Money markets experienced some kind of distortion in the last 18-24 months due to global dollar shortages as the Fed got into the swing of “normalizing” rates. Money markets several times become the arteries of the financial system. If they get clogged, shortages are observed – especially in overnight markets – which in turn makes the job of overseas banks that need wholesale funding more difficult.

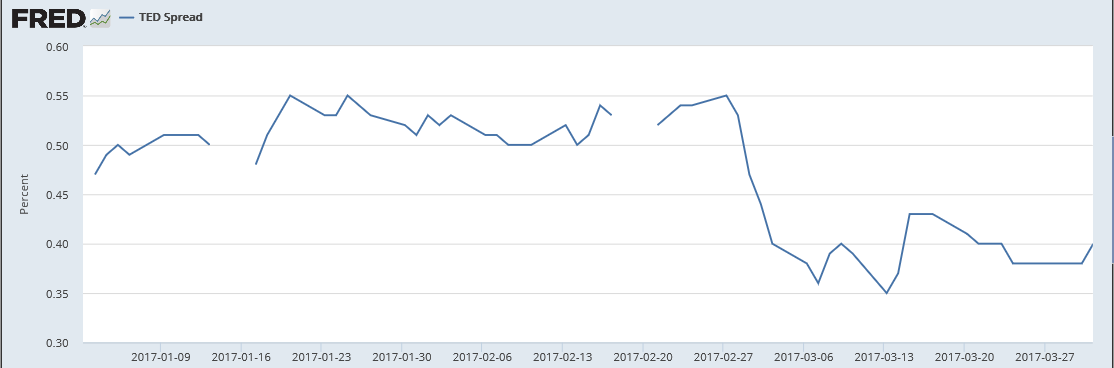

It seems that dollar shortages are becoming less of a problem lately, as overseas banks find alternative sources of funding and expectations of reduced regulation. At the end of last December banks were trying to dress up their balance sheets, and as that was happening, the cost of funding (a.k.a. cross-currency basis swap) increased significantly. However, at the end of the first quarter of this year, nothing similar to that December (and previous quarters) took place, signifying that dollar shortage pressures are easing. As the graph below shows the difference between the Libor and the 3-month TB rate (signifying credit risk) has been dropping, which possibly explains the more hawkish Fed talk from last week that it is time to start shrinking its balance sheet.

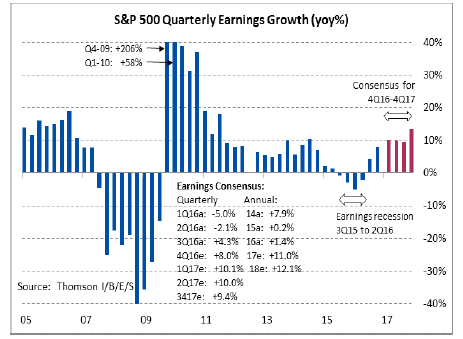

Earnings expectations are such that some kind of complacency is suppressing the markets. In the old days geopolitical developments (such as the recent happenings in Syria or the unfolding events with N. Korea, the terrorist attacks in Sweden and Egypt, and the possible deterioration in the relationship with Russia) would have taken the markets aback and would have required some weeks for them to recover. However, this time the markets dismissed those developments. The earnings expectations are shown below (see red bars for 2017).

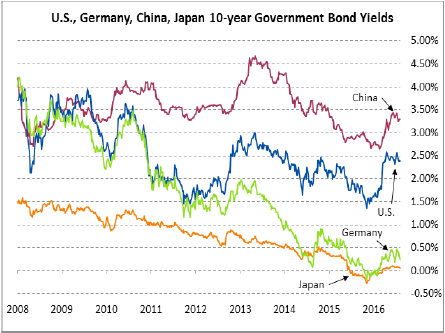

If earnings disappoint, and given Washington’s complexities and the geopolitical developments, then we would not be surprised if the markets switch into an auto-correction mode. On top of this and given the difference in the yields of ten-year government bonds between US and the EU (see below), we could say that any such auto-correction might be used to bring some convergence in those yields.

The world is changing and the leaderless tsunami of an opaque vision (let alone of reactionary policy rather than focused tactical moves that could at least be perceived as strategy) allow authoritarianism to rise, and when the latter rises check and balances disappear, fear is instilled, institutions are devalued and inevitable shocks and regimes end up undermining achievements that took decades to build. Case in point is Turkey: This Sunday irrespectively of what happens in the referendum, the regime of Erdogan will either institutionalize the violations of its own constitution that is taking place since 2014 (with a yes vote) or will simply continue violating it in the name of security.

Someone years ago taught me that when I hear such pronouncements I better prepare for the opposite.

Complacency in the Midst of Market Cycles: Liquidity Pressures and Geopolitics

Author : John E. Charalambakis

Date : April 11, 2017

Money markets experienced some kind of distortion in the last 18-24 months due to global dollar shortages as the Fed got into the swing of “normalizing” rates. Money markets several times become the arteries of the financial system. If they get clogged, shortages are observed – especially in overnight markets – which in turn makes the job of overseas banks that need wholesale funding more difficult.

It seems that dollar shortages are becoming less of a problem lately, as overseas banks find alternative sources of funding and expectations of reduced regulation. At the end of last December banks were trying to dress up their balance sheets, and as that was happening, the cost of funding (a.k.a. cross-currency basis swap) increased significantly. However, at the end of the first quarter of this year, nothing similar to that December (and previous quarters) took place, signifying that dollar shortage pressures are easing. As the graph below shows the difference between the Libor and the 3-month TB rate (signifying credit risk) has been dropping, which possibly explains the more hawkish Fed talk from last week that it is time to start shrinking its balance sheet.

Earnings expectations are such that some kind of complacency is suppressing the markets. In the old days geopolitical developments (such as the recent happenings in Syria or the unfolding events with N. Korea, the terrorist attacks in Sweden and Egypt, and the possible deterioration in the relationship with Russia) would have taken the markets aback and would have required some weeks for them to recover. However, this time the markets dismissed those developments. The earnings expectations are shown below (see red bars for 2017).

If earnings disappoint, and given Washington’s complexities and the geopolitical developments, then we would not be surprised if the markets switch into an auto-correction mode. On top of this and given the difference in the yields of ten-year government bonds between US and the EU (see below), we could say that any such auto-correction might be used to bring some convergence in those yields.

The world is changing and the leaderless tsunami of an opaque vision (let alone of reactionary policy rather than focused tactical moves that could at least be perceived as strategy) allow authoritarianism to rise, and when the latter rises check and balances disappear, fear is instilled, institutions are devalued and inevitable shocks and regimes end up undermining achievements that took decades to build. Case in point is Turkey: This Sunday irrespectively of what happens in the referendum, the regime of Erdogan will either institutionalize the violations of its own constitution that is taking place since 2014 (with a yes vote) or will simply continue violating it in the name of security.

Someone years ago taught me that when I hear such pronouncements I better prepare for the opposite.