In the last few days, some reports have been circulated – by prominent Wall Street banks –which tell us that things will return to normal in 2013. With all due respect we disagree with such an assessment for the following four fundamental reasons:

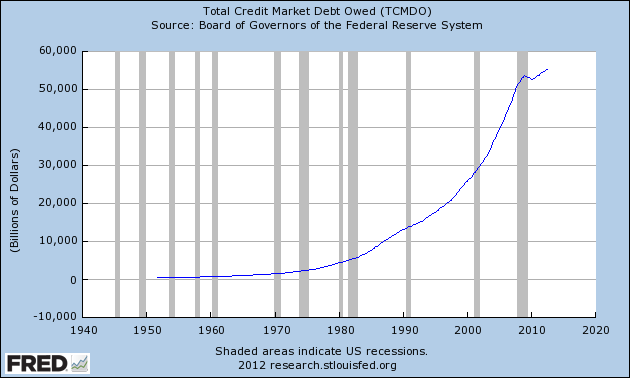

First, the total market credit debt in the US is close to $55 trillion and stands at the historical high level, as the following figure shows. With such credit over-extension, any return to market normalization is probably pure nonsense.

Second, the EU crisis is alive and well and with the impending instability in Italy, the much needed bailout in Spain, and the shaky French finances, it will obtain a new phase by the second quarter next year.

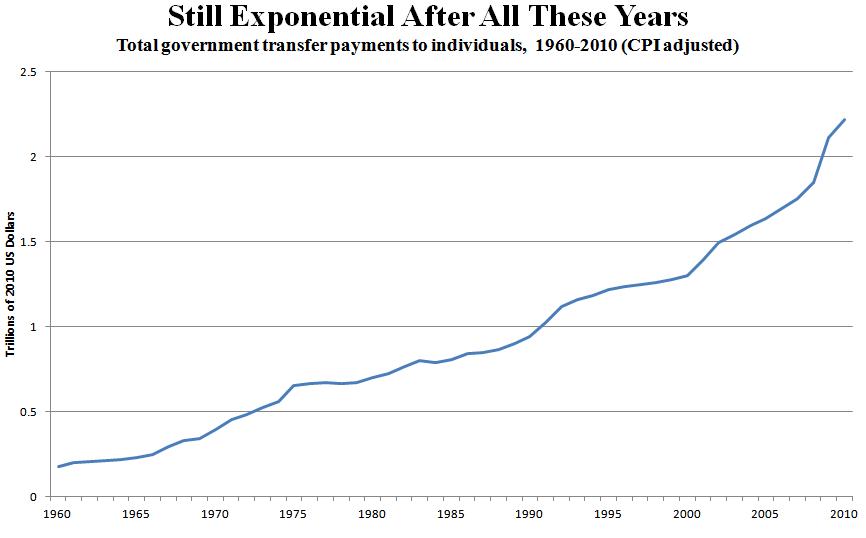

Third, unless all developed nations (US, EU, Japan, etc.) address the unfunded liabilities of their pension and healthcare plans – which at a very minimum make the real debt to GDP ratio at least 280 – all that is achieved by fiscal and monetary measures is the extension of the uncertainty and the misallocation of resources, i.e. malinvestments that reduce productivity and destroy wealth. As the following graph shows (base on data from the Bureau of Economic Analysis), the exponential growth in government transfer payments that started in the 1960s has not stopped, and thus the draining of the limited resources reinforce the concept that unless major reforms are undertaken, we will be talking about insolvency for many nations.

Fourth, just a couple of days ago, it was revealed that Deutsche Bank hid losses from derivatives’ trading that exceeded $12 billion. We have written several times in the past that the unstable derivative structure of $700 trillion resembles the tower that was built with a foundation to sustain twenty floors and now the penthouse owners on the fiftieth floor admire the view. As we did back in 2006 and 2007, we repeat now the same admonition: This tower is coming down.

The above points along with the current discussions in the US regarding the fiscal cliff make us skeptical as to the markets’ direction in the next few weeks. It might turn out to be cathartic to go through the fiscal cliff, but in the end what counts is long term stability, rising productivity, the cutting of waste, the restructure of the fiat money system, the exploitation of dormant resources, and the creation of wealth.

We shall revert shortly on gold and its future role, if it ends up considered an asset class for the banking system, as the latest Basel III regulation implies. In the meantime, hedging looks good.

Could we Start Experiencing a Normalization of Dislocation? An Assessment of Risks

Author : John E. Charalambakis

Date : December 8, 2012

In the last few days, some reports have been circulated – by prominent Wall Street banks –which tell us that things will return to normal in 2013. With all due respect we disagree with such an assessment for the following four fundamental reasons:

First, the total market credit debt in the US is close to $55 trillion and stands at the historical high level, as the following figure shows. With such credit over-extension, any return to market normalization is probably pure nonsense.

Second, the EU crisis is alive and well and with the impending instability in Italy, the much needed bailout in Spain, and the shaky French finances, it will obtain a new phase by the second quarter next year.

Third, unless all developed nations (US, EU, Japan, etc.) address the unfunded liabilities of their pension and healthcare plans – which at a very minimum make the real debt to GDP ratio at least 280 – all that is achieved by fiscal and monetary measures is the extension of the uncertainty and the misallocation of resources, i.e. malinvestments that reduce productivity and destroy wealth. As the following graph shows (base on data from the Bureau of Economic Analysis), the exponential growth in government transfer payments that started in the 1960s has not stopped, and thus the draining of the limited resources reinforce the concept that unless major reforms are undertaken, we will be talking about insolvency for many nations.

Fourth, just a couple of days ago, it was revealed that Deutsche Bank hid losses from derivatives’ trading that exceeded $12 billion. We have written several times in the past that the unstable derivative structure of $700 trillion resembles the tower that was built with a foundation to sustain twenty floors and now the penthouse owners on the fiftieth floor admire the view. As we did back in 2006 and 2007, we repeat now the same admonition: This tower is coming down.

The above points along with the current discussions in the US regarding the fiscal cliff make us skeptical as to the markets’ direction in the next few weeks. It might turn out to be cathartic to go through the fiscal cliff, but in the end what counts is long term stability, rising productivity, the cutting of waste, the restructure of the fiat money system, the exploitation of dormant resources, and the creation of wealth.

We shall revert shortly on gold and its future role, if it ends up considered an asset class for the banking system, as the latest Basel III regulation implies. In the meantime, hedging looks good.