Corporate debt is at record high. Net equity issuance has been negative for the last few years. The shares buyback pattern is simply staggering. The fact that almost 70% of corporate earnings are paid out in the form of corporate buybacks and dividends is antithetical to the concept of growth. How can we talk about a fundamental market upswing when it is based not on corporate earnings but rather on monetary manipulations which in turn stimulate such corporate payouts?

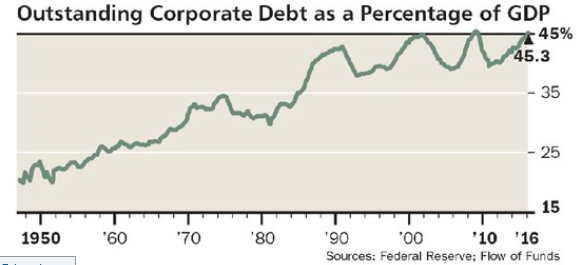

As the graph below shows the outstanding corporate debt as a fraction of the GDP stands at record high.

Is it a coincidence that soon thereafter such corporate indebtedness took place in 2001 and 2008, the economy fell into a recession? Prosperity bought on credit is not real prosperity, unless earnings and growth takes place.

If the supply of equity is shrinking while credit demand is rising, then a market dislocation is taking place where capital is misallocated which results in small or big busts. When we combine this development with the oxymoron of declining market volatility, we can envision a possible bursting due to the fact that risk-taking is on the rise simply because the hunting for yield is intensifying. As long as the spreads remain tight things could stay in a state of stable disequilibrium. However, if a tremor takes place then the spreads will become wider and investors/funds will rush to re-balance portfolios.

Given the fact that capital investment spending has been declining while productivity also is on a downtrend, we are of the opinion that investors should be looking into reducing the duration of their bond holdings as well as placing trailing stops of their equity positions. Moreover, the recent rising appetite for emerging markets seems to be another oxymoron given their fundamentals, which leads us to believe that exuberance feeds an overall frenzy that is not justifiable. The Great Wall of Steroids a.k.a. China faces tremendous problems which in turn makes us wonder if portfolios have enough insurance that can withhold a possible market tremor.

Such tremor could be triggered even in the EU given that the non-performing loans there exceed $1.5 trillion. When we add to this the fact that just one bank (Deutsche Bank) has a derivatives exposure in excess of $50 trillion (whose real value cannot be calculated due to its synthetic nature) we can only imagine how another banking tremor there could upset the nirvana of a market that buys prosperity on credit.

Credit Markets and the Financial Bloodline: The Oxymoron of an Upswing

Author : John E. Charalambakis

Date : August 12, 2016

Corporate debt is at record high. Net equity issuance has been negative for the last few years. The shares buyback pattern is simply staggering. The fact that almost 70% of corporate earnings are paid out in the form of corporate buybacks and dividends is antithetical to the concept of growth. How can we talk about a fundamental market upswing when it is based not on corporate earnings but rather on monetary manipulations which in turn stimulate such corporate payouts?

As the graph below shows the outstanding corporate debt as a fraction of the GDP stands at record high.

Is it a coincidence that soon thereafter such corporate indebtedness took place in 2001 and 2008, the economy fell into a recession? Prosperity bought on credit is not real prosperity, unless earnings and growth takes place.

If the supply of equity is shrinking while credit demand is rising, then a market dislocation is taking place where capital is misallocated which results in small or big busts. When we combine this development with the oxymoron of declining market volatility, we can envision a possible bursting due to the fact that risk-taking is on the rise simply because the hunting for yield is intensifying. As long as the spreads remain tight things could stay in a state of stable disequilibrium. However, if a tremor takes place then the spreads will become wider and investors/funds will rush to re-balance portfolios.

Given the fact that capital investment spending has been declining while productivity also is on a downtrend, we are of the opinion that investors should be looking into reducing the duration of their bond holdings as well as placing trailing stops of their equity positions. Moreover, the recent rising appetite for emerging markets seems to be another oxymoron given their fundamentals, which leads us to believe that exuberance feeds an overall frenzy that is not justifiable. The Great Wall of Steroids a.k.a. China faces tremendous problems which in turn makes us wonder if portfolios have enough insurance that can withhold a possible market tremor.

Such tremor could be triggered even in the EU given that the non-performing loans there exceed $1.5 trillion. When we add to this the fact that just one bank (Deutsche Bank) has a derivatives exposure in excess of $50 trillion (whose real value cannot be calculated due to its synthetic nature) we can only imagine how another banking tremor there could upset the nirvana of a market that buys prosperity on credit.