This year marks the 60th anniversary since Kafka published his least understood philosophical novel titled “The Fall”. The novel is a series of monologues by its main character (Clamence). Clamence’s words echo a dark masterpiece of a person who has fallen from grace. Clamence is afraid to be judged as he struggles to find meaning in his life. Such fear leads him to a liberating understanding/confession: Clamence experiences a fall from self-deception. Such a fall is liberating because it frees Clamence from the ultimate self-deception that he is a person without flaws, while allows him to understand the consequences of both his actions and inactions (where he failed others by not taking a stand and intervening where he could).

The current economic outlook resembles Clamence’s wakeup call: Prosperity has been bought on credit and the fiat currencies which have been used for the buyout (dollars, euros, yen, renminbi, etc.) have imposed a self-deception in the global economy. Fiat currencies are full of flaws and the credit creation mechanism is creating a feedback loop which sooner or later will look like a fault line whose tectonic plates could inflict significant pain to the economy. Next year might be the year when the tectonic plates of currencies start moving, creating in the process an amalgam of uncertainty and volatility.

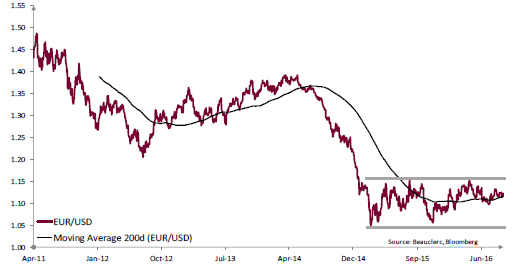

The following figure shows that the EUR/USD exchange rate has stayed within a range of 1.10-1.14 this year.

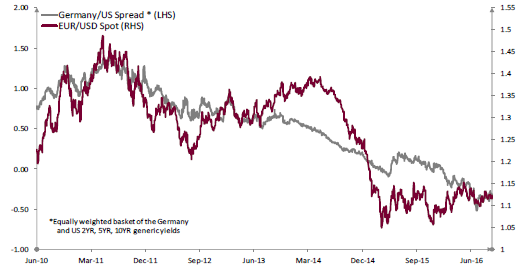

Given the macroeconomic trajectory of the EU and the forthcoming interest rate increases in the US, we would not be surprised if the Euro takes a dive against the dollar. Specifically, and as can be seen below, the interest rate differentials precede a drop in the Euro, especially when the latter has been kept artificially high.

When we also take into account Italy’s financial seismic activity and the resurgence of problems in the southern frontier of the EU at a time when EU’s locomotive (Germany) faces a number of issues, then we could say that this might be one front of a Kafkanian analogy.

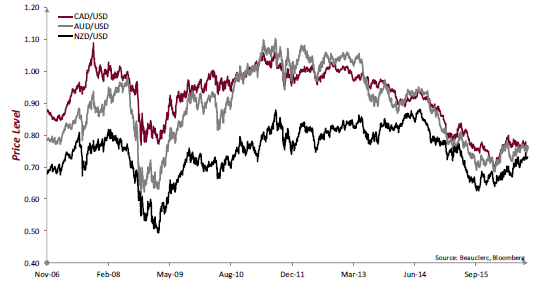

Another front would be the commodity-based currencies (such as Canadian, Brazilian, S. Africa, etc.).

We could say that the upswing experienced in some commodities over the last several months, has put a stop in their downward trajectory. However, this might be temporary especially if China’s higher demand for commodities proves to be temporary. As it can be seen below, the exchange rates of those currencies stabilized against the dollar, however the persistent current account deficits that those countries experience could act as the law of gravity and we anticipate that their downward trajectory will resume in the next few months.

On top of the current account deficits that those countries experience, we also need to take into account the fact that business investments are minimum, which make us consider commodity-based currencies as another brick on the wall of uncertainty.

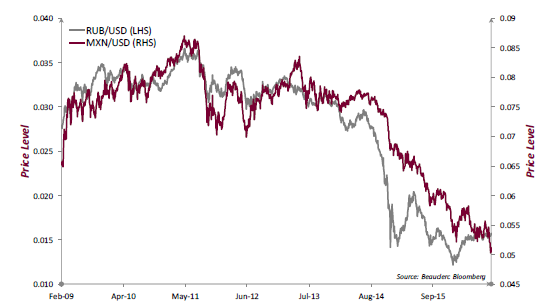

As far as other emerging countries’ currencies (Mexican Peso, Russian Ruble, Turkish Lira, etc., see also figure below) , we could say that their trajectory seems also to be downward given their current account deficits, low level of foreign reserves, higher forthcoming interest rate differentials with the US, and the fact that credit impulse that fueled their economies and stabilized their currencies over the last several months might be questioned starting in 2017.

Clamence’s realization that he was living in a bubble of denial precipitates an intellectual crisis that moves him from Paris to Amsterdam where he spends his time in a bar called Mexico City. The Brexit fall may precipitate a forthcoming fracture in the fault lines of currencies.

Credit Impulse and Currency Outlook: Kafka’s Clamence Ponders on Currencies’ Trajectory

Author : John E. Charalambakis

Date : October 18, 2016

This year marks the 60th anniversary since Kafka published his least understood philosophical novel titled “The Fall”. The novel is a series of monologues by its main character (Clamence). Clamence’s words echo a dark masterpiece of a person who has fallen from grace. Clamence is afraid to be judged as he struggles to find meaning in his life. Such fear leads him to a liberating understanding/confession: Clamence experiences a fall from self-deception. Such a fall is liberating because it frees Clamence from the ultimate self-deception that he is a person without flaws, while allows him to understand the consequences of both his actions and inactions (where he failed others by not taking a stand and intervening where he could).

The current economic outlook resembles Clamence’s wakeup call: Prosperity has been bought on credit and the fiat currencies which have been used for the buyout (dollars, euros, yen, renminbi, etc.) have imposed a self-deception in the global economy. Fiat currencies are full of flaws and the credit creation mechanism is creating a feedback loop which sooner or later will look like a fault line whose tectonic plates could inflict significant pain to the economy. Next year might be the year when the tectonic plates of currencies start moving, creating in the process an amalgam of uncertainty and volatility.

The following figure shows that the EUR/USD exchange rate has stayed within a range of 1.10-1.14 this year.

Given the macroeconomic trajectory of the EU and the forthcoming interest rate increases in the US, we would not be surprised if the Euro takes a dive against the dollar. Specifically, and as can be seen below, the interest rate differentials precede a drop in the Euro, especially when the latter has been kept artificially high.

When we also take into account Italy’s financial seismic activity and the resurgence of problems in the southern frontier of the EU at a time when EU’s locomotive (Germany) faces a number of issues, then we could say that this might be one front of a Kafkanian analogy.

Another front would be the commodity-based currencies (such as Canadian, Brazilian, S. Africa, etc.).

We could say that the upswing experienced in some commodities over the last several months, has put a stop in their downward trajectory. However, this might be temporary especially if China’s higher demand for commodities proves to be temporary. As it can be seen below, the exchange rates of those currencies stabilized against the dollar, however the persistent current account deficits that those countries experience could act as the law of gravity and we anticipate that their downward trajectory will resume in the next few months.

On top of the current account deficits that those countries experience, we also need to take into account the fact that business investments are minimum, which make us consider commodity-based currencies as another brick on the wall of uncertainty.

As far as other emerging countries’ currencies (Mexican Peso, Russian Ruble, Turkish Lira, etc., see also figure below) , we could say that their trajectory seems also to be downward given their current account deficits, low level of foreign reserves, higher forthcoming interest rate differentials with the US, and the fact that credit impulse that fueled their economies and stabilized their currencies over the last several months might be questioned starting in 2017.

Clamence’s realization that he was living in a bubble of denial precipitates an intellectual crisis that moves him from Paris to Amsterdam where he spends his time in a bar called Mexico City. The Brexit fall may precipitate a forthcoming fracture in the fault lines of currencies.