Most of us at some point were exposed to a great teacher. Joel Fingerman was that teacher for me. Joel taught me in one of his quantitative classes (Business & Economic Forecasting) that the only certain thing about a forecast is that it will be wrong in one way or another. Hence, I decided to do my own prognostication about a Grexit scenario. Here it is:

It is a fact that Grexit is by now the basic scenario of the majority of the largest investment groups. My humble opinion is that this scenario has less than a 50% chance for the following reasons:

- The US may not want to entertain the geopolitical risks of forcing the hand of the Syriza-led government in seeking “new harbors” and support with non-traditional western players such as Russia (something that some within the Syriza-led government are pushing for) since that would imply some geopolitical risks for a NATO country. In addition, the turmoil in the Middle East does not allow the West to jeopardize the region. On the contrary the Western Alliance needs a strong base in the Mediterranean.

- There is significant uncertainty about the potential scale of underestimated consequences of a Grexit. While the consensus is that the risks are contained, the tail risks could well be underestimated when combined with geopolitical and Chinese considerations (see next point).

- With the uncertainty going on in China and the pertinent volatility there (the Shanghai index is down by more than 25% in the last 20 days), the markets may not be able to sustain a double blow and hence a compromise between Greece and the troika could be achieved.

- The Greek government is between a rock and a hard place with the banks closed and being threatened with bankruptcy (it was reported that Piraeus Bank cancelled $745 million of its covered bonds on Monday), with business activity dropping by 70%, and with ATMs that may soon run out of cash. It could well be “cornered” by mid-July when it will not be able to make payroll and with empty ATMS, thus it will be forced to compromise and cut a deal with its creditors, in a way that all players save face.

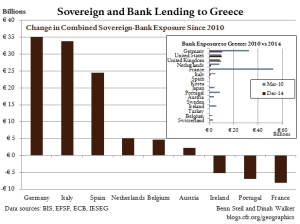

- Already Italy and France indicated on Monday that they want a compromise. Italian banks are more exposed to Greek debt today than they were three years ago (see graph below). Certainly no one wants to relive the moments of 2012 when spreads between Italian and Spanish and the Bunds were widening

- The Euro is a political project. The politicians know the risk of jeopardizing what they have called an irreversible experiment.

Enjoy the ride!

Contemplating the Grexit Scenarios

Author : John E. Charalambakis

Date : July 6, 2015

Most of us at some point were exposed to a great teacher. Joel Fingerman was that teacher for me. Joel taught me in one of his quantitative classes (Business & Economic Forecasting) that the only certain thing about a forecast is that it will be wrong in one way or another. Hence, I decided to do my own prognostication about a Grexit scenario. Here it is:

It is a fact that Grexit is by now the basic scenario of the majority of the largest investment groups. My humble opinion is that this scenario has less than a 50% chance for the following reasons:

Enjoy the ride!