. As the average daily volume of derivatives picks up speed, liquidity is advanced, which in turn lubricates the engine of spending and hence the ephemeral measures of GDP, employment, and paper gains.

The risks in this environment are more geopolitical (uncertainty in the Middle East, instability in the Southern frontier of the EU) than financial. However, as Machiavelli demonstrated in The Prince the establishment has no moral restraints and can place technical tools-“solutions” at the disposal of liberators and despots. As this Hegelian tragedy of centralized power is being unfolded through credit manipulations, it is not the realist view that will reign supreme (and which calls for the breakup of the big banks that perpetrate this madness called credit over-extension) but rather the Staatsraison (raison d’ etat,) view that calls for the unfolding of any scheme capable of postponing the inevitable downfall and “winning” the war, no matter what the means are. The problem is that credit will eventually become an orphan and Dire Straits lyrics Money for Nothing will sound loud and clear when the music stops.

Man we could have some fun

And he’s up there, what’s that? Hawaiian noises?

Bangin’ on the bongoes like a chimpanzee

That ain’t workin’ that’s the way you do it

Get your money for nothin’ …